Prime Minister Requests Lower Bank Interest Rates

On November 26, Prime Minister Pham Minh Chinh signed a dispatch on continuing to boost the domestic market and stimulate consumer demand.

The dispatch states that from now until the end of the year, the global situation is expected to remain complex, with political tensions and military conflicts potentially escalating and spreading, as well as risks of supply and production chain disruptions.

In light of this, the Prime Minister requested the Minister of Industry and Trade to continue directing the effective and synchronous implementation of solutions to regulate supply and demand, stabilize the market, and encourage consumption to boost the domestic market, linking production with distribution and consumption of goods.

Reducing interest rates for businesses and individuals to promote production and business in the last months of 2024 and early 2025. Illustrative image.

The Prime Minister asked the Minister of Finance to manage an appropriately expansive fiscal policy, focusing on key areas, in coordination with monetary policy and other macroeconomic policies to promote growth, stabilize the macro-economy, control inflation, and ensure the economy’s major balances.

The Governor of the State Bank of Vietnam was assigned to proactively, flexibly, timely, and effectively manage the monetary policy, in harmony and consistency with the fiscal policy and other macroeconomic policies.

The Prime Minister also requested the Governor of the State Bank to continue directing commercial banks to save costs, promote the application of digital technology, and reduce interest rates for businesses and individuals to promote production and business in the last months of 2024 and early 2025.

Nearly VND 670,000 billion to be injected into the economy

Mr. Nguyen Khac Duy, Deputy Director of Chon Chinh Company, a rice export enterprise, said that the company’s orders this year have increased by 200% thanks to the expansion of export markets. With the increase in orders, the enterprise’s capital demand also rises. Fortunately, the two banks that the enterprise has credit relations with are reducing lending rates from 7%/year to 5-5.5%/year. The enterprise plans to borrow more capital to invest in machinery and factory expansion to increase production scale.

According to the State Bank of Vietnam’s report, the lending interest rate has decreased by about 2.5%/year in 2023. In the first ten months of this year, the average lending interest rate decreased by 0.76%/year compared to the end of 2023. Currently, banks are deploying preferential credit packages and offering low-interest rate loans to promote year-end credit growth, with short-term lending rates ranging from 4.5-6.5%/year and medium and long-term rates below 9%/year.

To enhance businesses’ access to capital and promote credit growth, banks are implementing large-scale preferential credit packages to serve the year-end business season, with short-term lending rates ranging from 4.5-6.5%/year and medium and long-term rates below 9%/year.

A rice export enterprise needs to borrow hundreds of billions of VND at the end of the year to expand its scale (Photo: Ngoc Mai)

According to the State Bank of Vietnam, by the end of October, credit had increased by about 10.08%. This figure is higher than the 7.4% increase in the same period last year. Thus, nearly VND 670,000 billion will be injected into the economy in the last two months of this year.

PGS.TS Nguyen Huu Huan, a senior lecturer at the University of Economics Ho Chi Minh City, said that promoting credit growth to support economic growth should be reasonable and not at all costs, especially in controlling inflation. He added that if the VND 670,000 billion flows into production, business, and people’s consumption, it could create GDP growth of over 6%.

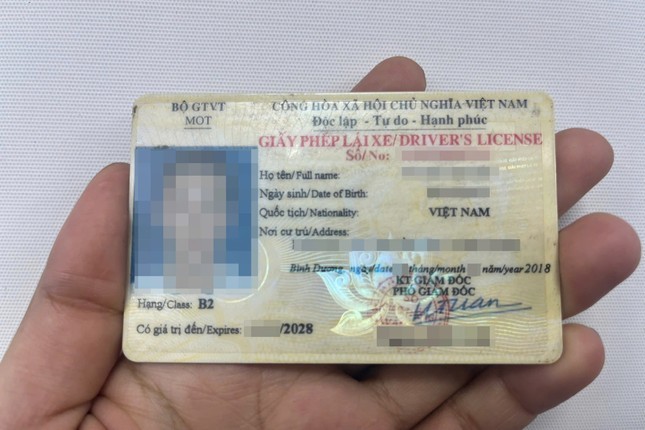

Important Information About Driver’s License Categories B1 and B2

The Law on Road Traffic Order and Safety, passed by the National Assembly and taking effect on January 1, 2025, includes changes in driver’s license categories. Many people with driver’s licenses in categories B1 and B2 are concerned about whether they need to exchange their licenses before January 1, 2025.

Mr. Bui Hoa An, Deputy Director of the Ho Chi Minh City Department of Transport, addressed this issue at a press conference on November 28, providing information on the city’s socio-economic situation.

All currently valid driver’s licenses, including those issued before 1995, can still be used after January 1, 2025. Photo: Nhan Le.

Mr. An affirmed that all currently valid driver’s licenses, including those issued before 1995, can still be used after January 1, 2025.

For B1 and B2 licenses that are still within their validity period, they can continue to be used until the expiration date. License holders can choose to exchange them for a B category license if they wish.

Regarding the issue of a serious shortage of driver’s license paper, Mr. An informed that the number of license paper available in Ho Chi Minh City still cannot meet the sudden increase in demand from the people.

