At the 2024 Member Organization Conference held on November 29, 2024, Vietnam National Payment Corporation (NAPAS) announced that its system processed an average of over 26 million transactions per day in 2024, a significant increase of 30.8% in volume and 15.9% in transaction value compared to 2023. Notably, the NAPAS 247 instant money transfer service witnessed a substantial surge, with a 34.7% rise in volume and a 16.4% increase in value, accounting for 93.5% of NAPAS’ total services. Additionally, the VietQR code payment method demonstrated remarkable growth, recording a 2.2-fold jump in transaction volume and a 2.6-fold increase in transaction value compared to the previous year.

ATM cash withdrawal services through the NAPAS system showed a sharp decline in 2024, dropping by 19.5% compared to the previous year and accounting for only 2.4% of the total transactions in the system. These results highlight the growing adoption of electronic payment methods as a replacement for cash in the daily lives of individuals and businesses.

Regarding cross-border payment expansion, under the guidance of the State Bank of Vietnam, NAPAS has been actively pushing forward with cross-border payment connections using QR codes with countries in the region. This year, NAPAS successfully expanded the implementation of QR code services between Vietnam and Thailand for two member organizations and piloted the service between Vietnam and Laos for six member organizations.

As per the 2025 plan, NAPAS will continue to expand cross-border payment connections using QR codes with countries such as China, Japan, and South Korea, among others. This expansion aligns with the shared goal of promoting the use of local currencies in cross-border transactions, fostering trade, investment, and tourism between Vietnam and other ASEAN countries.

Amid the digital transformation journey, online banking has also faced potential risks and threats. To mitigate and prevent the escalation of high-tech criminal activities, NAPAS has collaborated with member organizations to update technical standards and develop technological solutions. Additionally, NAPAS has coordinated with the Ministry of Public Security and the Banking Association to propose processes for handling accounts/cards involved in suspected fraudulent, counterfeit, or deceptive transactions. These efforts have contributed to enhancing the monitoring, operation, and risk prevention capabilities of member organizations in providing cashless payment services to customers. The NAPAS system achieved an impressive 99.997% continuous operation rate in 2024, surpassing the committed level.

Mr. Nguyen Quang Hung, Chairman of the Board of Directors of NAPAS, delivering his speech

|

“Reflecting on the past 20 years, numerous products and services introduced by NAPAS, such as the NAPAS contactless payment card, NAPAS 247 instant money transfer, and VietQR code transfer/payment, have become part of the daily payment routines of individuals and enterprises, contributing to the popularization of electronic payments,” shared Mr. Nguyen Quang Hung, Chairman of the Board of Directors of NAPAS, at the event.

Han Dong

The Future of Cashless Transactions: SmartPOS & SoftPOS Solutions for Small Businesses and Merchants

As the cashless payment trend becomes an integral part of daily life, businesses and merchants are keen to adopt cutting-edge consumer trend-leading solutions to best serve their customers. Among these, SmartPOS (hardware-based card payment acceptance) and SoftPOS (card payment acceptance via banking apps) are regarded as the fastest, safest, and most convenient payment tools for both sellers and buyers.

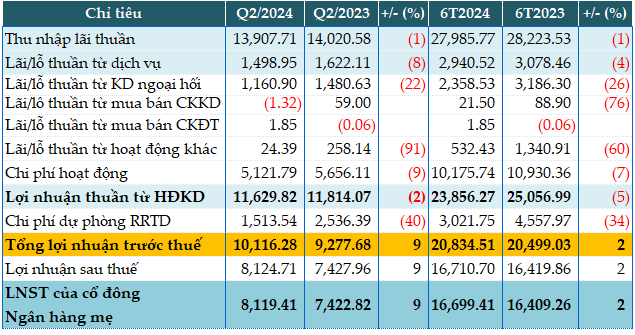

The Digital Transformation Dividend: Vietnamese Banks Reap the Rewards of their Billion-Dollar Investment

With significant investments of time and resources, many Vietnamese banks have now begun to reap the rewards of their digital transformation efforts.

Indictment: Bank Employee in Ho Chi Minh City Accused of Embezzling 8 Billion VND of Customer’s Disbursed Funds

As the primary loan officer, Luong Hoang Gia exploited his position to gain access to customers’ Internet Banking login credentials under the pretext of providing consulting services. Gia then collaborated with a criminal syndicate in Cambodia to orchestrate unauthorized withdrawals from these compromised accounts.