Technical Signals of VN-Index

During the trading session on the morning of November 28, 2024, the VN-Index witnessed a slight increase and formed a candle pattern resembling a High Wave Candle. This was accompanied by volatile trading volume, which fluctuated and remained below the 20-day average in recent sessions, indicating investors’ indecision.

At present, the index remains above the Middle Bollinger Band, while the MACD and Stochastic Oscillator indicators continue to trend upward after generating buy signals, suggesting a relatively optimistic short-term outlook.

Technical Signals of HNX-Index

On November 28, 2024, the HNX-Index rose and retested the Middle Bollinger Band, while trading volume displayed erratic fluctuations, reflecting investors’ unstable sentiment.

Currently, the Stochastic Oscillator indicator continues to trend upward after a Bullish Divergence and provides a buy signal. The index is retesting the old bottom of April 2024 (corresponding to the 217-225-point region). If there is an improvement in money flow in the upcoming sessions, the outlook will be more positive.

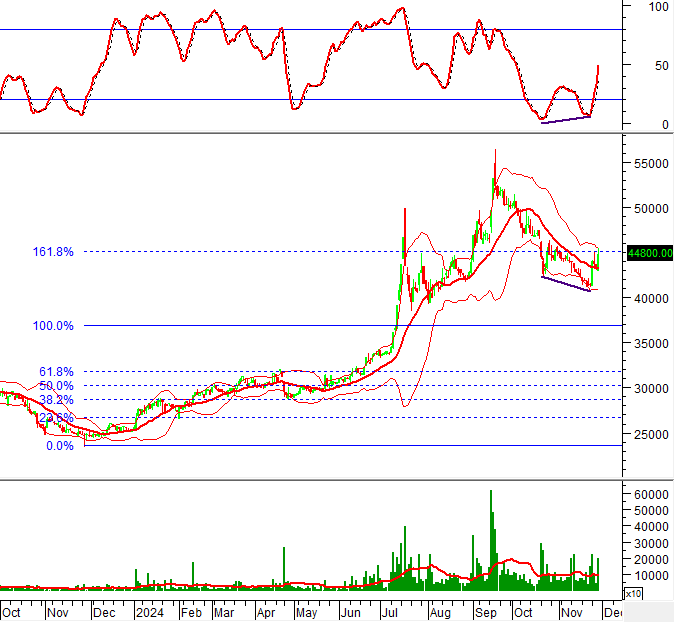

IMP – Imexpharm Pharmaceutical Joint Stock Company

On the morning of November 28, 2024, IMP witnessed a sharp rise and formed a Bullish Engulfing candle pattern, accompanied by increased trading volume, surpassing the 20-session average. This indicates the presence of optimistic investor sentiment.

At present, the stock price is retesting the Fibonacci Projection 161.8% threshold (corresponding to the 44,500-46,000 region) while the Stochastic Oscillator has generated a buy signal and continues to trend upward. If the stock price surpasses this level in the upcoming sessions, the recovery outlook will likely be sustained.

VTP – Postal Joint Stock Company Viettel

On November 28, 2024, VTP witnessed a strong surge and remained above the SMA 100-day and SMA 200-day moving averages, indicating a positive long-term outlook.

However, the stock price continues to reach new 52-week highs after successfully surpassing the old peak of March-June 2024 (corresponding to the 92,600-96,000 region). Meanwhile, the Stochastic Oscillator is forming a Bearish Divergence in the overbought region. If the indicator falls out of this zone, there is a risk of short-term adjustments in the upcoming sessions.

Technical Analysis Department, Vietstock Consulting

The Power of Persuasive Writing: Crafting Compelling Headlines

“The Week Ahead: Uptrend Momentum Sustained”

The VN-Index extended its gains from the previous week, forming a bullish White Marubozu candlestick pattern. This indicates strong buying pressure as the index closed near its high. Additionally, the VN-Index has crossed above the 200-week SMA, reflecting a positive long-term outlook and an increasingly optimistic investor sentiment. However, the MACD indicator is currently showing a sell signal, and a drop below the zero line could trigger a short-term correction. If this occurs, the likelihood of a downward adjustment increases.

Technical Analysis for the Session on November 29: Investor Sentiment Continues to Improve

The VN-Index and HNX-Index both climbed, with a notable surge in trading liquidity during the morning session, indicating a positive shift in investor sentiment.

Market Beat: Telecoms Rebound, VN-Index Surges Over 8 Points

The market ended the session on a positive note, with the VN-Index climbing 8.35 points (0.67%) to reach 1,250.46, while the HNX-Index gained 1.07 points (0.48%), closing at 224.64. The market breadth tilted in favor of buyers, with 402 tickers advancing against 279 declining ticks. The VN30 basket painted a similar picture, as bulls dominated with 21 gainers, 6 losers, and 3 unchanged stocks, ending the day in the green.

Stock Market Week of Nov 25-29, 2024: Foreign Investors Maintain Net Buying

The market remains cautious despite a strong recovery in the VN-Index last week. Trading volume needs to improve in the coming period to sustain this upward momentum. Notably, consecutive net buying by foreign investors is a positive signal that bodes well for the VN-Index’s outlook.