Mirae Asset has released an updated report on the banking sector, highlighting the uneven recovery in asset quality among banks.

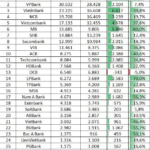

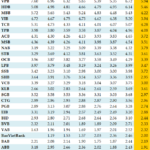

The group’s non-performing loan (NPL) ratio decreased slightly in Q3 2024, falling by an average of 7 basis points to 2.47%. However, this figure remains 42 basis points higher than the beginning of the year.

While there has been some improvement in asset quality overall, the pace of recovery is not significant, partly due to the real estate market, which seems to need more time to rebound, especially in the home loan segment. With a stable macroeconomic recovery and an expected upturn in the real estate sector, the banking industry is anticipated to stabilize its asset quality.

The loan loss reserve (LLR) ratio also improved in Q3 2024 but remains less than ideal, supported by favorable policies. The high NPL and relatively low LLR partly explain the decision to maintain low-interest rates. Therefore, there is a risk of increasing non-performing loans as multiple factors indicate that lending rates will continue to rise in the future.

Additionally, the risk from corporate bonds that will mature in mid-2025 could also put pressure on the industry’s asset quality if the cash flow of issuing companies, especially in the real estate sector, does not improve.

Net interest margin (NIM) performance differed from expectations, slightly decreasing in Q3 2024. However, Mirae Asset remains optimistic about NIM maintenance or recovery in the upcoming period. The advantage of state-owned banks in maintaining NIM may change as their net income remains stagnant, provisions increase, and the ample provisioning buffer is being fully utilized to maintain profit growth.

Regarding profitability, Mirae Asset states that the full-year target is relatively optimistic compared to the nine-month performance in 2024. Profit growth may slow down in Q4 2024 due to the high base effect of Q4 2023 and plans to increase provisions as banks anticipate higher expenses to improve asset quality.

Many banks have also made limited progress toward their annual plans. For 2025, profit growth will largely depend on net interest income driven by credit growth. Non-interest income is not expected to improve significantly, lacking substantial drivers. Net profit growth is projected to reach 15–20%, depending on banks’ prudence in normalizing health indicators and profits.

While still positive, this growth rate is unlikely to be as robust as in the 2017–2022 period, as the economy is currently in a recovery phase. The real estate sector’s weight is expected to adjust relatively, while increasing the weight of production sectors.

In the stock market, investors have high expectations for the recovery of domestic businesses, including the banking sector, with many large banks targeting growth rates above 30% for 2024. However, the results appear to fall significantly short of expectations, especially for banks, which have consistently missed their targets in 2023 and are likely to do so again in 2024.

Therefore, despite a very positive start, the market prices of this group have experienced significant adjustments, especially after the first and third quarters, as the results, although positive, fell short of expectations. External drivers, such as Fed rate adjustments, strong US economic growth, and China’s economic stimulus policies, have failed to excite the market. Instead, changes are often interpreted negatively.

The banking sector’s recovery in terms of capitalization from the end of Q3 to the beginning of Q4 2023 was in line with the return to positive profit growth in the same period. As a result, valuations returned to the five-year average from -1 standard deviation (std). However, the market lacks the momentum to surpass this valuation threshold, and adjustments are mostly made at this level. Currently, most valuations are below -0.5std, and according to Mirae Asset, this presents an opportunity to gradually accumulate bank stocks.

At present, attractively valued stocks, such as TCB and VPB, are likely to pose fewer risks in the short term, especially given that the overall economic recovery will not be smooth.

The outlook for state-owned banks is a relatively long-term story as the issue of retaining profits is expected to be resolved soon, and these banks also have unique competitive strengths. For example, CTG with sustainable FDI, BID benefiting from increased public investment, and VCB’s potential to increase market share in imports and exports.

The Dark Cloud of Bad Debt

As per the latest data from the State Bank of Vietnam, the on-balance sheet bad debt ratio stood at 4.55% as of the end of Q3 2024, almost on par with the level at the end of 2023. In its recently updated report on the banking sector outlook, SSI Research noted that the bad debt ratios at state-owned and joint-stock commercial banks rose to 1.49% and 2.59%, respectively, in Q3 2024.

The Ultimate Guide to Bank Risk Buffers: Strengthening Your Financial Safety Net

The banking sector report, released by VIS Rating on November 20, 2024, revealed a concerning trend. According to the report, nearly 20% of the assessed banks demonstrated weak capital safety profiles. This issue was particularly prominent among small and medium-sized banks, which also faced heightened liquidity risks due to their reliance on short-term market funds and the rise in interbank interest rates.

The Bank’s NIM is Thinning

The Q3 2024 NIM for banks across the board witnessed a decline compared to Q2, indicating the industry is grappling with a host of challenges. A stark contrast is emerging between large and small banks, giving rise to an uneven competitive landscape. This dynamic environment demands that banks adopt more agile strategies to enhance their performance and keep pace with the evolving market conditions.