The Evolution of Payment Security: Safeguarding Vietnam’s Digital Economy

Vietnam’s banking sector is facing a slew of security challenges and risks, as highlighted by Pham Anh Tuan, Director of the Payment Department at the State Bank of Vietnam. With an increasing trend of high-tech crimes, the country has seen a rise in fraud and theft of money and accounts, with estimated losses reaching up to VND 10,000 billion in 2023.

RISKS FROM “FAKE” ACCOUNTS

In 2023, the total amount of money lost by victims is estimated to reach VND 8,000-10,000 billion, a 1.5-fold increase from 2022. Notably, 91% of these cases were related to the financial sector, and 73% of mobile device and social media users were constantly harassed by scam messages and calls.

In the first nine months of 2024, the Authority of Information Security (under the Ministry of Information and Communications) received over 22,200 reports of online fraud from Internet users.

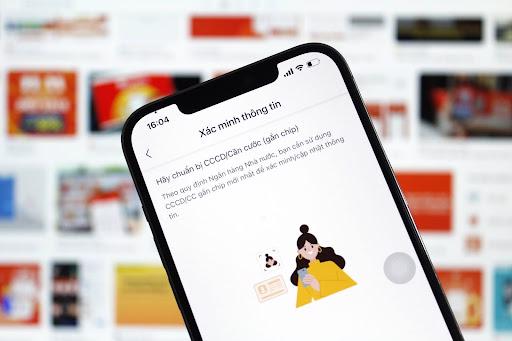

These online scams, often initiated through online transactions, are perpetrated using “fake” accounts or accounts that do not belong to the true owner. To combat this, the State Bank of Vietnam has issued Decision 2345 and circulars providing guidance on implementing security measures for online and card-based payments.

Starting January 1, 2025, bank and e-wallet account holders must verify their accounts before conducting any transactions. Customers can only withdraw money and make electronic payments after completing the identity verification process, which includes providing identity documents and biometric data. Accounts that have not been verified by banks or payment intermediaries will only be able to access services directly at the counter.

FRAUD CASES DECREASE WITH STRONGER IDENTIFICATION

According to Dao Minh Tu, Deputy Governor of the State Bank of Vietnam, approximately 38 million customers had successfully registered their biometric data as of October. Quick reports from credit institutions show a 50% decrease in fraud cases after the implementation of biometric authentication.

Following the new regulations, banks have started notifying customers about reviewing their identity documents and updating their biometric data to avoid disruptions in online transactions. Electronic wallet providers, such as ShopeePay, have also adjusted their operations, requiring users to authenticate their biometric data for a safer and more seamless payment experience.

According to ShopeePay’s representative, users only need to authenticate their biometric data once, a process that takes just 1-2 minutes, to secure their e-wallet effectively. The platform has also improved its chip-reading functionality, making the user experience faster and more convenient than before. Currently, ShopeePay’s security system has achieved the highest level of global security certification, PCI DSS Level 1.

“In the context of the increasing popularity of mobile cashless payments, it is crucial to authenticate information through NFC or KYC to protect one’s e-wallet. This not only enhances security but also makes transactions faster, more convenient, and safer, effectively preventing any abnormal account activity,” the ShopeePay representative added.

ShopeePay is committed to protecting its users and encourages them to update their ID cards using NFC to enjoy a safer and more seamless online payment experience.

“I’ve witnessed many online payment scams, so I immediately enabled NFC and KYC on my smartphone when I received the notification. The process is quite simple and only takes a few minutes. It’s also more convenient when making payments, as I only need to verify my face without having to manually enter a password,” said Ngoc Anh (Ho Chi Minh City).

To address potential issues, the State Bank of Vietnam has instructed credit institutions to identify and resolve any difficulties faced by customers. They are also required to continuously upgrade their mobile banking applications to counter new fraud schemes and ensure the security of their systems.

“As 95% of transactions are now digital, we are more concerned than anyone else. In addition to customer information, our data also includes account balances and savings. Therefore, ensuring security is at the core of our operations,” said Pham Tien Dung, Deputy Governor of the State Bank of Vietnam.

ShopeePay is dedicated to providing a seamless and secure online payment experience, offering daily attractive promotions. Users who successfully update their NFC information will receive a VND 10,000 discount voucher for mobile phone card purchases through the ShopeePay app.

Additionally, users can enjoy a range of discounts for online shopping on the Shopee e-commerce platform and food orders on ShopeeFood. Moreover, ShopeePay offers a series of attractive discounts for bill payments, mobile phone recharges, and QR code payments through the app.

For more promotions, visit: https://shopeepay.vn/.

Revolutionizing the Banking Experience: VietinBank’s Synchronized Approach to Customer Satisfaction

Complying with Decision 2345 of the State Bank on the deployment of security and safety solutions in payment, VietinBank has implemented biometric authentication for customers since July 1, 2024, and has been recognized as one of the pioneering and effective implementers of this significant directive.

Two Customer Groups Face Transaction Suspension from Multiple Banks

Over ten banks have issued a notice urging customers to submit their identity documents and complete biometric authentication before January 1, 2025.