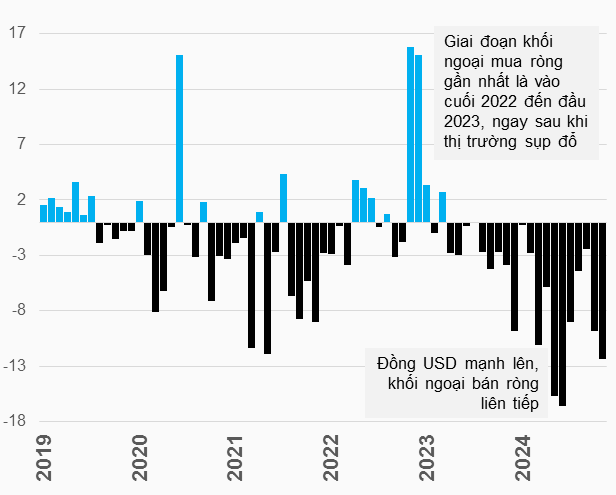

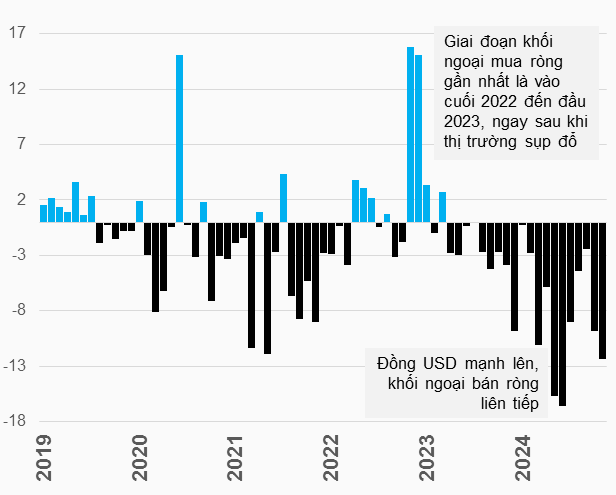

Foreign investors have been consistently selling Vietnamese stocks since April 2023.

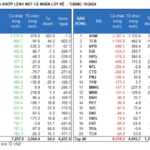

On the HOSE exchange, in 2024, the net selling of foreign investors as of November 20th reached VND 90.2 trillion, far exceeding any previous historical period.

|

Withdrawal

Net transaction value of foreign investors at HOSE from 2019 to present Unit: Trillion VND

Data as of November 20, 2024. Source: VietstockFinance

|

The main reason attributed to the foreign block’s sell-off is the exchange rate (that USD has appreciated against the VND) and, more profoundly, the interest rate differential between Vietnam and the US. While the Fed initiated the fastest and strongest policy tightening cycle in decades to fight inflation, the State Bank of Vietnam (SBV) oriented lowering interest rates to encourage the economy.

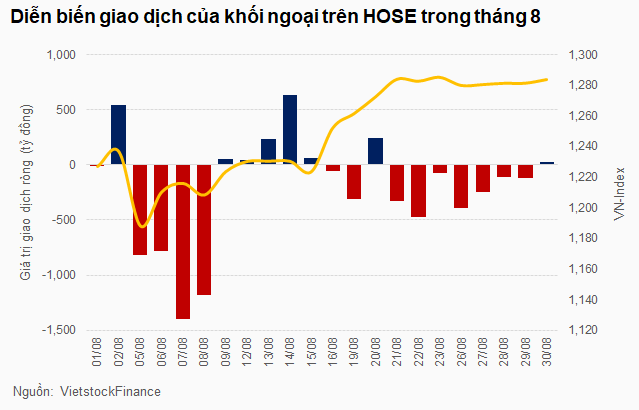

In 2024, from September 16th to October 3rd, when the USD/VND exchange rate cooled down and stabilized below 24,600, foreign investors showed signs of returning, specifically net buying nearly VND 1.8 trillion. But immediately after, they continued to sell strongly along with the hot increase in the exchange rate again.

The scenario of foreign investors’ withdrawal from the Vietnamese stock market is also in the context that experts agree: the strong USD potentially causes instability for other countries, especially emerging and frontier market countries.

“The USD is our currency, but it’s your problem” – this was the statement of US Treasury Secretary John Connally in 1971, when he was confident about the position of USD in the global economy and its strong influence on other countries.

The present context is different from 50 years ago, but Mr. Connally’s implication still holds value today.

But is the greenback the only reason for the wave of foreign net selling?

