The VN-Index closed last week’s trading session at 1,250.5 points, a rise of 22.4 points or 1.82% from the previous week. The average trading value of matched orders was 10,131 billion VND, a decrease of 16.8%.

This is the lowest weekly value since May 2023. In the past eight weeks, the average trading value of matched orders on HOSE has never exceeded 15,000 billion VND.

Across the three exchanges, the total average trading value for the week was 13,606 billion VND, with the average matched trading value at 11,247 billion VND, a decrease of 16.1% from the previous week and 19.7% from the five-week average.

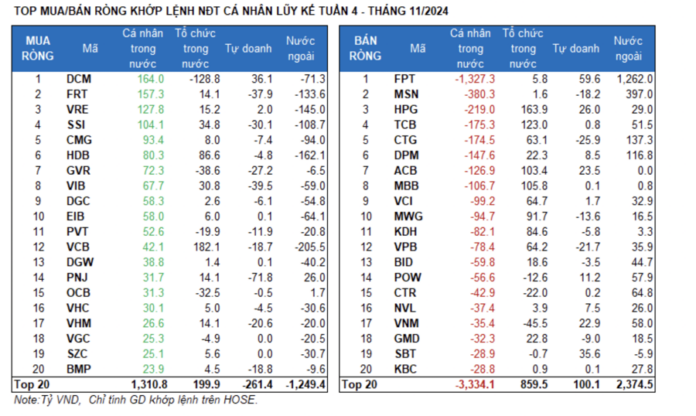

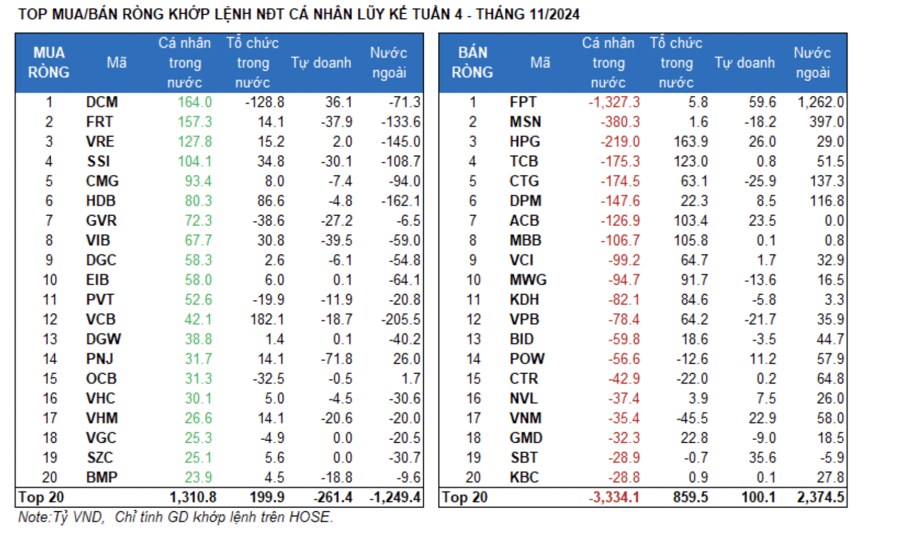

Foreign investors bought a net amount of 997.8 billion VND, with a net purchase of 1,112 billion VND in matched orders. Their main net purchases in matched orders were in the Information Technology, Food and Beverage sectors. The top stocks they net bought were FPT, MSN, CTG, DPM, CTR, VNM, POW, TCB, BID, and VPB.

On the selling side, their main net sales in matched orders were in the Banking sector. The top stocks they net sold were VCB, HDB, VRE, FRT, SSI, DCM, EIB, VIB, and DGC.

Individual investors net sold 1,979.5 billion VND, with a net sale of 2,162.5 billion VND in matched orders. In matched orders, they net bought 8 out of 18 sectors, mainly in the Chemicals sector. Their top net purchases included DCM, FRT, VRE, SSI, CMG, HDB, GVR, VIB, DGC, and EIB.

