Recently, Mr. Nguyen Trong Hieu, Member of the Board of Directors and General Director of Truong Thanh Wood Industry Corporation (HoSE: TTF), reported his recent stock transactions.

Between November 19 and November 26, Mr. Hieu purchased 330,000 TTF shares, increasing his ownership from 0% to 0.08% of the company’s capital.

Mr. Nguyen Trong Hieu, Member of the Board of Directors and General Director of Truong Thanh Wood Industry Corporation

This transaction took place during a period when the TTF stock price has been consistently declining. From the beginning of March to November 28, 2024, the TTF stock price dropped by approximately 39%, reaching VND 3,040 per share.

Based on the current market price, Mr. Hieu is estimated to have invested over VND 1 billion in this transaction.

Born in 1982, Mr. Nguyen Trong Hieu holds an MBA from SEJONG University, Seoul, South Korea. He was appointed as the Vice General Director of TTF in April 2017 and has been serving as a Member of the Board of Directors and General Director since 2019.

Despite the recovery of the wood industry, with many businesses reporting positive profits, Truong Thanh Wood Industry Corporation continues to face challenges and remains in a prolonged spiral of losses.

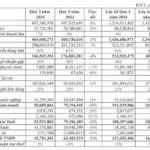

Specifically, in the third quarter of 2024, Truong Thanh Wood Industry Corporation (HoSE: TTF) recorded a revenue of over VND 236 billion, a 39% decrease compared to the same period last year, with a net loss of more than VND 21 billion, a significant increase from the VND 6 billion loss recorded in the previous year.

For the first nine months of the year, the company’s revenue reached VND 942 billion, a 15% decrease year-on-year. As a result, the company incurred a tax loss of nearly VND 27 billion, bringing the total cumulative loss as of September 30 to nearly VND 3,268 billion.

TTF stock price movement

According to the company’s explanation, the decline in revenue was due to difficulties faced by major customers, resulting in a decrease in export revenue, as well as increased logistics costs and global transport disruptions caused by conflicts in certain regions. As a consequence, some customers postponed their deliveries to the fourth quarter of 2024.

Additionally, revenue from domestic projects decreased due to delays in the implementation of real estate projects by investors and the impact of natural disasters in the northern provinces, affecting the company’s profits.

To address these challenges, Truong Thanh Wood Industry Corporation is focusing on expanding and seeking new customers in European, American, and especially Asian markets to increase production volume in the fourth quarter. The company also plans to restructure inefficient subsidiaries to concentrate resources on new business projects.

The Finest Timber Crafts a New Venture: Truong Thanh Wood Invests in Binh Duong-based Furniture Company

The Ho Chi Minh City Stock Exchange-listed (HOSE: TTF) Truong Thanh Wood Industry Corporation has announced its investment in Natuzzi Vietnam JSC. With a total chartered capital of VND 30.6 billion, Truong Thanh contributes over VND 1.5 billion, equivalent to a 5% stake in the company.