Ms. Nguyen Thi Phuong, Vice President of the Vietnam Bank Association’s Legal Club, shared that one of the obstacles faced by banks in implementing the 2023 Housing Law regarding secured assets is individually-built houses with construction permits that have not been updated on land-use rights certificates (“red books”). The current regulations do not specifically mention whether this refers to “existing houses” or “houses to be built in the future.” As a result, banks are uncertain about accepting mortgages and providing credit for purposes other than the four specified: buying, constructing, repairing, or renovating the mortgaged house itself.

Article 39, Clause 8 stipulates that within 50 days from the handover of the house to the buyer or from the date the leasing buyer has fully paid according to the agreement, the seller must submit a request to the competent state agency to grant a certificate to the buyer or leasing buyer. Unless the buyer or leasing buyer voluntarily applies for the certificate.

“In reality, the procedure for granting certificates to home buyers is often delayed, affecting the rights of home buyers and banks that accept mortgages on houses without certificates (unable to complete mortgage registration procedures). How can this problem be solved?” Ms. Phuong wondered.

There are still many difficulties and obstacles in the implementation and application of the 2024 Land Law, 2023 Housing Law, and 2023 Real Estate Business Law for bank lending activities

Given these challenges, banks have proposed that ministries, branches, and People’s Committees of localities promptly issue guiding documents to ensure a unified and smooth process for administrative procedures related to land, housing, and assets attached to land, protecting the interests of land users and related parties.

At the same time, it is recommended to digitize the national land database, conduct online security registration for land-related assets, and digitize procedures related to certificate issuance, registration of changes, and updates to reduce administrative procedures. It is also suggested to publish land and land-attached asset information on a centralized channel of the Ministry of Natural Resources and Environment to enable banks to pre-screen before accepting mortgages or coordinating debt collection before the mortgaged land is reclaimed by the state…

Regarding the handling of bad debts from real estate collateral, Mr. Do Giang Nam, Member of the Members’ Council of the Vietnam Asset Management Company of Credit Institutions, shared that in cases where there is no cooperation from borrowers in seizing the assets, the only resolution currently is to initiate a lawsuit. However, this measure faces many challenges and impracticalities in reality.

“The time required for litigation procedures is often prolonged. In the common scenario where the customer does not cooperate, a case can drag on for many years without a resolution from the court, significantly impacting the costs of preserving and safeguarding the mortgaged assets, as well as other expenses,” said Mr. Do Giang Nam.

Unlocking Housing Opportunities: The Prime Minister Calls for Transparency in Social Housing Credit Schemes

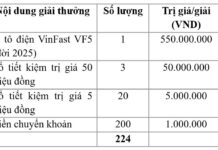

As per the Prime Minister’s instructions, the State Bank is to direct credit institutions to effectively deploy and ensure transparency in the social housing and worker housing credit package.

The Business Dialogue of Ba Ria – Vung Tau

Chairman of the People’s Committee of Ba Ria-Vung Tau Province, Nguyen Van Tho, has called for open and honest feedback from businesses. He encourages companies and investors to share their opinions and not shy away from highlighting areas of improvement for the province’s investment environment. Mr. Tho assures that the local government is committed to addressing challenges and removing obstacles faced by businesses and investors in the region.

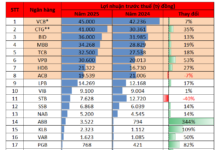

The Two Main Reasons Behind Rising Deposit Interest Rates

Deposit interest rates continue to rise at many banks in September. Speaking to *Kiem Toan* Newspaper, financial and banking expert, Dr. Nguyen Tri Hieu, attributed this trend to two main reasons.

What Are the Requirements for Obtaining a Red Book for Land Without Documents?

The 2024 Land Law introduces a host of new provisions, including relaxed requirements for land use certificate eligibility for undocumented land. This significant development addresses long-standing issues related to land ownership and paves the way for a more efficient and equitable land management system.