According to Kay Hart, President, Ford International Markets Group (IMG includes Australia and New Zealand, ASEAN, North and South Africa, and the Middle East): “We conducted research to gain insights into their perspectives on electric vehicles: what appeals to them, what concerns them, and what could encourage or deter them from purchasing an electric vehicle.”

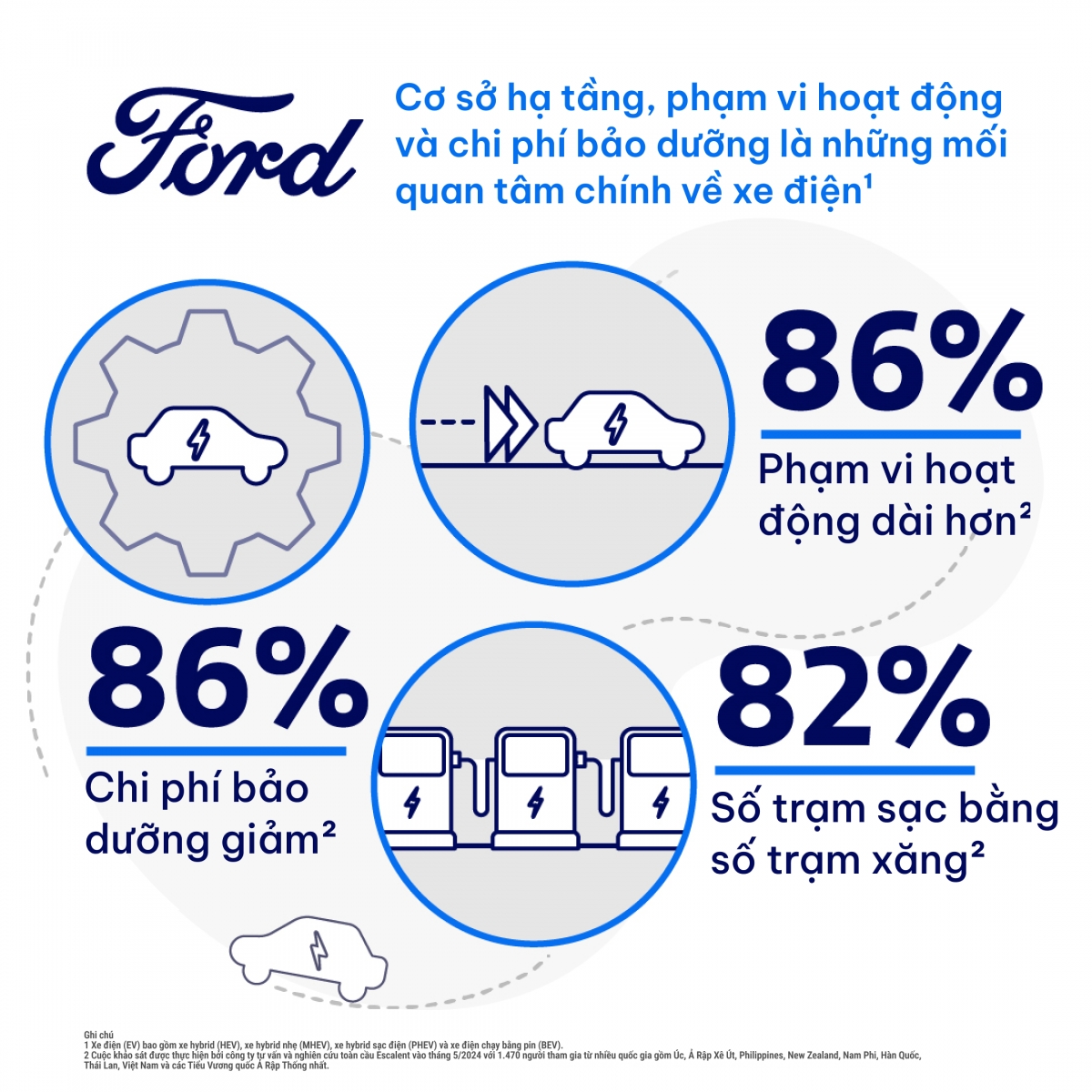

“Research across multiple markets indicates a need for enhanced foundational knowledge about electric vehicles, addressing cost concerns, range anxiety, infrastructure, and promoting the benefits of electric mobility,” shared Hart.