According to regulations, each year, localities will summarize the required number of license papers and register with the Road Administration Department for bidding. After the bidding, the Department of Transport will sign a contract to purchase the necessary amount of license paper.

Gold Price Fluctuations Worry Many People

On November 29, Sai Gon Jewelry Company listed SJC gold bar prices at 82.9 – 85.4 million VND/tael (buying – selling), a decrease of 100,000 VND/tael compared to the previous day. The buying-selling gap was 2.5 million VND/tael.

Other gold businesses, such as Bao Tin Minh Chau Jewelry Company and Doji Group, also listed SJC gold bar prices at 85.4 million VND/tael.

Gold prices decreased sharply.

Gold ring prices also followed the downward trend of SJC gold bars, but the decrease was more significant. Specifically, Bao Tin Minh Chau Jewelry Company listed gold ring prices at 83.38 – 84.73 million VND/tael (buying – selling), a decrease of 250,000 VND/tael compared to the previous day. The buying-selling gap narrowed to 1.35 million VND/tael.

Doji Group listed gold ring prices at 83.5 – 84.7 million VND/tael, a decrease of 400,000 VND/tael in the buying price and 200,000 VND/tael in the selling price. The buying-selling gap narrowed to 1.2 million VND/tael.

High ‘Commissions’ Reveal Banks’ ‘Forcing’ Customers to Buy Insurance

The State Bank of Vietnam is drafting Decree 88 on administrative sanctions in the monetary and banking fields.

Accordingly, the State Bank of Vietnam stipulates a fine of VND 400-500 million if banks attach non-mandatory insurance products to the provision of banking products and services in any form. This sanction aims to align with the Law on Credit Institutions, which took effect in July 2024.

The banking industry’s new sanction mechanism comes after numerous complaints from people who were forced to buy life insurance when taking out loans. Many borrowers had to accept purchasing life insurance (a high-value product with long-term premiums) to obtain loan disbursements.

Additional sanctions aim to prevent banks from “forcing” customers to buy non-mandatory insurance for their loans.

In an interview with Tien Phong newspaper, Mr. Nguyen Quang Huy, a finance expert at Nguyen Trai University, said that in the first half of this year, there were still reports of customers having to participate in insurance programs to get loan disbursements. The reason is that insurance companies offer very high commissions for linked investment insurance products, with some companies paying over 100% to their partners, leading banks to ignore the issue.

Mr. Huy also stated that although the law prohibits this practice, banks have the upper hand, and customers need them, so they have no choice but to comply. Many banks are also under pressure to recover revenue to meet the agreements they have signed with insurance companies.

If they fail to meet their targets, banks must refund the pre-paid amounts to the insurance companies. Therefore, bank employees continuously devise new strategies, such as asking relatives to stand in for the customers or offering interest rate incentives of 1-2%/year if they agree to buy insurance, so that customers “voluntarily” agree to the insurance. Bank employees themselves have admitted that the pressure to meet targets leads them to suggest that customers purchase insurance.

Bac Giang Announces High Tet Bonus

In an interview with Tien Phong newspaper on November 27, Mr. Duong Ngoc Chien, Director of the Department of Labor, Invalids, and Social Affairs of Bac Giang province, said that the province currently has 322,000 laborers, an increase of 16,000 people compared to the same period in 2023. The labor demand for December is expected to be about 10,000 people.

According to a quick report, this year’s Tet bonus of enterprises in Bac Giang province is expected to be equal to or 5-10% higher than in 2023.

Bac Giang’s highest Tet bonus is expected to be VND 146 million. Photo: Nguyen Thang.

The average monthly salary this year is over VND 7.8 million/person, an increase of 2.9% compared to 2023. Currently, 172 enterprises employing over 155,800 laborers have planned for the Tet bonus, with an average bonus of VND 290,000/person, an increase of 13.7% compared to the previous year. The highest bonus is over VND 52 million/person, belonging to the private enterprise sector, while the lowest bonus is VND 100,000/person.

There are 311 enterprises in Bac Giang with plans for the 2024 Lunar New Year bonus for more than 178,800 laborers, with an average of over VND 6.6 million/person, an increase of 17.4% compared to 2023. The highest bonus is VND 146 million/person, belonging to foreign-invested enterprises, while the lowest bonus is VND 100,000/person.

“The Speaker’s Call to Action: Expediting the Creation of a Legal Framework for Emerging Issues to Catalyze Vietnam’s Development”

After 29 and a half days of diligent, scientific, democratic, and responsible work, with a spirit of innovation and a timely resolution of difficulties, bottlenecks, and blockages, the 8th Session of the 15th National Assembly has successfully concluded, having accomplished all its proposed agenda items. This session was marked by a strong focus on economic and social development, national defense, security, and improving the lives of the people.

The Dynamic City: Unlocking Growth, A Bold Vision for Vietnam’s Newest Municipality.

The proposed strategy is to gradually increase the proportion of capital from non-budgetary sources and FDI while decreasing the state sector’s contribution.