The depreciation of the VND affects the effectiveness of participating in the market in USD terms of foreign investors, as the AFC Vietnam Fund recently pointed out this situation. Along with assets denominated in USD in the US, typically tech stocks, becoming more attractive, further urging recalculation by cross-border players.

The stock market, dominated by traditional economic sectors in Vietnam (with the largest proportion being banking and real estate), seems less appealing when compared to the opportunity to participate in the future (such as artificial intelligence – AI) in a developed market.

Despite Vietnam’s continued international praise for its economic growth, the assets of leading listed companies are clearly not favored. Foreign investors’ transactions prove this.

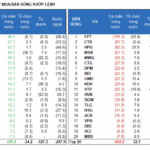

In 2024, Vinhomes, a powerhouse in the real estate industry, was net sold by foreign investors. FPT, the national technology leader, was also net sold. HPG, the heavy industry giant, was net sold as well. So was the consumer goods conglomerate MSN.

Previously, in 2023, retail giant MWG witnessed a wave of foreign withdrawal, including major shareholders. MWG used to be a “favorite” stock with a premium of 30-40% higher than the market price, but now it has an open foreign ownership room.

The wave of net selling has spread, causing significant loss of attraction for tightly-held foreign stocks. The VN Diamond Index tracking fund, FUEVFVND, witnessed a net selling value of VND 7.2 trillion by foreign investors this year as of November 20th.

Investment opportunities in Vietnam’s largest enterprises seem to fail to satisfy foreign investors’ demands.

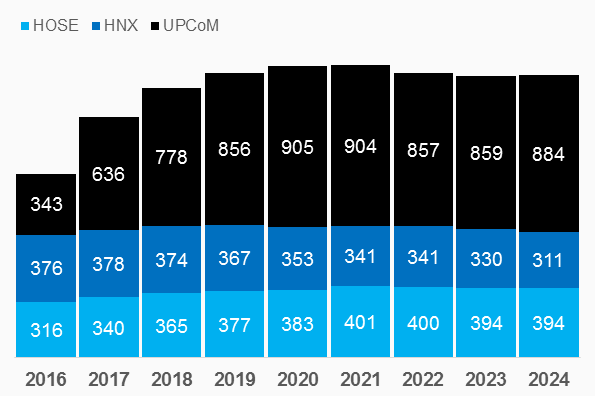

And while the once-popular Bluechips are losing their appeal, another issue is that since 2019, the Vietnamese stock market has also lacked new listings to attract investors.

Not considering the quality aspect, a statistic recently published by the Ho Chi Minh City Stock Exchange (HOSE) shows that the number of listed companies has been stagnant for the past five years.

|

Stagnant for 5 years

Number of listed and UPCoM enterprises as of September 30 each year from 2016 to 2024 Source: Consolidated from the Report on Corporate Governance Evaluation for Listed Companies in Vietnam in 2024 – HOSE

|

It is difficult to attribute the withdrawal of foreign investors solely to external factors because if the future prospects of domestic listed companies were attractive enough, perhaps they would shrug off moderate exchange rate losses of 4-5%.

Fortunately, the “water level” in the stock market is still being maintained, thanks to domestic investors’ capital inflows offsetting the wave of foreign net selling. However, this trend may also pose potential instability risks in the future when “foreigners keep selling, and locals get bored.”

In 1971, US Treasury Secretary John Connally was famous for his statement about the USD when he participated in negotiations regarding the US withdrawal from the Bretton Woods system (an international monetary system established after World War II, in which the USD was pegged to gold). This statement reflected America’s confidence in its decision to stop exchanging USD for gold (in 1971). The event disrupted the global monetary system, and other countries had to face significant changes in their transaction methods and foreign reserve management. |

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.

Foreign Investors Net Buy for the 6th Straight Session, Strong Demand for FPT Shares

The market continues to rally despite uncertain cash flows, with today’s liquidity not exceptionally high. The three exchanges witnessed a matching volume of nearly VND 15,000 billion, including net foreign buying of VND 359.7 billion. Specifically, in terms of matched orders, they were net buyers to the tune of VND 226.9 billion.

Stock Market Blog: Just an Intraday Adjustment, the Market is Strong

It appears that there are visible shifts in the behavior of those with purchasing power. Buyers have now accepted higher prices after multiple instances of the market “dipping” rather than taking a significant downturn. The market is trending in a direction where procrastinating with caution will only lead to worse buying opportunities.