Electric vehicles are perceived as financially and environmentally beneficial, fuel-efficient, eco-friendly, and progressive.

Ford’s electric vehicle study revealed that people in various countries are intrigued by electric vehicles and supportive of businesses adopting them. However, concerns persist about charging infrastructure and battery longevity. Here are some key trends from the research:

Familiarity with Electric Vehicles:

Two-thirds of survey respondents categorized electric vehicles as “fun to drive,” “cool,” “sporty,” and even “easy to own.” Moreover, two-thirds of respondents shared that their perception of electric vehicles has become more positive over the past year, mainly due to environmental benefits. Nearly 50% of respondents have ridden in an electric vehicle, with 35% having test-driven one.

Preferred Type of Electric Vehicle:

In all surveyed markets except Thailand, respondents selected hybrid vehicles (HEV) as their top choice “if cost was not a factor,” followed by plug-in hybrid electric vehicles (PHEV) and then battery electric vehicles (BEV).

First Impressions:

A majority of survey participants indicated that they would be more inclined to date someone driving an electric vehicle. More than 3/4 of respondents from South Africa, Thailand, the Philippines, Vietnam, and the UAE stated they would choose an electric vehicle over an internal combustion engine car to make a good first impression. In contrast, only 57% of Australians and 48% of New Zealanders agreed.

Positive Emotions:

Over half of the survey participants described electric vehicle owners as environmentally conscious, progressive-thinking, and tech-savvy. Additionally, 61% stated they would consider purchasing an electric vehicle.

Electric Vehicles in Daily Life:

Most respondents agreed that they would be inclined to use electric vehicles for deliveries or as service vehicles and would also prefer them for their daily commutes.

Electricity Costs:

While most participants agreed that electric vehicles save costs by eliminating fuel expenses, Australia deviated from this trend. Sixty percent of Australians believed that charging an electric vehicle at home would significantly increase their electricity bill, equivalent to the cost of fueling an internal combustion engine car.

Charging Stations:

A majority of survey participants selected service stations as the ideal location for public charging services, followed by shopping centers and office buildings.

Infrastructure:

Many respondents lacked information about public charging stations near their residences. Forty-five percent of those surveyed in South Africa were unaware of any charging stations within a 20-kilometer radius of their homes, while shopping centers were deemed the most suitable locations for charging stations.

Performance Requirements:

