MB has recently adjusted its deposit interest rates for select tenors, increasing them by 0.1 percentage points. According to the new rate card, customers who opt for savings deposits with tenors of 3-5 months will enjoy an interest rate of 3.6% per annum, while those choosing tenors of 6-11 months will receive 4.2% per annum. The highest interest rate offered for over-the-counter deposits stands at 5.7% per annum.

For online savings, the interest rates are slightly higher, approximately 0.2 percentage points above the counter rates. The digital savings product offers an attractive interest rate of 5.9% per annum for tenors of 24 months and above.

Since the beginning of November, several banks, including BVBank, Nam A Bank, VIB, Vietbank, VietABank, and Agribank, have also raised their deposit interest rates. These moves are aimed at meeting the surge in capital demand during the year-end period while navigating the challenges posed by the high USD/VND exchange rate.

Banks are increasing deposit interest rates to meet the year-end capital demand and cope with the high USD/VND exchange rate.

Interest rates of 6% per annum and above are now available at many banks, with BVBank offering 6% for online savings with tenors of 18 months and longer.

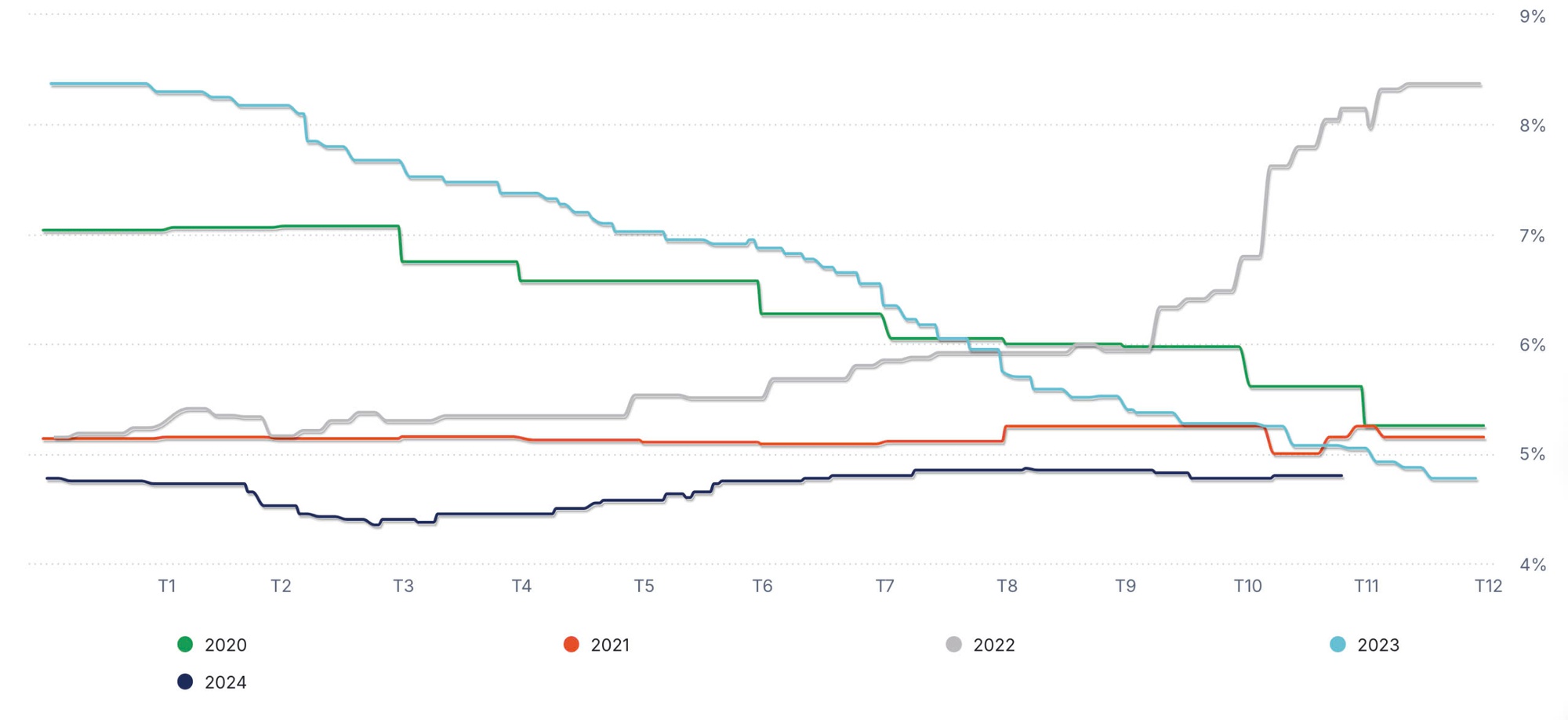

With the stock market experiencing a lull and gold prices fluctuating, individuals with idle funds are considering savings deposits as interest rates start to climb. Mr. Ngo Minh Sang, Director of the Retail Banking Division at BVBank, commented that compared to the beginning of the year, savings interest rates are showing a slight upward trend. This reflects the increased capital demand from credit institutions during the year-end period, coupled with credit demand stimulus policies.

Mr. Sang views the rise in savings interest rates as an opportunity for individuals, especially small depositors such as salaried employees or retirees, to optimize their income from savings. He recommends opting for tenors above 12 months to ensure greater stability in the event of a potential interest rate decline in 2025, similar to the trend witnessed in 2024.

12-month deposit interest rates of major commercial banks over the years, indicating a tendency for rates to increase in the last quarter. Source: Wigroup

BVBank is currently offering small-denomination certificates of deposit with a minimum face value of VND 10 million, featuring interest rates that are 0.5% to 0.7% higher than the listed rates for tenors ranging from 18 to 36 months. This move aligns with the trend of increasing deposit interest rates to meet the strong credit demand during the year-end period.

Mr. Nguyen Thanh Lam, Head of Retail Banking Division Analysis at Maybank Securities Company, attributed the recent uptick in interest rates to factors such as increased borrowing demand, pressure from exchange rates, and fluctuations in the interbank market. These factors have collectively pushed up the overall deposit interest rate level.

According to Mr. Lam’s forecast, deposit interest rates could rise by an additional 0.5% in the next 6-12 months. However, this increase is considered appropriate and will not significantly impact macroeconomic management policies. Notably, lending rates are predicted to rise at a slower pace due to inter-bank competition and government policies aimed at maintaining reasonable rates to support economic growth.

In the short term, the trend of increasing interest rates is evident, but 2025 may bring about a shift towards greater stability, depending on macroeconomic conditions and the government’s credit policy orientation.

The Power of Compounding: Maximizing Returns, Nurturing Business Growth

“Despite a slight uptick in deposit rates, banks are unlikely to raise lending rates as they strive to boost credit growth towards the year-end. The industry’s focus on maintaining accessible borrowing rates underscores their commitment to supporting economic expansion and recovery.”