Global inflation has shown signs of cooling off, and the Fed has also indicated a shift towards lowering interest rates. While these developments seem to ease some pressures, global investors still appear cautious about equity markets. Domestically, Vietnam presents a positive picture with inflation under control, low-interest rates favoring businesses, and a stable exchange rate. However, investors remain apprehensive about the impact of these factors on the market.

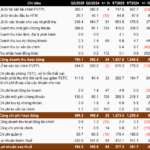

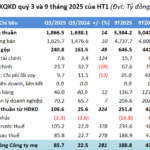

This cautious sentiment has resulted in a reluctance to invest, causing the VN-Index to fluctuate without decisively surpassing the 1,300-point mark. Weekly statistics reveal that the average trading value per session reached VND 18,642 billion, with the matched trading value averaging VND 16,323 billion. This represents a 17% and 6.8% decrease, respectively, compared to the average of the previous five weeks. Since the beginning of November, the average liquidity on the three exchanges has been VND 14,547 billion, a significant drop of 18% from the previous month and a staggering 46.7% decline from the early months of the year. The peak liquidity in March reached VND 27,300 billion per session.

Meanwhile, foreign investors, who have a substantial influence on the domestic market, have net sold over VND 91,000 billion since the beginning of the year, equivalent to approximately USD 3.6 billion.

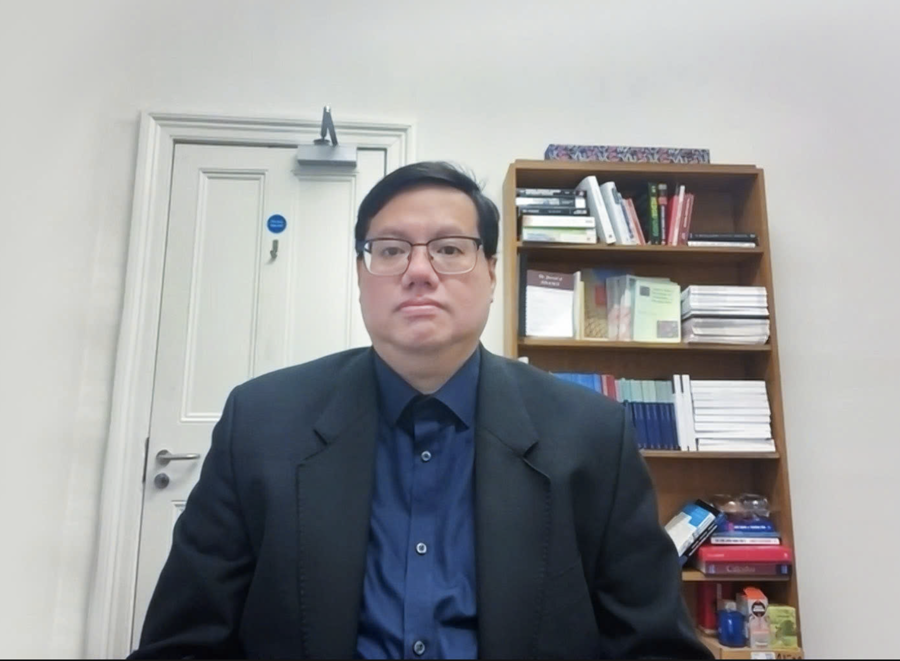

Commenting on the trend of capital flows in a recent talk show, Mr. Ho Quoc Tuan, a senior lecturer at the University of Bristol, UK, emphasized that Vietnam’s macroeconomic story remains stable, but uncertainties arise from external factors. These include the strengthening of the US dollar and the rise in US government bond yields, which naturally attract international capital to places where higher interest rates are anticipated.

Another unknown factor is the European market. The European economy is currently facing challenges, but the question remains whether it will become more difficult or recover by 2025. If the European economy deteriorates, as some predict, the euro could depreciate to a level equal to or even lower than the US dollar. This would trigger a capital outflow from the Eurozone, likely flowing into the US. Consequently, the US market is expected to remain attractive for capital investments until at least the first half of 2025.

“What we can do at this point is try our best to maintain macroeconomic stability and hope that businesses can capitalize on the advantages presented by this situation. As for the uncertainties associated with Trump’s trade policies and other factors, we must wait for more information before formulating appropriate strategies,” he said.

Regarding domestic investor capital, Mr. Tuan noted that they are not focusing on the stock market, possibly due to production and business activities. Additionally, other avenues such as gold, crypto, and real estate are experiencing a certain level of overheating.

Bank savings statistics also show a significant increase, indicating that people still view savings as a safe haven for their money.

Looking ahead, Mr. Tuan shared his insights on inflation, stating that the expected inflation rate in the US is 3%. While inflation may rise, it is unlikely to surge to the levels seen in the 7% range. This gives the Fed room to cut interest rates for the US dollar. In contrast, Europe and even Canada and Australia may have to implement more aggressive rate cuts.

As a result, the US dollar will remain strong, putting pressure on Asian countries like Vietnam to refrain from lowering interest rates. This presents a challenging situation.

Both China and Vietnam are currently inclined to provide further economic stimulus, which involves reducing interest rates. However, if the US lowers interest rates for the US dollar, our room to reduce interest rates will be limited, and we will have to cope with exchange rate maintenance pressures. In such a scenario, we won’t be able to rely on monetary policy to support the economy, and we’ll have to turn to public investment stimulation. If we can boost public investment, it will create numerous opportunities, and countries and investors will feel optimistic about Vietnam’s prospects.

“I believe that if we aim for a breakthrough next year, it won’t come from exchange rates or interest rates but from public investment. Only by ramping up public investment can we create new momentum for the economy. However, based on the current situation, I don’t foresee a significant surge in capital inflows, and maintaining the current level will be a success for Vietnam until new developments emerge to attract capital into the market,” emphasized Mr. Tuan.

The Prime Minister Directs the State Bank of Vietnam to Enhance Credit Management Solutions for 2024

Prime Minister requests SBV to focus on more drastically and effectively performing the tasks and solutions on directing interest rates, exchange rates, credit growth, open market operations, money supply, and reducing the lending interest rate floor to provide the economy with capital at a reasonable cost.

The Art of Financial Flexibility: Central Bank’s Credit Extension

This adjustment was made amidst well-controlled inflation, falling below the target set by the Government and the National Assembly. The move was in line with the directives of the Government and the Prime Minister to manage the monetary policy flexibly, effectively, and promptly to meet the capital needs of the economy and support production and business development.

Unlocking Housing Opportunities: The Prime Minister Calls for Transparency in Social Housing Credit Packages

As per the Prime Minister’s instructions, the State Bank of Vietnam must direct credit institutions to effectively implement and ensure transparency in the social housing and worker housing credit package.