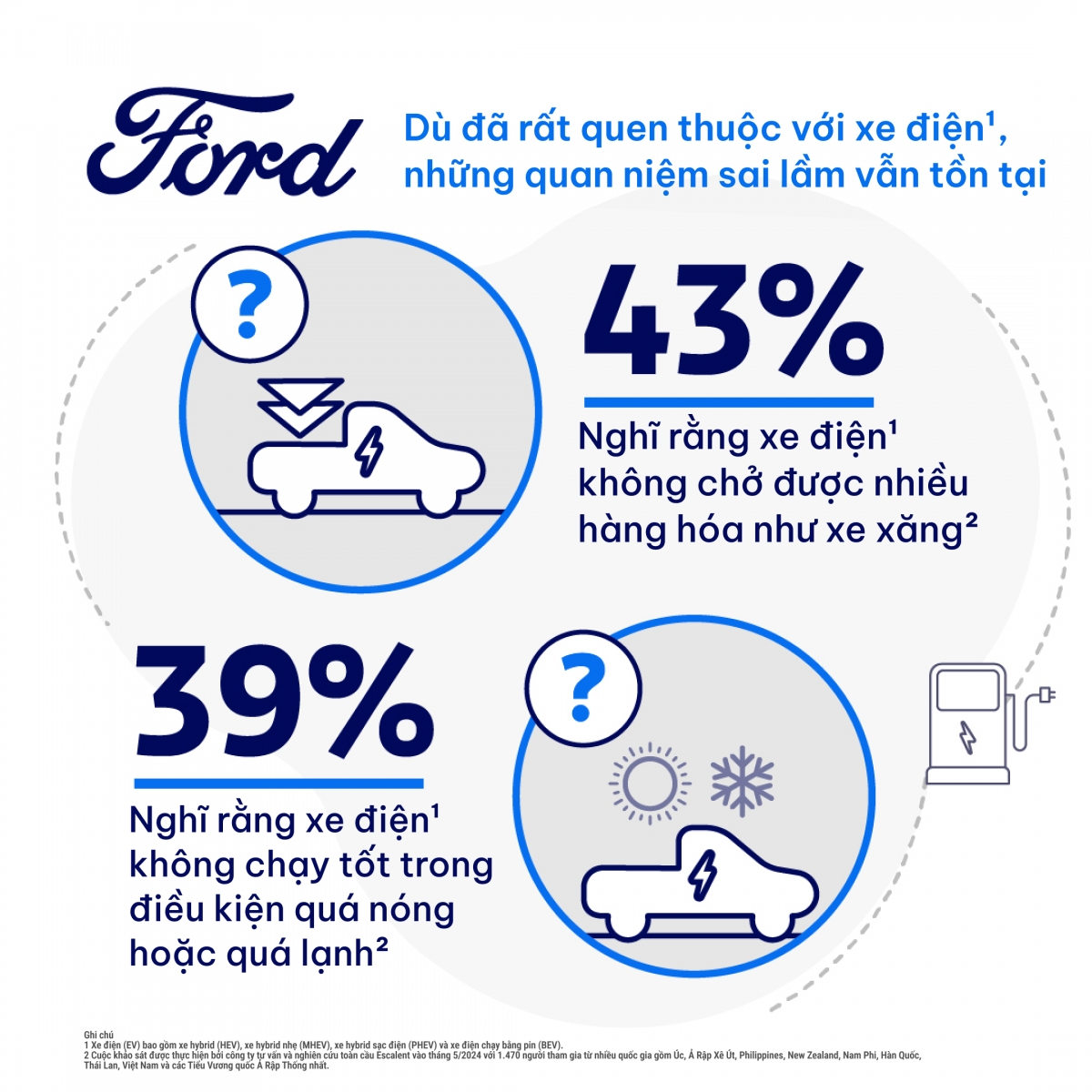

Gas and diesel vehicles remain preferred for enduring harsh conditions, towing, or off-roading. However, most participants shared that they would be more inclined to purchase electric vehicles if they performed better in terms of towing and off-roading capabilities. Some respondents also worried that electric vehicles might not accommodate as much luggage or cargo as their internal combustion engine counterparts.

Barriers to Purchase:

More than 3/4 of respondents believed that electric vehicles are as safe as internal combustion engine cars in collisions. However, over a quarter expressed concerns about electric vehicles’ performance in extreme temperatures and the potential for charging stations to malfunction. They indicated that they would be more likely to purchase electric vehicles if improvements were made in range, long-term maintenance costs were reduced, and charging infrastructure developed. Battery longevity was also a significant concern.

VinFast Unveils Smaller, More Affordable Model than VF3: Stock Surges as $10 Billion Valuation Nears Top 5 Global EV Makers

This product is designed for service-based businesses, such as taxi companies and ride-sharing platforms. With its cutting-edge features and intuitive design, it revolutionizes the way these businesses operate, helping them streamline their services and elevate the customer experience to new heights.

What Does the International Press Say About VinFast’s Achievement as Vietnam’s No.1 Brand?

“The Green Revolution’s Trailblazer”, “A Pioneer”, and “A Testament to Vietnamese Determination” – these are just a few ways international media has described VinFast’s remarkable journey to becoming Vietnam’s number one automotive brand. In a short span of time, VinFast has not only captured the hearts of Vietnamese drivers but has also left its fossil fuel-dependent competitors in the dust.

Electrifying Sustainability: Revving Up the Electric Vehicle Production Line

Supplying cutting-edge technology, production lines, and innovative solutions, Bühler Group is at the forefront of sustainable electric vehicle manufacturing in Vietnam and beyond. By reducing resource wastage, minimizing emissions, and optimizing production processes and costs, the company is paving the way for a greener future.