Who Owns DP2?

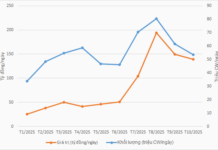

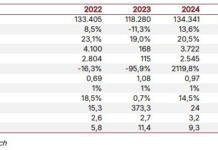

Recently, Central Pharmaceutical Joint Stock Company 2 (coded: DP2, on UPCoM) announced its Q3/2024 financial report, with an after-tax profit loss of over 5.8 billion VND, a 29.7% increase in loss compared to the same period in 2023.

Central Pharmaceutical 2 explained that the loss was due to increased input costs for products as the prices of raw materials, auxiliary materials, and packaging increased while selling prices remained unchanged. In addition, the company invested in building a GMP-WHO standard pharmaceutical production facility in Quang Minh Industrial Park, Me Linh, Hanoi, with investment capital mainly from bank loans, resulting in high interest expenses and depreciation costs.

Illustrative image

As of September 30, 2024, Central Pharmaceutical 2 recorded owner’s equity capital at 200 billion VND, with three major shareholders: Vietnam Pharmaceutical Corporation contributing nearly 13.6 billion VND, holding 6.78% of capital; Finance and Land Investment Joint Stock Company contributing more than 24.7 billion VND, holding 12.37% of capital; and Saigon Handicraft Export Joint Stock Company contributing 150 billion VND, holding 75% of capital. Other shareholders contributed nearly 11.7 billion VND, equivalent to 5.84% of capital.

Among them, the company’s shareholder, Finance and Land Investment, is known to be owned by businessman Cao Minh Son, born in 1961.

As for Saigon Handicraft Export Joint Stock Company, Ms. Cao Thuy Tien, Mr. Cao Minh Son’s daughter, holds the position of Chairman of the Board.

Which Companies Does Mr. Cao Minh Son Represent?

Entrepreneur Cao Minh Son (born in 1961) is known as the founder and legal representative of numerous companies across Vietnam. Some of these companies are still operational, while others have quietly closed down.

Chairman Cao Minh Son

Some notable companies he is associated with include Dat Viet Investment Joint Stock Company, Mediplantex Land Joint Stock Company, Phuc Thinh Investment Consulting Joint Stock Company, and Phuong Mai Joint Stock Company (land rent payment). Mr. Son currently represents multiple companies, including Song Chau Joint Stock Company, Indochine Hotel Joint Venture Company (Hanoi), Phuc Thinh Finance and Investment Joint Stock Company, Nhat Minh Production and Import-Export Joint Stock Company, Nhat Minh Production and Import-Export Limited Liability Company, Binh An Development Investment Joint Stock Company, An Binh Saigon Joint Stock Company, Song Chau Branch in Hanoi, Chau Son Tourism Development Joint Stock Company, Dong A Textile and Garment Joint Stock Company, and Lam San Production and Export-Import Joint Stock Company of Forestry Products and Small Industry.

Cao Minh Son’s ‘Golden Land’ Takeover Game

Mr. Son’s notable ‘golden land’ acquisitions include the collaboration between Finance and Land Investment and Central Pharmaceutical 2. Together, they developed a real estate project on a 11,165 m2 plot of land at 9 Tran Thanh Tong, Hai Ba Trung District, Hanoi.

This land previously housed Central Pharmaceutical 2’s workshop and was approved by the Hanoi People’s Committee for the establishment and implementation of a mixed-use commercial project following the policy of relocating production facilities out of the inner city.

As a result, Central Pharmaceutical 2 and Finance and Land Investment decided to establish Binh An Development Investment Joint Stock Company in 2009 to carry out this project.

In Central Pharmaceutical 2’s 2023 annual report, the company still acknowledged its investment in the joint venture to exploit the land use advantage at this location. However, due to the Ministry of Defense’s request to the Prime Minister to allocate the land for expanding the funeral home, the project has been delayed, causing the company to be unable to hand over the site to the joint venture. The partner is actively working with relevant authorities to maintain the advantage for the joint venture.

In addition, Mr. Son’s company also collaborated with Saigon Tourist Transportation Joint Stock Company – Satraco (coded: STT, on UPCoM) to implement a luxury apartment and office building project on a 9,252 m2 plot of land at 99C Pho Quang. As per the cooperation agreement, the two parties agreed to establish a new company to carry out this project. Simultaneously, STT agreed to allow Finance and Land Investment to proactively seek and negotiate with a third partner to establish the project company.

99C Pho Quang land plot

Meanwhile, the project on the 99C Pho Quang land plot has not been implemented for many years, and the authorities have proposed its revocation. Specifically, in December 2016, the Ho Chi Minh City Department of Natural Resources and Environment issued Notice No. 13585/TB-TNMT-VP on the results of the inspection and handling of slow-implementing projects, recommending the revocation of the 99C Pho Quang project if the investor failed to implement it within 12 months of the city’s approval of the extension.

In June 2018, the Department of Natural Resources and Environment sent Official Letter No. 6083/STNMT-TTR to the Ho Chi Minh City People’s Committee, proposing not to extend the investment policy for the 99C Pho Quang project and requesting the termination of land and asset lease agreements on this land plot.

In addition to the two aforementioned ‘golden land’ plots, Mr. Cao Minh Son is also involved in a luxury hotel project on a 1,500 m2 plot on Tran Khat Chan Street (Hanoi). The Ministry of Planning and Investment’s Decision No. 1324/GP approved the investment project for the Vietnam Tea Auction Center and a 3-star hotel in 1995. The project was a joint venture between Vietnam Tea Corporation – Joint Stock Company and Mulpha Haute Couture SPN.BHD of Malaysia.

The joint venture established the Indochine Hotel Joint Venture Company (Hanoi) on July 21, 1995, with the main business line being short-term accommodation services, specifically operating a 3-star international hotel on Tran Khat Chan Street, Hai Ba Trung District, Hanoi, along with related services. The company also engages in construction, specifically the construction of an international 3-star hotel on Tran Khat Chan Street, Hai Ba Trung District, Hanoi, and the import-export of machinery, equipment, and other commodities.

In 1996, the Hanoi People’s Committee issued Decision No. 1042/QD-UB, allocating 1,500 m2 of land to Vietnam Tea Corporation – Joint Stock Company on a 30-year lease at Tran Khat Chan Street, Thanh Nhan Ward, Hai Ba Trung District, for their joint venture with the Malaysian partner to build the Vietnam Tea Auction Center and the 3-star Indochine – Hanoi hotel.

According to Vietnam Tea Corporation – Joint Stock Company’s audited 2012 financial statements, the company invested nearly VND 3.9 billion in the joint venture. However, by the end of 2014, this investment was no longer reflected in the corporation’s financial statements.

As of December 20, 2019, Indochine’s charter capital was over VND 40.4 billion, with Vietnam Tea Corporation – Joint Stock Company contributing more than VND 12.12 billion, holding 30% of the capital, and Mulpha Haute Couture SPN.BHD contributing over VND 28.28 billion, holding 70% of the capital. At that time, Mr. Cao Minh Son served as the General Director and Legal Representative of Indochine.

According to the latest enterprise registration publication No. 0108363431 dated November 13, 2024, Mr. Cao Minh Son remains the General Director and Legal Representative of Indochine.