Prime Minister Pham Minh Chinh has issued Dispatch No. 122 to the Governor of the State Bank of Vietnam, requesting a focus on credit management measures for 2024.

According to the dispatch, the complex global situation, along with natural disasters such as Storm No. 3, has caused significant challenges for local production and business activities. Many people and businesses have suffered heavy losses, and accessing credit has become increasingly difficult, leading to a rise in bad debts for banks.

A social housing project in Thu Duc City, Ho Chi Minh City. (Photo: NLD)

To enhance credit management and strengthen state management in the monetary and banking sectors, thereby boosting economic growth and striving to achieve the highest possible targets in the 2024 socio-economic development plan, the Prime Minister has requested the State Bank to focus on several key tasks.

Specifically, the State Bank is instructed to guide credit institutions to make further efforts to reduce lending interest rates by cutting costs, simplifying administrative procedures, and promoting the application of information technology and digital transformation.

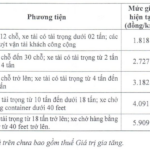

“Effectively implement and ensure transparency in preferential credit packages tailored to the characteristics of each credit institution, focusing on critical sectors that contribute to the economy’s growth drivers in line with the Government’s policies. These include social housing, worker housing, and credit packages for forestry and fisheries products,” the dispatch states.

The Prime Minister emphasized the need for credit institutions to uphold their social responsibility and business ethics by supporting and sharing the burdens of people and businesses facing difficulties.

Credit should be prioritized for production and business activities, priority sectors, and economic growth drivers, such as digital transformation, green transformation, climate change response, circular and sharing economies, science, technology, and innovation.

At the same time, tight control over credit in risky areas is essential to ensure safe and efficient lending practices. Policies to facilitate access to credit for businesses and individuals should continue, along with promoting lending for production, business, and consumer needs during the year-end and Tet holiday in 2025.

The State Bank is also tasked with instructing credit institutions to proactively review and identify borrowers affected by Storm No. 3, implementing support measures such as debt restructuring, interest rate reduction, and debt relief. Additionally, new loans should be provided to help restore production and business activities, in accordance with current regulations, and debt handling procedures should be followed for affected borrowers.

The Prime Minister requested the State Bank to coordinate with relevant agencies to proactively, flexibly, and effectively manage monetary policy, in harmony with a reasonably expanded fiscal policy and other macro policies. This includes a strong focus on implementing tasks and solutions related to interest rates, exchange rates, credit growth, open market operations, money supply, and reducing lending interest rates to provide capital for the economy at a reasonable cost.

“Smoothly and harmoniously manage the injection and withdrawal of money, avoiding abrupt moves and ensuring liquidity for the banking system. This will support people and businesses in overcoming the aftermath of Storm No. 3, recovering and developing production and business activities, promoting economic growth, maintaining macroeconomic stability, controlling inflation, and ensuring the balance of the economy and the safety of banking activities and credit institutions,” the dispatch states.

The State Bank is expected to implement timely and effective credit solutions aligned with macroeconomic and inflationary trends, meeting the capital needs of the economy, and addressing the difficulties of people and businesses. This should be done in the spirit of harmonious interests, shared risks, mutual support, and solidarity.

Additionally, it is crucial to ensure that credit flows into the economy are substantive and effective, without any bottlenecks, delays, or misallocation, preventing any mechanism of favoritism or negative influences in the credit allocation process of the credit institution system.

The Prime Minister emphasized the target of achieving a 15% credit growth rate for 2024.

The State Bank is instructed to continue implementing effective measures within its authority to reduce the lending interest rates of credit institutions, supporting people and businesses in their production and business development, generating revenue and profits, and repaying bank loans.

Furthermore, the State Bank is assigned to intensify inspection, examination, control, and strict supervision of credit granting and interest rate publication by credit institutions. Timely and strict handling of violations is essential, along with implementing effective solutions to address bad debts in the system.

Deputy Prime Minister Ho Duc Phoc is assigned to directly guide the State Bank and relevant agencies in performing the tasks assigned in this dispatch.

The Central Bank Eases Credit Limits for Commercial Banks

The recent adjustment has been made in a context of well-controlled inflation, falling below the target set by the National Assembly and the Government. This move is in line with the directives of the Government and the Prime Minister to manage the monetary policy proactively, effectively, and promptly to meet the capital needs of the economy and support production and business development.

Unlocking Housing Loans: The Prime Minister Calls for Transparency in Social Housing Credit Schemes

As per the Prime Minister’s instructions, the State Bank of Vietnam must direct credit institutions to effectively implement and ensure transparency in the social housing and worker housing credit package.