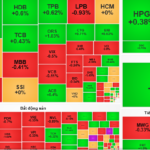

Vietnam’s stock market opened on November 28th with a positive sentiment, as the VN-Index climbed nearly 10 points, surpassing the 1,250 mark. However, profit-taking pressures later caused many stocks to reverse their gains, with the VN-Index even dipping into negative territory momentarily before closing with a meager gain of 0.14 points (+0.01%), ending the day at 1,242.11 points.

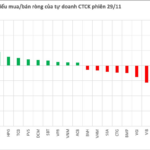

Trading was relatively muted, with matched orders on HoSE reaching nearly VND 9,500 billion. On a positive note, foreign investors continued to net buy, although the value was not significant, totaling just under VND 40 billion across the three exchanges.

On HoSE, foreign investors net bought VND 43 billion.

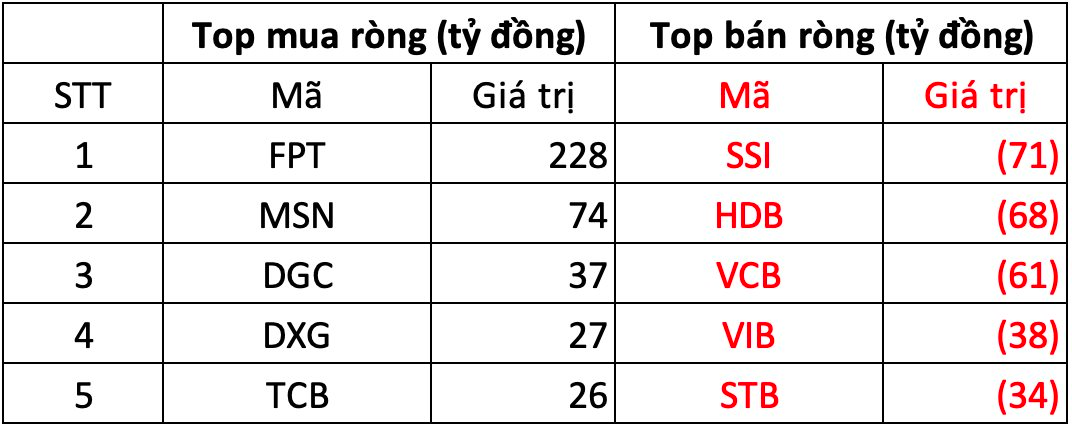

FPT shares were once again the focus of foreign investors’ purchases on HoSE, with a net buy value of over VND 228 billion. This was followed by MSN and DGC, which were net bought for VND 74 billion and VND 37 billion, respectively. POW and BID also saw net buying interest, with VND 23 billion and VND 19 billion, respectively.

In contrast, financial stocks (banks and securities companies) witnessed strong net selling by foreign investors on November 28th, including SSI (VND 71 billion), HDB (VND 68 billion), VCB (VND 61 billion), VIB (VND 38 billion), and STB (VND 33 billion), among others.

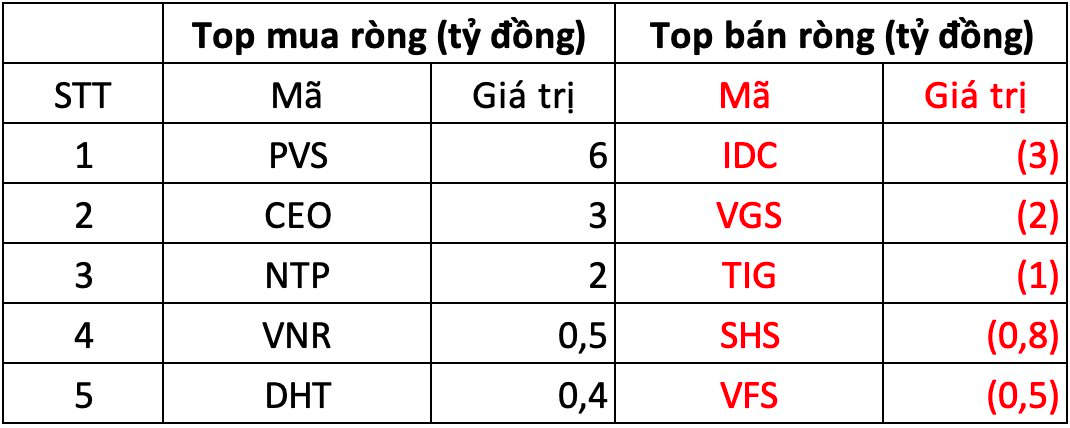

On HNX, foreign investors net bought nearly VND 5 billion.

PVS was the most net bought stock on HNX, with a value of nearly VND 6 billion. This was followed by CEO and NTP, with net buy values of VND 3 billion and VND 2 billion, respectively.

On the other hand, IDC and VGS were the two stocks that witnessed the strongest net selling by foreign investors on HNX, with net sell values of VND 3 billion and VND 2 billion, respectively. The net sell value for other stocks did not exceed VND 1 billion.

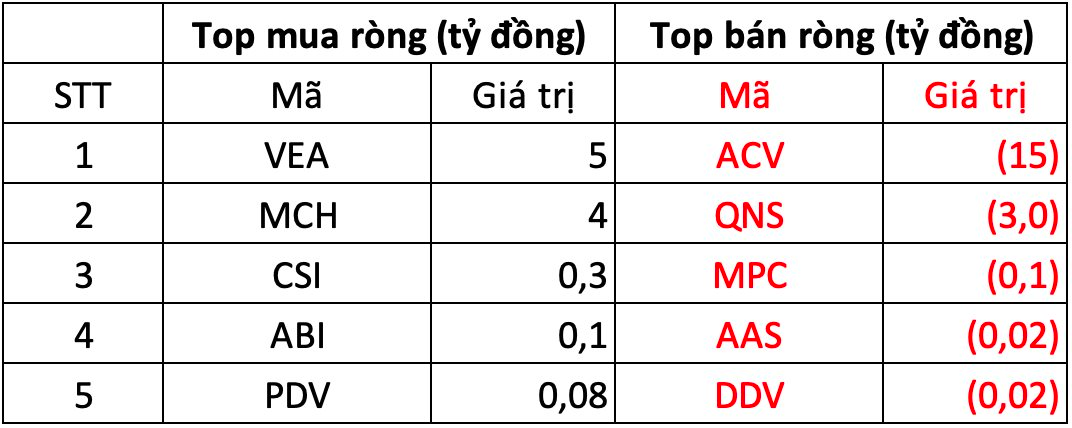

On UPCoM, foreign investors net sold over VND 9 billion.

In terms of purchases, VEA and MCH were the two stocks that saw strong net buying on UPCoM during the November 28th session, with values of VND 5 billion and VND 4 billion, respectively. On the opposite end, ACV was dumped by foreign investors, with a net sell value of nearly VND 15.5 billion, followed by QNS, which saw net selling of over VND 3 billion.

The Profit-Leading Construction Companies: Unveiling the Secrets to Their Success in 2024

The top 5 construction companies have seen impressive profits in the first 9 months of 2024, with figures ranging from 300 billion to 900 billion VND. What’s truly remarkable is the turnaround of one industry giant, which has gone from heavy losses to staggering profits.