|

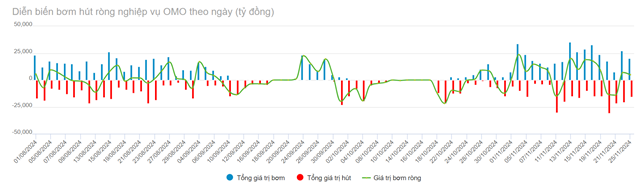

Net OMO pumping and suction developments by day from August to November 2024. Unit: VND billion

Source: VietstockFinance

|

Specifically, during the period from November 18 to 25, the operator lent commercial banks (NHTM) 88,000 billion VND through the 7-day term purchase channel at an interest rate of 4%/year to balance with the large maturity (115 thousand billion VND).

In addition, the SBV still regularly calls for bids on the bill channel with limited successful bids (4.1 thousand billion VND) out of a total of 41.45 thousand billion VND matured.

Thus, at the end of the November 25 session, the SBV net injected a slight amount of 10.35 thousand billion VND in the open market operation channel. This is also the lowest net injection level of the operator in 4 consecutive weeks of net injection (from October 28 to November 25, 2024).

|

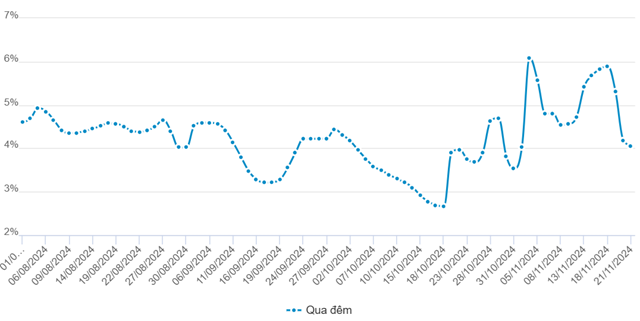

Interbank interest rates for overnight term from August to November 2024. Unit: %

Source: VietstockFinance

|

According to SSI Research, the overnight interbank interest rate stood at above 5% in the first two days of the week (November 18-19), then cooled down to 4.3% and returned to 4.7% in the trading session on Friday (November 22), with the average daily trading volume high (357 thousand billion/day, up 3.6% compared to the previous week).

In general, the end of the year is the time when the system’s liquidity will lean towards a state of shortage and the interest rate level of the 2-term market is expected to fluctuate strongly. Exchange rate pressure is a factor that the SBV considers to use open market operations in a sufficient volume to maintain liquidity at a reasonable level to balance the interest rates of VND and USD.

The DXY index rose by 0.8% in the past week, and other major currencies all depreciated against the USD, including EUR (-1.2%), GBP (-0.7%), and JPY (-0.3%). Currencies in the Asian region fell to varying degrees, while THB (+0.9%) and MYR (+0.14%) recovered after falling sharply in the previous week, and other currencies fell by 0.2-0.7%.

In the domestic market, the USD/VND interbank exchange rate rose slightly by 0.13% to 25,420 – approaching the SBV’s selling intervention rate (25,450 VND/USD). The exchange rate quoted by commercial banks continued to trade at the allowed ceiling, while the free market exchange rate fluctuated within a narrow range (25,700-25,800 VND/USD).

With the SBV signaling that it will control the system’s liquidity at a reasonable level to maintain a balance between interest rates and exchange rates, along with its readiness to intervene by selling foreign currencies if necessary, and the relatively strong remittance inflows in the pre-Tet period, SSI Research expects the exchange rate to remain balanced as it is now and may depreciate slightly in case the DXY index cools down.

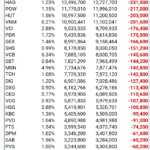

The Big Banks’ Big Payout: Unlocking $400 Trillion for Dividends—Vietcombank Leads the Pack, but LPBank is the One to Watch

As of the end of the third quarter, the three state-owned commercial banks, Vietcombank, VietinBank, and BIDV, boasted a staggering combined after-tax profit of over 200,000 billion VND, accounting for nearly 45% of the total undistributed profits of the 27 banks listed on the stock exchange.