Continuing the working agenda of the 8th session of the 15th National Assembly, on the morning of November 23, Deputy Prime Minister Le Thanh Long presented a report on the draft Law on Management and Investment of State Capital in Enterprises.

Deputy Prime Minister Le Thanh Long presented a report on the draft Law on Management and Investment of State Capital in Enterprises

|

According to the Deputy Prime Minister, in implementing the Party’s guidelines and policies and the State’s policies on improving the efficiency of management and use of state capital invested in production and business in enterprises, and facing new requirements from practical management and international integration, it is necessary to timely address the limitations and shortcomings of the current Law on Management and Use of State Capital Invested in Production and Business at Enterprises (Law No. 69/2014/QH13), ensuring the consistency and uniformity of the Vietnamese legal system. Therefore, the Government proposes the Law on Management and Investment of State Capital in Enterprises to replace Law No. 69/2014/QH13.

Regarding the application scope, when formulating the policy, it was determined that “Enterprises with other state capital investment” are enterprises with investment capital of over 50% of their charter capital, in which there is a 100% state-owned enterprise that directly invests in their charter capital.

During the process of concrete research in drafting the Law, to ensure unity with the principle of state management according to the invested capital flow and in accordance with the actual contributed capital in the enterprise, based on the recommendations of enterprises, ministries, sectors, and related units, the Government agreed to exclude the subject of enterprises with other forms of state capital investment from the scope of adjustment of the Law and assigned the responsibility to the enterprises with state-invested capital.

Thus, the subjects of application include: State-owned enterprises as prescribed in the Law on Enterprises; credit institutions in which the State holds more than 50% of the charter capital (excluding Deposit Insurance and Policy Banks); representative agencies of the owner of capital and representatives of the owner of capital in state-owned enterprises as prescribed in the Law on Enterprises and credit institutions in which the State holds more than 50% of the charter capital; agencies, organizations, and individuals related.

Regarding the principles and order of profit distribution after tax, the Government proposes to allocate no more than 50% to the Development Investment Fund for retention in the enterprise. The management and use of the Development Investment Fund retained in the enterprise shall be carried out according to the regulations of the Government. The remaining amount, after using and allocating to the funds as prescribed, shall be paid to the state budget by the enterprise.

According to this option, the estimated amount paid to the state budget from profit, dividend, and post-tax profit sources will decrease by about VND 19,847 billion/year (according to the approved state budget settlement for 2021 by the National Assembly, the total amount paid to the state budget from dividends, profits, and post-tax profits of enterprises was VND 69,463 billion), and enterprises will be able to use this source according to the Government’s regulations.

Regarding the mechanism for paying salaries and bonuses to employees in enterprises, for those who are appointed, introduced, or hired by the representative agency of the owner of the capital to work directly in the enterprise, when proposing the Law, it is necessary to supplement the content of this expenditure in accordance with the spirit of Resolution No. 27-NQ/TW dated May 21, 2018, of the 7th Plenum of the 12th Party Central Committee.

After absorbing the opinions, the Government proposes not to stipulate the contents related to the salary payment mechanism in the draft Law and stipulates in Point 15, Article 12 that “Enterprises are allowed to pay salaries, wages, and remuneration to employees according to the production and business efficiency and results of the enterprise.”

Ensuring SOEs Operate According to Market Mechanisms

Chairman of the National Assembly’s Finance and Budget Committee (NA FBC) Le Quang Manh presented a report on the draft Law

|

Reviewing the draft Law, regarding the issue of profit distribution and fund usage, Mr. Le Quang Manh, Chairman of the National Assembly’s Finance and Budget Committee (NA FBC), said that the NA FBC basically agreed with the Government’s report on the necessity to promulgate the Law on Management and Investment of State Capital in Enterprises to replace the Law on Management and Use of State Capital Invested in Production and Business at Enterprises.

The NA FBC noted that the provisions of the draft Law would contribute to the institutionalization of the Party’s views and guidelines on continuing to restructure, renovate, and improve the efficiency of SOEs; ensuring that SOEs operate according to market mechanisms, respecting and enhancing the autonomy and self-responsibility of enterprises; and strengthening the state’s inspection and supervision in managing and investing capital in enterprises.

