Donald Trump’s victory in the US presidential election this year, along with the Republican Party’s control of both the Senate and the House of Representatives, has ushered in a new era for the Republican Party’s “Red Wave,” focused on cutting taxes for businesses and increasing tariffs on imports.

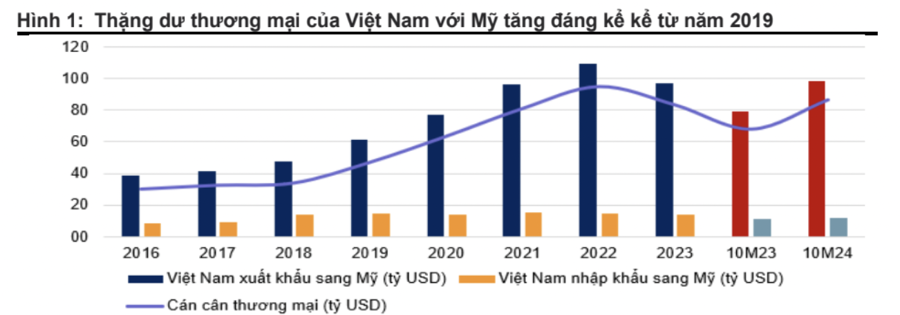

This shift will reshape the position of America’s major trading partners, including Vietnam, which recorded bilateral trade with the US at $110 billion in 2023.

In light of these developments, VnDirect has provided comprehensive analyses of the policies proposed by Trump and their potential impact on Vietnam’s trade position, FDI investment, and fiscal and monetary policy maneuverability.

US TARIFFS: OPPORTUNITIES AND CHALLENGES FOR VIETNAM

The 60% tariff proposed by Trump on imports from China and the general tariff of 10-20% on all imports from other countries could significantly impact the global economy, including Vietnam.

According to VnDirect, import tariffs may increase inflationary pressure in the US, weigh on consumer demand, and subsequently affect Vietnam’s export prospects, as the US is its largest export market, accounting for approximately 29% of Vietnam’s export turnover.

There is also a risk that Vietnam will face increased trade protectionism investigations from the US due to the large trade deficit between the two countries ($104.6 billion in 2023 and $90.6 billion in the first ten months of 2024) and the growing trend of Chinese FDI in Vietnam. In 2023 alone, the US initiated 59 trade protectionism investigations against Vietnam, accounting for nearly 25% of the total number of trade protectionism cases investigated by foreign countries against Vietnamese exports.

Given the unpredictable nature of Trump’s potential import tariffs, VnDirect outlines three scenarios for their impact on Vietnam’s export prospects, corresponding to different tax levels.

Base Case Scenario: China is subjected to a 60% tariff, and other exporting countries face a 10-20% tariff. Assuming all other factors remain constant, Vietnam’s export growth is expected to remain stable at 8% year-on-year. Even if Trump applies a general tariff of 10-20% on countries exporting to the US (excluding China), Vietnam’s advantage in tariff differentials with China is expected to help maintain its market share in the basket of imports from the US.

Optimistic Scenario: China is subjected to a 60% tariff, and no general tariff is applied to other countries. Vietnam’s export growth is predicted to surpass 8%, bolstered by significant tariff differentials with China, along with competitive advantages in strategic location, signed free trade agreements, low labor costs, and abundant labor force.

Pessimistic Scenario: China is hit with a 60% tariff, other exporting countries face a 10-20% tariff, and Vietnam is subjected to additional taxes. In this pessimistic scenario, Vietnam’s export growth is forecast to decline significantly from the expected 8%.

The negative impact may not only stem from additional taxes but also from the increased risk of trade protectionism investigations. Simultaneously, Vietnam will face competitive pressures in vying for market share in the US market from exporting countries with similar competitive advantages. The severity of the impact will depend on the type of export product, the current tax rate, and the timing of the tax imposition.

The impact of increased taxes on Vietnam’s export products, if it occurs, will vary depending on the tax rate applied, the timing of implementation, the proportion of exports to the US market in the total export value of the product, and competition from domestic US substitute products and other exporting countries within the same segment.