In terms of net sales in matched orders, they net sold 10 out of 18 sectors, mainly in the Information Technology and Banking sectors. The top net sold stocks were FPT, MSN, HPG, TCB, CTG, DPM, MBB, VCI, and MWG.

Proprietary traders net sold 209.2 billion VND, with a net sale of 163.4 billion VND in matched orders.

In matched orders, proprietary traders net bought 7 out of 18 sectors. Their largest net purchases were in the Information Technology and Food and Beverage sectors. The top net purchased stocks by proprietary traders this week were FPT, VTP, DCM, SBT, HPG, ACB, VNM, DXG, HAG, and POW.

The top net sold stocks were in the Banking sector, including PNJ, VIB, FRT, FUEMAV30, SSI, GVR, CTG, VPB, VHM, and REE.

Domestic institutional investors net bought 1,190.9 billion VND, with a net purchase of 1,213.9 billion VND in matched orders. In matched orders, domestic institutions net sold 5 out of 18 sectors, with the largest net sales in the Chemicals sector. The top net sold stocks were DCM, VNM, GVR, OCB, FUEVFVND, BAF, CTR, VTP, PVT, and TCH.

In terms of net purchases, the largest sector was Banking. The top net purchased stocks were VCB, HPG, TCB, MBB, ACB, MWG, HDB, KDH, VCI, and VPB.

The allocation of money flow decreased in key sectors (Banking, Real Estate, Securities, Steel, and Retail) while increasing in some smaller sectors such as Information Technology, Chemicals, Construction, Agriculture & Fisheries, Electricity, Textiles, and Aviation.

The money flow allocation hit a 10-week low in Banking, Securities, and Steel, but the price indices of these sectors moved in tandem with the market, recording gains. The divergence between prices and money flow in the Banking sector continued for the second consecutive week, observed in many leading stocks such as VCB, BID, CTG, and TCB.

In the Real Estate sector, the money flow allocation significantly decreased, and the price index rose less than the overall market, indicating a “losing steam” signal for real estate stocks.

Among the sectors with an increased money flow allocation, Information Technology (FPT) and Express Delivery (VTP) stood out with price indices that outperformed the overall market. For FPT, in particular, the increase in money flow and price was notably influenced by strong net buying from foreign investors.

Looking at the weekly picture, the money flow allocation decreased in the large-cap VN30 group while increasing in the mid-cap VNMID and small-cap VNSML groups.

Last week, money flow remained concentrated in the large-cap VN30 group, accounting for 48.7% of the total, although lower than the previous week’s 52.3%. The allocation to the mid-cap VNMID and small-cap VNSML groups increased, reaching 36.7% and 11.5%, respectively.

In terms of money flow size, the average trading value decreased most significantly in the large-cap VN30 group (-1,760 billion VND/-28%), followed by the mid-cap VNMID group (-270/-6.2%). Meanwhile, the small-cap VNSML group saw a slight improvement in liquidity (+41 billion VND/+3.5%).

Regarding price movements, the VN30 and VNSML indices outperformed the overall market, rising by 1.96% and 2.01%, respectively. In contrast, the VNMID index recorded a lower increase of 1.75%.

Post-inspection, C4G altered its capital allocation plans for the 2022 and 2023 issuances.

On November 26, 2024, Joint Stock Company CIENCO4 Group (UPCoM: C4G) reported changes to its plan for utilizing capital raised from two issuances in 2022 and 2023. The company also supplemented and finalized its 2022 and 2023 financial statements to address conclusions from an inspection by the State Securities Commission of Vietnam (SSC) on October 11, 2024.

The Flow of Funds: Why Stockholders are Holding On – What Incentives are Driving the Money Holders?

The market climbed for another week, with indices outperforming the previous week’s numbers. However, liquidity took a significant dip, falling to a record low in the last one and a half years. Experts suggest that this upward trend is being supported by supply rather than cash flow, and even those with money are unsure whether to jump in at this point.