Illustrative image

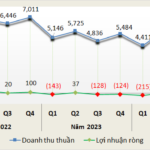

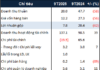

According to the latest report by VIS Rating on the Residential Real Estate Sector, while project sales have recovered since Q1/2024, most developers are unlikely to meet their 2024 profit targets. Housing demand remains robust, as evidenced by high absorption rates and a strong growth in home loans of 7% year-over-year. Expectations of rising home prices, coupled with reduced down payment requirements, will continue to fuel strong demand from homebuyers. Many developers, including Vinhomes (VHM), Nam Long (NLG), Khang Dien (KDH), An Gia (AGG), and Ha Do (HDC), have reported increased sales, mainly in the high-end segments.

Source: VIS Rating

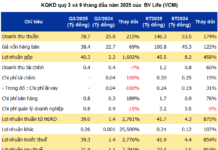

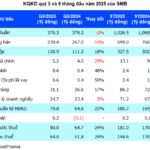

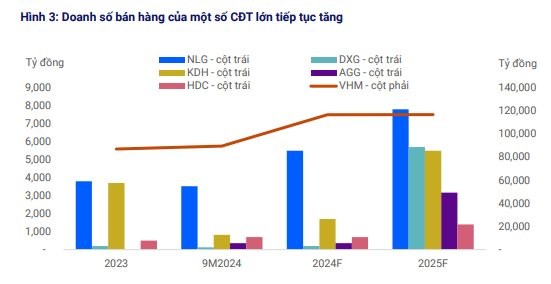

However, the revenue and profit of the companies tracked by VIS for 9T2024 decreased by 20% and 43%, respectively, year-over-year due to lower deliveries resulting from weak sales in 2023. As a result, VIS Rating estimates that over 60% of developers will fall short of their full-year 2024 profit plans.

The issuance of several circulars and decrees providing guidance or taking effect in Q3/2024 is expected to expedite project development and sales in 2025.

Source: VIS Rating

Over 20 decrees/circulars were issued in Q3/2024 to support the implementation of the amended Land, Housing, and Real Estate Business Laws. These provide clearer guidance for businesses to carry out procedures and promote the development of new projects. They cover aspects such as land pricing, land retrieval, fees, and various other factors. Additionally, the government’s efforts to expedite legal approvals for prominent real estate projects since early 2024 have resulted in an increase in newly licensed projects and those qualified for sales in Q3/2024. In 2025, businesses are expected to significantly increase the number of new projects, improving their sales and cash flow.

VIS Rating believes that the industry’s debt-servicing ability remained weak in Q3/2024, but leverage will be controlled thanks to new regulations, and corporate cash flow will improve with increasing sales.

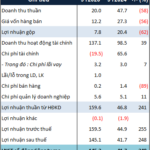

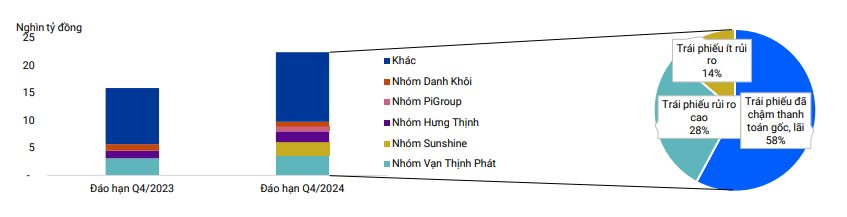

Approximately VND 22,000 billion worth of bonds issued by enterprises will mature in Q4/2024, a significant portion of which has already defaulted on principal and interest payments in previous periods.

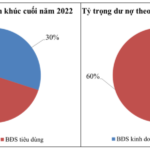

Of the bonds maturing in Q4/2024, VND 13,000 billion worth of bonds had already defaulted on principal and interest payments in 2023 and successfully negotiated with bondholders to extend the payments to the following year. These bonds were issued by companies related to real estate groups such as Van Thinh Phat, Novaland, and Hung Thinh. The remaining VND 9,000 billion worth of bonds were issued by 11 companies, 7 of which are assessed by VIS as having weak credit profiles and high risk. These companies mainly have no operating business, no connection to real estate groups, no operating revenue, and very limited cash flow.

Source: VIS Rating

On a positive note, the access to new capital for real estate companies has improved. These high-risk issuing organizations will need to rely on liquidity support from related companies or seek bondholders’ approval for payment extensions to avoid further defaults on principal and interest payments.

Real Estate Credit Risk: Is It Accumulating?

The real estate loan balance has been surging since the beginning of the year. What is fueling this credit growth in the industry? And what explains the significant disparity between the growth of business and consumer real estate credit?

The Soaring Land Prices and the Struggling Real Estate Stocks: Unraveling the Mystery.

The real estate market has witnessed a scorching surge across almost all segments, including land, low-rise homes, luxury apartments, affordable condos, and even older apartment buildings. This surge in property values contrasts sharply with the prolonged slump in real estate stocks, which continue to languish at rock-bottom levels.