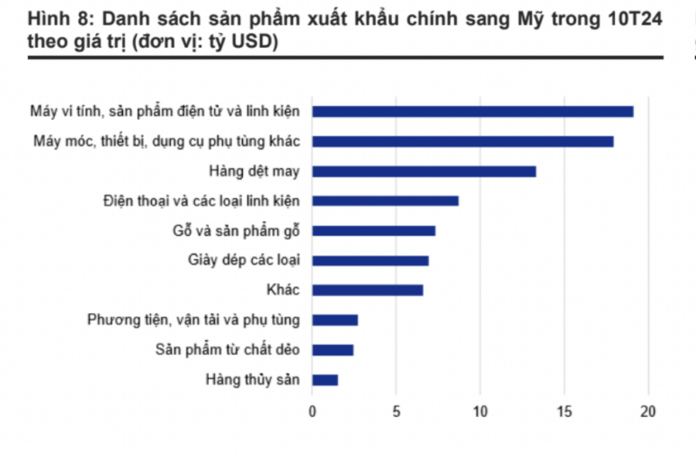

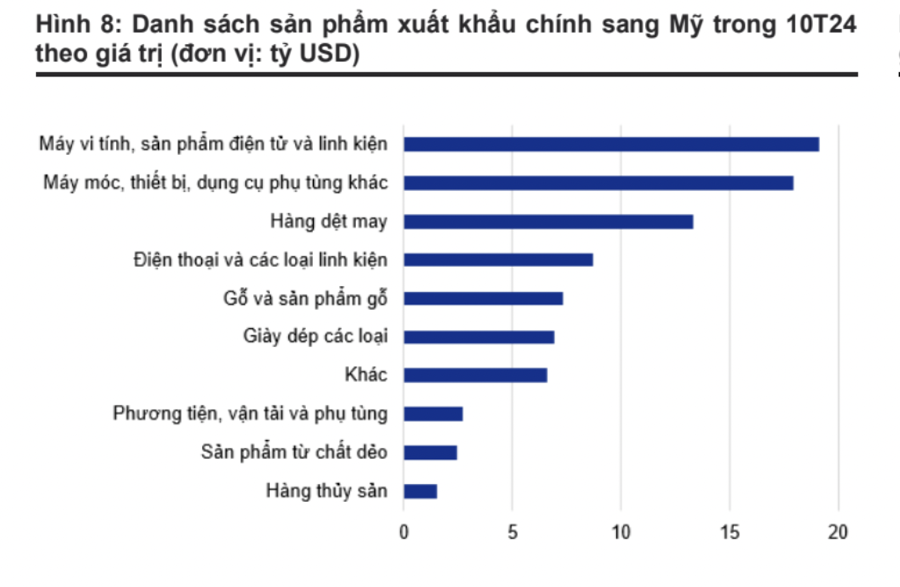

VnDirect assesses the potential impact of increased taxes (if enacted) on six main groups of export products from Vietnam to the US: electronics, textiles and footwear, machinery and equipment, wood and wood products, seafood, and iron and steel. These items account for nearly 80% of the US’s import value from Vietnam in 2023.

Overall, while exports of consumer goods may be affected by higher inflationary pressures in the US, exports serving American businesses will benefit from corporate tax cuts and relaxed regulatory restrictions.

VIETNAM: MORE OPPORTUNITIES THAN RISKS

VnDirect believes that escalating US-China trade tensions may impact Vietnam’s ability to attract FDI. While China has seen a significant increase in FDI into Vietnam, accounting for 13.3% of Vietnam’s total newly registered FDI in the first ten months of 2024, there is still a possibility that FDI from China could decrease due to heightened trade protectionism measures from the US related to origin and source of exports.

However, this shift may create opportunities for Vietnam to attract FDI from other US allies, such as South Korea, Taiwan, and Japan.

With China being the key target of Trump’s policies, US-allied countries may consider shifting their supply chains to Vietnam to mitigate risks associated with the US-China trade war. This is expected to lead to a diversification of FDI sources for Vietnam in the long run.

Overall, VnDirect believes that instead of basing investment decisions on a single four-year term of a US president, FDI inflows will depend on investors’ long-term strategies and the core values offered by the invested country. Vietnam’s attractive investment environment, modern free trade agreements, abundant labor force, and strategic geographical location will continue to make it appealing for FDI in the future.

To prepare for potential changes in US trade policies, Vietnam needs to strengthen its position as a reliable trading partner by enhancing transparency in trade and making recognized efforts to reduce the US trade deficit with Vietnam. This can be achieved by increasing imports, negotiating and signing significant trade agreements, such as those related to LNG gas and aircraft purchases from US manufacturers.

Additionally, to minimize the risk of becoming a transshipment center for Chinese goods exported to the US, Vietnam should continue to implement trade protectionism measures to counter Chinese products showing signs of “evading US tariffs.”

Furthermore, it is essential to foster diplomatic relations amid heightened geopolitical risks and the possibility of polarization.

As of now, despite Vietnam being classified as a “non-market economy,” the fact that it has been determined not to manipulate its currency is a positive sign. Most importantly, if Vietnam continues to establish itself as a trustworthy trading partner, it will reduce the likelihood of the US imposing harsh trade protectionism measures. This change in the US administration may bring about more opportunities than risks for the country.

“Chinese Automaker Slams EU’s High Taxes Over ‘Non-Cooperation’ Investigation: ‘They Want Too Much Information’”

This is the car manufacturer that has been slapped with the highest additional tax when importing electric vehicles for sale in Europe.