Sudden Capital Increase

On November 30, the National Assembly is expected to vote to adopt a resolution of the 8th Session of the 15th National Assembly, including a decision on the policy of supplementary state capital investment in Vietcombank.

Previously, the Government proposed allowing Vietcombank to use its remaining profit after tax, after deduction for dividend payment in the form of stock dividends. With this method, the dividend for state shareholders in shares is nearly VND 20,700 billion. This is considered a supplementary state investment in Vietcombank.

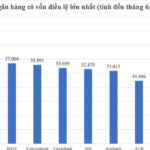

If approved by the National Assembly, Vietcombank can soon issue shares to pay dividends, increasing its charter capital by VND 27,666 billion (including both state and other shareholders’ capital), equivalent to a payment rate of 49.5%. After the issuance, Vietcombank’s charter capital will reach VND 83,557 billion – soaring to the top position in the banking system, far surpassing the two leading banks, VPBank (VND 79,339 billion) and Techcombank (VND 70,450 billion).

Eximbank has just been approved by the State Bank of Vietnam to amend its charter capital.

On November 25, Eximbank was officially approved by the State Bank of Vietnam to amend its charter capital in the License for Establishment and Operation under Decision No. 2570. Accordingly, Eximbank’s current charter capital is VND 18,688 billion. Specifically, Eximbank’s charter capital was increased by VND 1,218 billion through the issuance of shares to pay dividends from the source of undistributed profit accumulated up to 2023 after the establishment of funds. This plan to increase charter capital was approved by the bank’s 2024 Annual General Meeting of Shareholders.

The State Bank of Vietnam has also recently issued Decision No. 2378 on the adjustment of charter capital on the operating license of SeABank. Accordingly, SeABank’s charter capital increased by VND 3,393 billion, from VND 24,957 billion to VND 28,350 billion, equivalent to a total increase of nearly 13.6%.

At the recent Extraordinary General Meeting of Shareholders on November 16, LPBank shareholders approved the plan to increase charter capital in 2024 through the issuance of shares to pay dividends in 2023 to existing shareholders at a rate of 16.8%. LPBank’s charter capital after issuance is expected to increase to a maximum of VND 29,873 billion, putting the bank in the top 10 banks with the largest charter capital on the stock exchange.

HDBank has also recently received a document from the State Bank of Vietnam on approving the increase of charter capital through dividend payment in shares. Accordingly, HDBank is allowed to increase its charter capital by a maximum of more than VND 5,825 billion from the source of undistributed after-tax profit accumulated up to 2024 according to the plan to increase charter capital approved by the 2024 General Meeting of Shareholders.

After paying dividends in shares at a rate of 20%, HDBank’s charter capital will increase to more than VND 34,900 billion.

Bac A Bank has just announced the successful issuance of a VND 1,000 billion bond lot to raise capital to meet financial needs in the context of market fluctuations. At the same time, the bank plans to issue nearly 96 million ordinary shares to existing shareholders at an offering price of VND 10,000/share, a rate of 10% on the number of circulating shares.

Upon completion of the above two plans, Bac A Bank is expected to increase its charter capital by VND 1,579 billion, from VND 8,959 billion to VND 10,538 billion.

Increase in Risk Provision due to Bad Debts

Talking to Tien Phong newspaper, Dr. Nguyen Huu Huan – Ho Chi Minh City University of Economics – said that the need to increase the charter capital of banks arises from the increase in the ratio of risk provision, the expansion of medium and long-term capital sources, as well as the promotion of investment in technology, especially improving the capital adequacy ratio (CAR).

According to Dr. Huan, bad debts of banks tend to increase, even though Circular 02 of the State Bank has been extended until the end of this year. Therefore, charter capital plays an important role as a “buffer”, providing the necessary resources for banks to cope with challenges and fluctuations in the unstable economic environment, as well as creating more favorable conditions to continue providing capital support to businesses and individuals.

According to the State Bank, as of the end of September, the bad debt ratio was 4.55%, almost equal to the rate at the end of 2023.

Dr. Huan said that the amount of risk provision will depend on the “health” of each bank, so the debt coverage ratio between banks also varies. Banks that operate efficiently and have good business results will make high provisions and consider this as a “savings”, ensuring stable operations in the long term.

Some banks with low profits, even if they want to, cannot make high provisions but only enough to keep a modest debt coverage ratio. With a thin “buffer” of provisions, these banks will face more difficulties when handling potential risky loans that turn into bad debts.

The National Assembly Approves Additional Capital Injection of VND 20.7 Trillion for Vietcombank

Vietcombank has significantly increased its charter capital, issuing an additional 27,666 billion VND in shares. With this move, the bank’s total charter capital has reached an impressive 83,557 billion VND, making it the highest in the Vietnamese banking system to date. This substantial increase in capital underscores Vietcombank’s strong position and dynamic growth in the market.

The Eximbank Shareholder Group owning over 5% of the bank’s capital has once again proposed the dismissal of Ms. Luong Thi Cam Tu and Mr. Nguyen Ho Nam.

A group of shareholders owning over 5% of Eximbank’s capital has once again proposed the removal of Ms. Luong Thi Cam Tu and Mr. Nguyen Ho Nam from their positions as members of the Board of Directors. This proposal will be discussed at the upcoming extraordinary general meeting of shareholders scheduled for November 28.

A New Direction for Eximbank: Approving the Resignation of 3 Key Members and Relocating the Head Office to Hanoi

On November 28, 2024, the Vietnam Export Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) held an extraordinary general meeting to approve the relocation of its head office from Ho Chi Minh City to Hanoi. This move comes amidst a heated discussion sparked by a proposal from a group of shareholders ahead of the upcoming annual general meeting.