Cases of land revocation due to violations of land laws are stipulated in Article 81 of the 2024 Land Law as follows:

1. Using land for purposes other than those assigned by the State for allocation, lease, or recognition of land use rights, and having been administratively sanctioned for the act of using land for the wrong purposes but continuing to violate.

2. Land users who engage in land degradation and have been administratively sanctioned for land degradation but continue to violate.

3. Land allocated or leased to the wrong entities or beyond authorized limits.

4. Land acquired through transfer or donation from an individual or organization allocated land by the State, where such transfer or donation is not permitted under this Law.

In cases where land users fail to fulfill their financial obligations to the State, as specifically defined in Article 30 of Decree No. 102/2024/ND-CP, the land users in question shall be subject to land revocation upon the tax authority’s written request.

5. State-managed land that has been encroached upon or occupied.

6. Land users who fail to fulfill their financial obligations to the State.

7. Annual crop land, aquatic resource farming land left unused for 12 consecutive months, perennial crop land left unused for 18 consecutive months, and forest land left unused for 24 consecutive months, with administrative sanctions imposed but the land remains unused as stipulated in the administrative sanction decision;

8. Land allocated, leased, allowed for conversion of land use purposes, recognized for land use rights, or acquired through transfer of land use rights for investment projects that remain unused for 12 consecutive months from the date of site handover or with progress lagging 24 months behind the schedule specified in the investment project. In cases where the land remains unused or the progress falls behind the schedule specified in the investment project, the investor may be granted an extension of no more than 24 months and must pay the State an additional amount corresponding to the land use or land lease fee for the extended period. If the land remains unused upon the expiration of the extended period, the State shall revoke the land without providing compensation for the land, assets attached to the land, and remaining land-related investment costs.

9. The cases mentioned in Points 6, 7, and 8 of this Article shall not apply in cases of force majeure.

Attorney Tran Xuan Tien – Head of the Dong Doi Law Firm

Attorney Tran Xuan Tien, Head of the Dong Doi Law Firm, explains: “Force majeure, as applied in handling the cases mentioned in Points 6, 7, and 8 of Article 81 of the Land Law, refers to unforeseeable events and objective obstacles defined in the Civil Code. Accordingly, an ‘unforeseeable event’ is an objective occurrence that could not be foreseen and cannot be overcome despite the application of all necessary and permissible measures. Meanwhile, an ‘objective obstacle’ refers to circumstances that impede an individual or organization with civil rights and obligations from knowing that their legitimate rights and interests have been infringed upon or from exercising their civil rights and fulfilling their civil obligations.”

According to Clause 1, Article 31 of Decree 102/2024/ND-CP, unforeseeable events and objective obstacles directly affecting land use include:

1. Natural disasters and environmental disasters;

2. Fire, epidemics;

3. War, national defense and security emergencies;

4. Other cases prescribed by law on emergency situations;

5. Cases where the competent state agency applies temporary emergency measures, seals, or freezes land use rights and assets attached to the land in accordance with the law, and subsequently, the land user is allowed to continue using the land;

6. Administrative decisions or acts of the competent state agency that constitute an objective obstacle, not attributable to the land user, directly affecting land use;

7. Other cases decided by the Prime Minister upon proposal of the provincial-level People’s Committee or the Minister of the specialized management agency.

The law has provided a specific list of cases considered force majeure. When a land user has any of the above grounds, the provisions on land revocation shall not be applied. These provisions aim to ensure flexibility in handling special cases and protect the rights of land users in uncontrollable circumstances, Attorney Tran Xuan Tien emphasized.

According to the principle of compensation and resettlement support when the State revokes land, when the State revokes land, people will be compensated with land of the same use or money according to the land price. However, according to Clause 3, Article 101 of the 2024 Land Law, in cases where land is revoked due to violations of land laws, the State shall not provide compensation for the revoked land.

The Overgrown Haven: A Tale of Abandonment in Hà Đông’s New Residential Project

The New Residential Area and Service Land Project in Van Phuc Ward, Ha Dong District, Hanoi, has become an eyesore due to its abandoned state. The once-promising infrastructure investment is now riddled with overgrown vegetation, littered with construction waste, and home to unauthorized construction material yards, much to the dismay of the local residents.

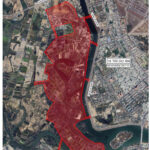

Unauthorized Land Allocations and Encroachments in Bac Ninh City Exceed 5,000 Cases

The northern city of Bac Ninh has witnessed over 5,100 instances of unauthorized land allocation, land encroachment, and arbitrary changes in land use purposes, encompassing a total area of more than 87 hectares. This issue highlights the challenges faced by local authorities in managing rapid urbanization and ensuring orderly and legal land use practices. The magnitude of these infractions underscores the need for stringent measures to be implemented to rectify the situation and prevent similar occurrences in the future.

Is Non-Payment of Land Use Fees Subject to “Interest Charges”?

Under the Tax Administration Law, citizens who fail to pay land use fees will be subject to a late payment fee of 0.03% per day. This fee is applied to encourage timely payment and ensure efficient tax management. It is important for citizens to be aware of their obligations and the potential consequences of any delays in payment to avoid this late fee.

The Capital’s Allocation of 68,000 Square Meters for the Construction of the Dong Anh Bus Terminal

The Dong Anh Bus Station spans an impressive 54,000 square meters and boasts a capacity of 148 parking spaces. The centerpiece of this transportation hub is the 3-story operational control building, strategically located at the heart of the bus station. Additionally, a striking feature of the station is the pair of 12-story public service complexes that complement the main building, elevating the overall functionality and aesthetic appeal of this modern transportation facility.