Trung An to Dissolve Two Subsidiaries Amid Financial Crisis

Trung An is one of the leading companies in Vietnam’s rice industry. Illustration

|

Trung An will dissolve Trung An Rice Export JSC and Trung An Real Estate Trading JSC to reorganize its structure. These are wholly-owned subsidiaries of Trung An, established on May 20, 2022, and are based in Can Tho city. The chartered capital of Trung An Rice Export is VND 20 billion, while that of Trung An Real Estate is VND 10 billion.

Currently, Mr. Le Trung Chi (born in 1985) is the Director and Legal Representative of Trung An Rice Export, while Mr. Pham Tran Thanh Tan (born in 1991) holds the same positions in Trung An Real Estate. Mr. Tan is also the Administrator of the parent company, Trung An.

After the dissolution of these two subsidiaries, Trung An will be left with only one subsidiary, Kien Giang Trung An High-Tech Agriculture JSC, a wholesale rice trading company established in 2016. The initial chartered capital was VND 42 billion, with Trung An contributing 49%. After two capital increases, the chartered capital rose to VND 303 billion, of which Trung An owns over 67%.

In addition, Trung An also owns two associated companies, Novotech – Trung Hung JSC and Viet Duc Rice Production, Processing, and Export JSC. The company’s Q3 2024 financial statements show that the original investments in these companies were over VND 10 billion and VND 4.7 billion, respectively, corresponding to 40% of Novotech – Trung Hung’s capital and 39% of Viet Duc’s capital.

Trung An is currently mired in a financial crisis. In Q3 2024, the company incurred a net loss of VND 22.5 billion, bringing the nine-month loss to over VND 31 billion, mainly due to higher production costs and interest expenses compared to the previous year.

Trung An’s business performance has been declining since 2023, with a net loss of nearly VND 16 billion due to a significant drop in gross profit margin and higher interest expenses.

| TAR’s Annual Net Profit |

As of September 30, 2024, Trung An’s short-term receivables increased by 63% from the beginning of the year to VND 1,756 billion, accounting for nearly 60% of total assets. Inventories stood at VND 338 billion, a third of the beginning of the year.

The company’s financial debt also increased by 8% from the beginning of the year to VND 1,677 billion. The largest lender was BIDV – Mekong Delta Branch, with a loan of VND 600 billion, followed by First Commercial Bank Ho Chi Minh City with nearly VND 424 billion, Sacombank – Can Tho Branch with over VND 297 billion, and Malayan Bangking Berhad – Ho Chi Minh City and Hanoi branches with more than VND 216 billion.

|

At a workshop held on November 18 in Can Tho city, Mr. Pham Thai Binh, Chairman of the Board of Directors and Vice President of Trung An, shared that in the rice value chain, companies must take out long-term loans (7-10 years) to invest. Without investment, it is impossible to engage in rice production and export. Therefore, the company hopes to secure long-term loans from banks. “If long-term loans are not available, most rice companies cannot participate in the production chain linked to consumption”, Mr. Binh emphasized. According to Mr. Binh, banks have been providing short-term loans to rice companies to fulfill rice purchase and export contracts for many years, but this only covers a small part of their needs. This is also the reason why the rice business is always precarious, with companies competing to lower rice prices to get money to repay their bank loans when they fall due. |

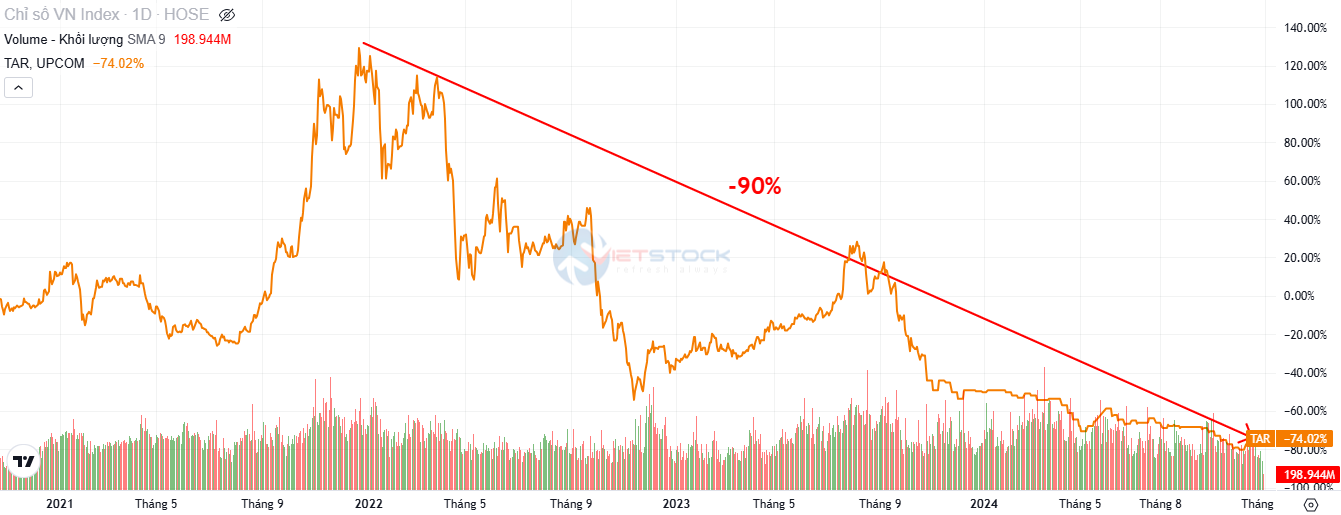

Stock Price Hits Bottom

During this crisis, the auditing firm withheld its opinion on Trung An’s 2023 financial statements due to a lack of adequate evidence regarding the ownership of 15 million TAR shares in the private placement in 2021 and the inventory data disclosed in the 2022 financial statements audited at VND 1,256 billion.

As a result, TAR shares were delisted from HNX on May 21, 2024, and resumed trading on UPCoM with restricted trading (only allowed on Fridays) from May 31, 2024.

During its golden age in 2021-2022, TAR share prices once surpassed VND 40,000/share. However, the stock has been on a downward trend since September 2023 and currently stands at only VND 4,600/share, a 45% drop since the beginning of 2024.

TAR share price movement. Source: VietstockFinance

|

The Manh