Illustrative image

On November 28, the State Bank of Vietnam (SBV) announced an adjustment to increase the credit growth target for 2024 for credit institutions (CIs), ensuring transparency and fairness. This additional limit is a proactive measure by the SBV, and CIs do not need to make a request for it.

According to the SBV, this adjustment is made possible by the successful control of inflation, which remains below the target set by the National Assembly and the Government. It also aligns with the Government and Prime Minister’s directives on flexible, effective, and timely credit institution management to meet the capital needs of the economy and support production and business activities.

Moving forward, the SBV will continue to closely monitor domestic and international market developments. They are prepared to provide liquidity support to enable CIs to extend credit to the economy and will promptly implement appropriate monetary policy measures.

In a document sent to commercial banks, the SBV stated that CIs with a credit growth rate of at least 80% of the previously communicated target can proactively adjust their credit balance. The formula for this adjustment is: (Credit balance on December 31, 2023) x (2023 Ranking Points) x 0.5%.

While the SBV did not disclose the list of institutions eligible for this increased limit, several banks had previously expressed their desire for higher credit quotas.

At a meeting between the Government and joint-stock commercial banks on September 21, 2024, HDBank’s Chairman, Kim Byoungho, shared that their credit growth had surpassed 15% at that point. To further boost credit, HDBank requested that the SBV consider allocating additional targets to credit institutions with strong capital allocation capabilities. They also suggested a review of the situation in the fourth quarter to make informed decisions.

At the same event, LPBank’s General Director, Mr. Ho Nam Tien, revealed that their credit growth had reached 15.97%, with an additional balance of nearly VND 44,000 billion, the highest in the system at that time.

During an investor meeting in the third quarter of 2024, Nam A Bank’s leadership disclosed that their credit growth had climbed to 14% by the end of August, utilizing 85% of the quota allocated by the SBV. They anticipated a further increase in their limit.

Recently published financial reports also indicated that several banks had achieved significantly higher loan growth than the industry average in the first nine months of the year, including Techcombank (20.8%), LPBank (16.1%), HDBank (16.1%), Nam A Bank (15.8%), MB (14.9%), TPBank (14.4%), MSB (14.4%), ACB (13.8%), and VPBank (12.2%). Consequently, these banks are likely to be among those receiving higher credit quotas.

Earlier in 2024, the SBV assigned credit growth targets to CIs, corresponding to an approximate industry-wide growth rate of 15%. This allocation method differed from previous years, where the SBV distributed quotas in multiple phases and required banks to submit requests for limit increases.

According to the SBV’s leadership, this change signaled to banks that capital injection into the economy this year must be more robust, decisive, and responsible. Unlike previous years, when some banks reached their limits while others fell short or even experienced negative credit growth, the new mechanism encourages banks to strive to achieve their assigned targets.

“Last year, some banks fully utilized their quotas, while others did not come close or even experienced negative credit growth,” said Deputy Governor Dao Minh Tu at a press conference at the beginning of 2024. “This change in mechanism is intended to motivate banks to reach their assigned credit targets.”

On August 28, the SBV announced an increase in credit growth targets for banks that had achieved at least 80% of their 2024 targets, as communicated at the beginning of the year.

Thus, since the beginning of the year, the SBV has made two adjustments to increase credit limits for banks with high credit growth rates. Conversely, banks with slower credit growth are likely to face reductions in their quotas.

Speaking at a regular press conference earlier this year, Deputy Governor Dao Minh Tu stated that banks failing to extend loans would have their credit limits transferred to other banks. “We will be strict with banks that have low credit growth rates, especially since the SBV has already allocated full credit limits to commercial banks at the beginning of the year,” Mr. Tu emphasized.

According to Mr. Tu, the SBV “will transfer the quotas of banks with low credit growth to proactively create favorable conditions for banks with potential for credit development in the coming time.”

With the banking sector’s planned credit growth rate of 15% for 2024, the system will inject more than VND 2,000,000 billion into the economy. As of November 22, 2024, credit growth across the system stood at 11.12% compared to the end of 2023, leaving a growth potential of approximately VND 520,000 billion in the remaining six weeks of the year.

The Central Bank Eases Credit Limits for Commercial Banks

The recent adjustment has been made in a context of well-controlled inflation, falling below the target set by the National Assembly and the Government. This move is in line with the directives of the Government and the Prime Minister to manage the monetary policy proactively, effectively, and promptly to meet the capital needs of the economy and support production and business development.

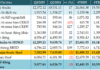

Positive Signals from the Vietnamese Banking Sector in Q3 2024

In a tumultuous economic climate, the Vietnamese banking sector in Q3 2024 demonstrated resilience and growth, with positive signals across the board. The latest financial reports indicate significant improvements in the financial performance of commercial banks, especially with the impending expiration of Circular 06. The CAMELS evaluation model paints a comprehensive picture of the current health and stability of the country’s banking system.

The Dark Cloud of Bad Debt

As per the latest data from the State Bank of Vietnam, the on-balance sheet bad debt ratio stood at 4.55% as of the end of Q3 2024, almost on par with the level at the end of 2023. In its recently updated report on the banking sector outlook, SSI Research noted that the bad debt ratios at state-owned and joint-stock commercial banks rose to 1.49% and 2.59%, respectively, in Q3 2024.