To perfect the draft Law, the NA FBC suggested that the authoring agency continue to review the specific provisions in the draft Law to fully and synchronously institutionalize the above viewpoints and principles.

Regarding the purpose and viewpoint of building the Law, the majority agreed with the viewpoint of strongly reforming administrative procedures in managing and investing state capital in enterprises associated with clear division and strong delegation of authority to the representative agency of the owner of state capital and enterprises; separating the functions and tasks of state management agencies and the representative agency of the owner of state capital from the business operations of enterprises as mentioned in the Government’s report.

However, some contents of the draft Law need to be further amended to address the current shortcomings and difficulties.

Regarding the scope of adjustment and subjects of application, the NA FBC noted that the scope of adjustment and subjects of application stipulated in the draft Law are generally suitable and consistent with the provisions on SOEs in the Law on Enterprises.

However, in addition to enterprises with more than 50% state capital, there are other forms of enterprises with state capital investment that are not yet included in the scope of adjustment of this draft Law.

Therefore, it is recommended to consider supplementing the scope of management and investment of state capital with general principles in the draft Law and, at the same time, assigning the Government to detail the provisions for these enterprises with state investment capital, with appropriate management measures and levels.

Regarding profit distribution and fund usage, the NA FBC agreed with the proposal to allocate a maximum of 50% of post-tax profits to the Development Investment Fund for retention in 100% state-owned enterprises. The draft Law has adjusted the regulations on the purpose of using the Development Investment Fund retained in the enterprise, which will be implemented according to the Government’s regulations. The NA FBC agreed with the draft Law but suggested that a draft Decree guiding the implementation of this content should be prepared to ensure compliance with the Law on Promulgation of Legal Documents.

At the same time, the draft Decree needs to specifically regulate the authority, decision-making, scope, and content of using the Fund, ensuring that state capital, after being invested in enterprises, is considered the property and capital of those enterprises.

“The State Capital Investment and Management Law: Ensuring SOEs Operate on Market Principles.”

The proposed Law on State Capital Management and Investment in Enterprises aims to empower enterprises by affording them greater autonomy in specific areas. Instead of prescribing detailed regulations on “the use of capital and assets in enterprises,” the law takes a more flexible approach. It entrusts enterprises with the authority to make decisions on capital utilization, capital mobilization, the purchase and sale of fixed assets, and the management of receivables and payables. This shift in focus towards “state capital investment in enterprises” is designed to foster a more dynamic and responsive business environment, allowing enterprises to adapt and thrive in a constantly evolving market landscape.

The National Assembly Approves Additional Capital Injection of VND 20.7 Trillion for Vietcombank

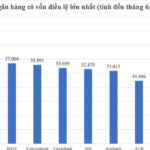

Vietcombank has significantly increased its charter capital, issuing an additional 27,666 billion VND in shares. With this move, the bank’s total charter capital has reached an impressive 83,557 billion VND, making it the highest in the Vietnamese banking system to date. This substantial increase in capital underscores Vietcombank’s strong position and dynamic growth in the market.

The Inefficient Management of State-Owned Enterprises: A Tale of Missed Opportunities and Underutilized Assets

“There is a pressing need for a new mechanism to oversee the operations of state-owned enterprises, according to Delegate Hoàng Văn Cường from the Hanoi Congressional Delegation. He emphasized that wherever there is investment of state funds, there must be a corresponding mechanism to monitor and manage that capital effectively.”

Unlocking the Potential: Strategic Investors Exit Early, Leaving Cienco 8 in the Capable Hands of the Phuc Loc Group, Led by Business Tycoon Luong Minh Tuong

The Inspectorate pointed out a series of violations during the equitization process at Cienco 8, including the formulation of vague criteria for selecting strategic investors, which led to early divestment by the investor. As a result, Cienco 8 quietly fell into the hands of the Phuc Loc Group, owned by tycoon Luong Minh Tuong.