Illustration

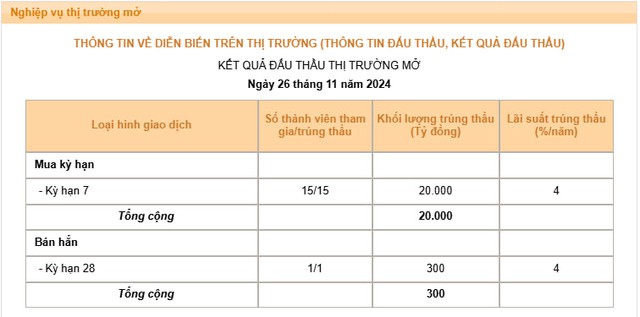

During the November 26 trading session, the State Bank of Vietnam (SBV) continued to offer 20 trillion VND in 7-day open market operations (OMOs) at an interest rate of 4.0%. All 15 participating members successfully bid for the full amount offered by the SBV.

Over the past month, banks have consistently bid for the entire OMO amount offered by the SBV, indicating a significant liquidity demand in the banking system.

Additionally, banks have shown less interest in the SBV’s bill issuance, with auction allotments only reaching a few hundred billion VND per session, despite the interest rate increasing to 4% per annum.

As of the close of the November 26 session, the total OMO volume in the collateralized lending channel had increased to nearly 78 trillion VND, while the volume of bills in circulation decreased to 17.45 trillion VND. Overall, the SBV is in a net injection position of nearly 60.55 trillion VND to the banking system.

Source: SBV

According to Rong Viet Securities (VDSC), a notable point regarding the open market operations in November is the consistently high number of participants and successful bidders in the collateralized lending channel. This suggests that liquidity conditions in the banking system are tightening across the board.

Interbank lending rates also support this view, with the average overnight lending rate in the first 20 days of the month at 5.17% per annum, 1.55 percentage points higher than the previous month’s average. Additionally, lending rates for tenors of less than one month increased by 1.03-1.45 percentage points.

However, the lower change in the 3-month tenor (up only about 0.85 percentage points from the previous month) suggests that the liquidity challenges are short-term and related to the peak season for credit growth in the final months of the year.

In the 1st market, deposit rates at commercial banks have been adjusted upward more significantly than in the previous month, with changes mostly occurring in short-term tenors of 1-3 months for joint-stock commercial banks in Group 2 (such as VIB and Nam A Bank).

Among the state-owned commercial banks, Agribank has consecutively increased deposit rates over the last four months, becoming the state-owned commercial bank with the highest deposit rates. Its 1-month, 3-month, 6-month, and 12-month deposit rates are now at 2.4%, 2.9%, 3.6%, and 4.8% per annum, respectively. However, Agribank’s deposit rates remain significantly lower than the average rates offered by private joint-stock commercial banks.

“Foreign exchange pressure continued to mount in November 2024. However, VDSC observed that the SBV did not sell foreign currency as it did in the previous month, possibly due to moderate foreign currency demand. Therefore, the main reason for the tight liquidity conditions in the system in November 2024 is still the high capital demand during the year-end period,” the analysts assessed.

In a recent report, Military Bank Securities (MBS) also attributed the high interbank lending rates to liquidity shortages. According to MBS, the SBV’s bill issuance and the State Treasury’s withdrawal of more than $4.5 billion from three major banks in Q3 2024 contributed to the increased liquidity pressure.

“Despite the SBV’s strong interventions through OMO injections, the overnight lending rate remained above 5%, indicating significant pressure in the system,” MBS stated.

MBS believes that this development is a factor driving banks to continue adjusting deposit rates upward to attract new capital and ensure liquidity. The analysts forecast a slight increase of 0.2 percentage points in deposit rates by the end of this year.

“The Ripple Effect”: What Experts Say About the Trend of Rising Savings Account Interest Rates

“The likelihood of a “race” to increase deposit interest rates in the final weeks of 2024 is predicted to be low.

The Artful Tap: Crafting Captivating Copy for a Cashless Society

Last week (November 18-25, 2024), the State Bank of Vietnam (SBV) continued its measured issuance of treasury bills while actively employing the open market operation (OMO) channel for term deposits to maintain reasonable liquidity.