MARKET REVIEW FOR THE WEEK OF 11/25/2024 – 11/29/2024

During the week of 11/25/2024 – 11/29/2024, the VN-Index continued its upward trend from the previous week, forming a White Marubozu candlestick pattern. Additionally, the index rose above the 20-week SMA, indicating increasing investor optimism.

However, the MACD indicator is signaling a sell-off, and there is a possibility of it falling to the 0 threshold. If the indicator cuts down to this level, the risk of a short-term correction will increase.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Approaching the 61.8% Fibonacci Projection Level

On November 29, 2024, the VN-Index rose and remained above the Middle Bollinger Band, while trading volume recovered compared to the previous session, indicating a short-term recovery outlook. The index is approaching the 61.8% Fibonacci Projection level (equivalent to the 1,250-1,260-point region) as the ADX indicator continues to move in the gray area (20<>

HNX-Index – Formation of a White Marubozu Candlestick Pattern

On November 29, 2024, the HNX-Index rose, forming a White Marubozu candlestick pattern, accompanied by increased trading volume that surpassed the 20-session average, reflecting improved investor sentiment. Meanwhile, the index rose above the Middle Bollinger Band, and the MACD indicator signaled a buy opportunity, suggesting a positive short-term outlook.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index indicator for the VN-Index fell below the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Foreign Capital Flow Variation: Foreign investors continued net buying on November 29, 2024. If foreign investors maintain this stance in the coming sessions, the outlook will become even more optimistic.

Technical Analysis Department, Vietstock Consulting

Market Beat: Telecoms Rebound, VN-Index Surges Over 8 Points

The market ended the session on a positive note, with the VN-Index climbing 8.35 points (0.67%) to reach 1,250.46, while the HNX-Index gained 1.07 points (0.48%), closing at 224.64. The market breadth tilted in favor of buyers, with 402 tickers advancing against 279 declining ticks. The VN30 basket painted a similar picture, as bulls dominated with 21 gainers, 6 losers, and 3 unchanged stocks, ending the day in the green.

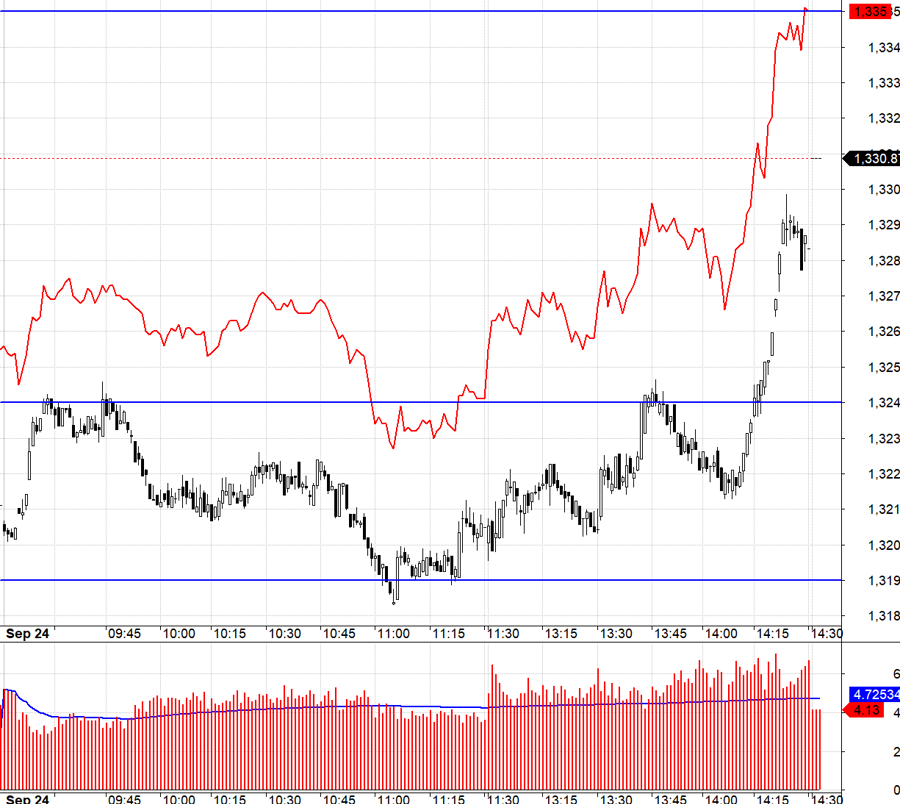

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.