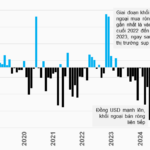

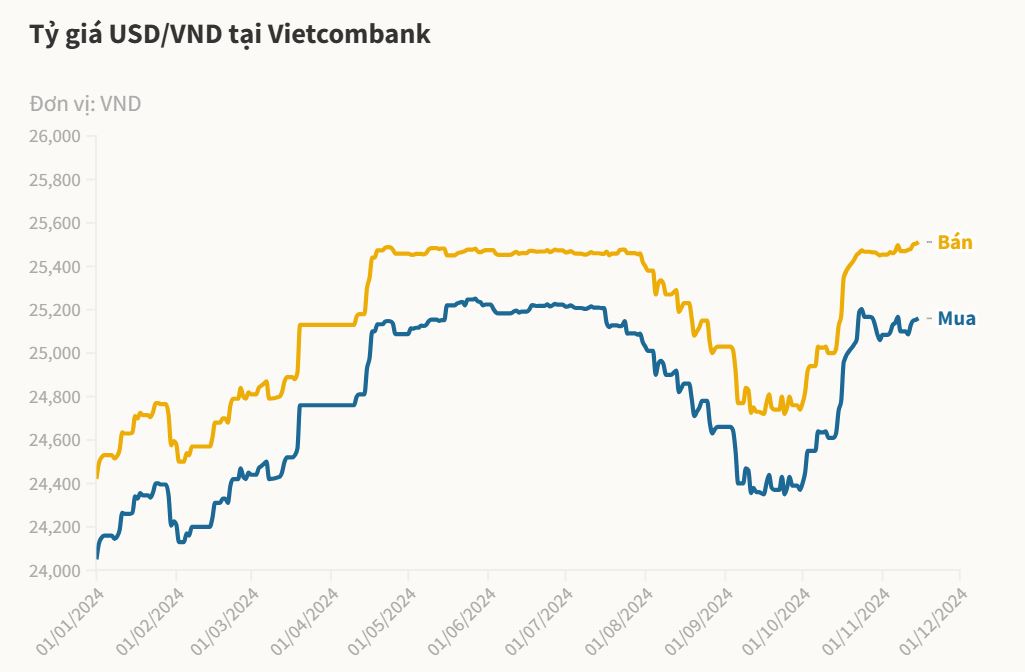

On November 15, the State Bank of Vietnam announced the central exchange rate at 24,298 VND, up 8 VND from the previous day. With a 5% margin on either side of this rate, commercial banks are allowed to trade USD within a range of 23,083 – 25,512 VND.

Commercial banks have also pushed their selling rates closer to the ceiling, setting a new record high. Meanwhile, their buying rates remain lower than late October levels.

Specifically, Vietcombank’s rates are up 6-8 VND from yesterday, now standing at 25,160 – 25,512 VND per USD. BIDV offers rates at 25,190 – 25,512 VND. Eximbank has increased its rates to 25,160 – 25,512 VND… Compared to the beginning of the year, each USD is now almost 4.5% higher at these banks.

In the meantime, the black market has seen foreign exchange points quoting buying and selling rates at 25,600 – 25,709 VND this morning, slightly lower than the previous day. As a result, the gap between black market and commercial bank rates hovers around 200 VND on the selling side and 350-400 VND on the buying side.

Last updated at 2:00 PM on 11/13/2024

|

The appreciation of the USD in Vietnam is in line with the movement of the US Dollar Index, which measures the greenback’s strength against other major currencies. Donald Trump’s re-election as US President has raised global investors’ concerns about the potential for higher inflation, stemming from higher trade tariffs with China as well as increased risks of US fiscal deficit and debt. Consequently, long-term US bond yields have risen, leading to a stronger US dollar.

At a recent question-and-answer session in the National Assembly, Governor Nguyen Thi Hong remarked that the US dollar has been experiencing complex fluctuations, with periods of sharp declines but a rising trend since the third quarter. These movements have had an impact on the domestic foreign exchange market.

Stabilizing the exchange rate and foreign currency market is challenging, according to Governor Hong, due to the dependence on actual supply and demand in the market, namely the amount of foreign currency injected into the economy and the sources of revenue available.

Moreover, the governor noted that the foreign exchange market still faces dollarization, making it susceptible to psychological expectations. Organizations and businesses hold foreign currency but are reluctant to sell. The governor assured that when the market experiences significant fluctuations, the State Bank will consider selling foreign currency to stabilize the market and meet the needs of the people.

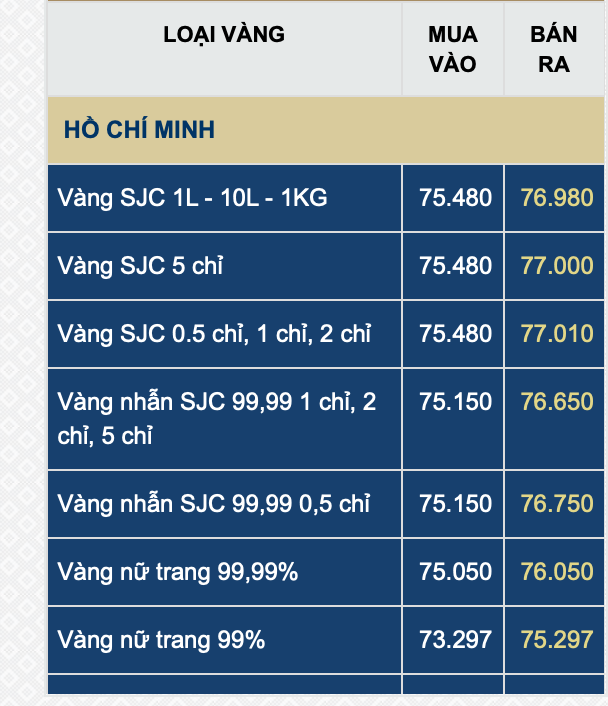

In contrast to the movement of the USD, gold bullion and plain rings showed a stable trend today compared to yesterday. Saigon Jewelry Company (SJC) quoted gold bullion prices at 80 – 83.5 million VND per tael. SJC’s buying and selling rates for plain rings hovered around 79.3 – 81.8 million VND.

By Quynh Trang

The Vanishing Liquidity: Personal Cash Flows Take Profits, Net Selling 2,200 Billion VND Last Week

Individual investors net sold 1,979.5 billion VND this week, of which 2,162.5 billion VND was net sold in matched orders.

Post-inspection, C4G altered its capital allocation plans for the 2022 and 2023 issuances.

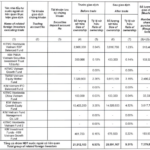

On November 26, 2024, Joint Stock Company CIENCO4 Group (UPCoM: C4G) reported changes to its plan for utilizing capital raised from two issuances in 2022 and 2023. The company also supplemented and finalized its 2022 and 2023 financial statements to address conclusions from an inspection by the State Securities Commission of Vietnam (SSC) on October 11, 2024.