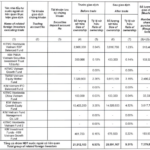

On November 29, the central exchange rate continued its sharp decline, falling by 20 VND against the previous session, as quoted by the State Bank of Vietnam at 24,251 VND/USD. With a +/-5% fluctuation band, the ceiling and floor rates are 25,463 VND/USD and 23,038 VND/USD, respectively.

Vietcombank quoted their buying and selling rates at 25,130 – 25,463 VND/USD, a decrease of 15 VND and 21 VND, respectively, compared to the previous day’s close. Vietcombank’s selling rate is very close to the ceiling rate set by the State Bank.

BIDV offered rates at 25,160 – 25,463 VND/USD, a reduction of 15 VND on the buying side and 21 VND on the selling side from the previous day’s close.

Techcombank’s buying and selling rates stood at 25,147 – 25,463 VND/USD, marking a decrease of 30 VND and 21 VND, respectively, from the previous session’s close.

VietinBank maintained its buying rate while lowering its selling rate by 21 VND, resulting in a range of 25,160 – 25,463 VND/USD.

Eximbank adjusted its rates to 25,110 – 25,463 VND/USD, with the buying and selling rates witnessing a drop of 40 VND and 21 VND, respectively, from the previous day’s close.

Maritimebank made a minor adjustment, increasing the buying rate by 2 VND and decreasing the selling rate by 21 VND, resulting in a range of 25,146 – 25,463 VND/USD.

In the unofficial market, the exchange rates remained unchanged from the previous session, with transactions occurring at 25,690 – 25,790 VND/USD.

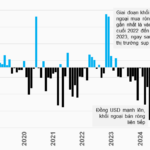

Globally, the USD Index (DXY), which measures the strength of the US dollar against a basket of major currencies, stood at 106 points, the lowest level in the past two weeks.

According to Citi Bank’s analysts, the US dollar could experience a temporary decline in December as a series of central bank meetings take place.

Nine out of ten central banks in the G10 group (including Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the UK, and the US) will convene within the next three weeks. It is anticipated that five central banks, namely the US Federal Reserve (Fed), the European Central Bank (ECB), the Bank of Japan (BoJ), the Bank of Canada (BoC), and the Swiss National Bank (SNB), will announce interest rate adjustments.

Citi Bank highlighted that data from the US and Canada, particularly the labor market report on Friday, December 6, will play a crucial role in shaping market sentiment.

Regarding the ECB, BoJ, and SNB, Citi expects limited scope for significant short-term market surprises but foresees a gradual alignment of market expectations as their meetings draw closer.

Analysts suggested that in the short term, the performance of the US dollar could be influenced more by the interest rate decisions of central banks than by policy developments in the US.

Despite anticipating a mild depreciation of the US dollar in the near term, Citi Bank maintained a strategically positive outlook for the currency in the first half of 2025. The institution expressed its intention to capitalize on USD corrections in December to build a favorable position for the first half of the upcoming year.

The Greenback Gallops On: USD Bank Rates Surge to New Highs

Today, the bank has increased its USD selling price to a record high of VND 25,512. This move underscores the bank’s confidence in the strength of the USD and its commitment to offering competitive exchange rates. With this new rate, customers can expect to get even more value for their money when conducting transactions involving the USD.

Who Qualifies for the 3.2% Interest Rate Home Loan in Ho Chi Minh City?

On November 28, at a press conference on socio-economic issues, Mr. Phan Huu Vinh, Head of the Appraisal Division of the Housing Development Fund in Ho Chi Minh City, provided information related to borrowers, loan conditions, interest rates, and other relevant details for individuals seeking to establish housing in the area.

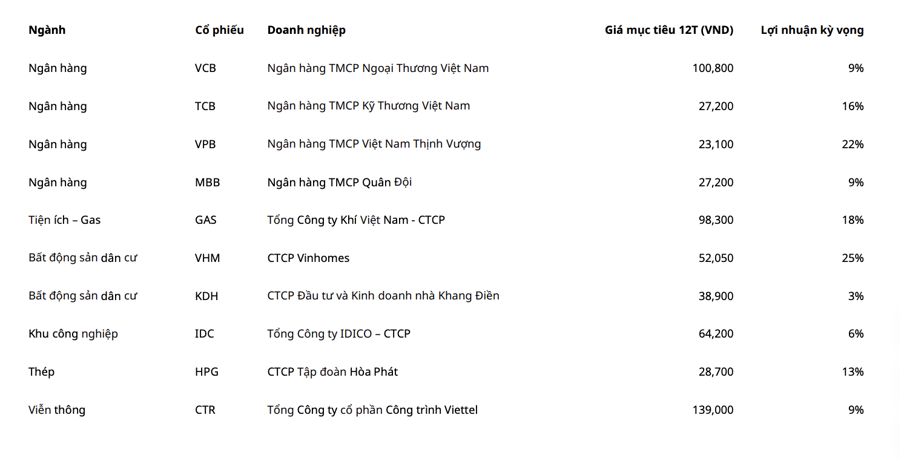

Is There Still Appeal in Vietnamese Stocks? A Deep Dive into the $3.8 Billion Foreign Sell-Off on HOSE.

The extent and trend of foreign investor retreat from the stock market is indeed surprising, given that Vietnam has consistently boasted of being a developing country with the fastest-growing economy in Asia and the world.