The CNT Group has committed to providing financial backing to Blue Bay Quy Nhon for the aforementioned project, pledging nearly VND 83 billion in capital contribution.

|

CNT successfully bid for the land use rights of over 1,500 sq. m of cleared land to develop a commercial apartment complex along Huynh Tan Phat Street. The accounting value in the books at the end of Q3 was approximately VND 40 billion, equivalent to about VND 25.5 million/sq. m, and nearly VND 2 billion higher than the starting price. The company held a groundbreaking ceremony for this project on November 2, 2024, and it is estimated to require more than VND 280 billion to construct 2 basements and 18 floors, resulting in 181 apartments for the market. |

Notably, Blue Bay Quy Nhon was established just recently on October 9, 2024, with a charter capital of VND 83 billion. Mr. Tran Cong Quy, Vice Chairman of CNT, acts as its legal representative, while Mr. Pham Quoc Khanh, Chairman of CNT’s Board of Directors, manages CNT’s capital contribution in Blue Bay Quy Nhon.

This newly established company specializes in real estate and land use rights, whether owned, leased, or rented; consulting, brokering, and auctioning real estate and land use rights are also within its scope of business.

A day earlier, CNT also contributed VND 97 billion (owning 100%) to establish Dream1 Thu Duc Company Limited to undertake a project in Binh Chieu Ward, Thu Duc City.

In contrast, according to the latest resolution announced on November 25, CNT approved the dissolution of its subsidiary, CNT Ha Tien JSC, in which it holds 99.77% capital. According to CNT, the dissolution aims to restructure its group of subsidiaries to optimize operations as the parent company shifts its business strategy and no longer requires the subsidiary’s services.

With the addition of two new companies and the dissolution of one subsidiary, CNT now has a total of four subsidiaries and two associated companies.

|

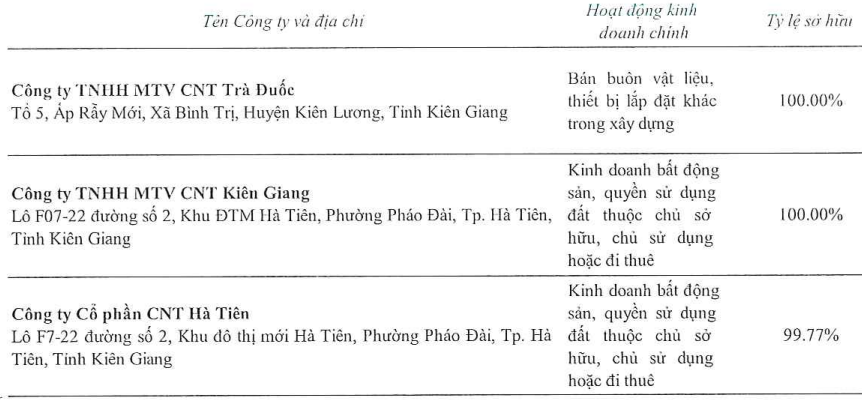

Subsidiaries of CNT as of September 30, 2024

Source: CNT

|

Regarding business performance, CNT recorded a consolidated net revenue of nearly VND 204 billion and a net profit of almost VND 122 billion in the first nine months of 2024, representing a 14% and 21% decrease, respectively, compared to the same period last year.

For the full year 2024, CNT set targets of VND 240 billion in net revenue and VND 118 billion in after-tax profit. As of the end of Q3, the company has achieved 85% of its revenue target and surpassed the profit plan by 3%.

CNT Group Restructures Its Subsidiaries, Paving the Way for New Real Estate Projects?

An Individual Investor Increases Ownership in PV Trans Pacific to 6.17%

“In a recent development, prominent investor Le Ngoc Anh has acquired 189,600 PVP shares, increasing her stake in PV Trans Pacific to 6.17% from the previous 5.99%. This strategic move by Le Ngoc Anh underscores her confidence in the company’s potential and growth trajectory.”

Danang’s Real Estate Market Soars with the Free Trade Zone

The Danang real estate market, particularly the Lien Chieu district, is experiencing a surge in development, fueled by a series of breakthrough growth catalysts. These catalysts include the next-generation free trade zone (FTZ), the Lien Chieu port, and a cluster of high-tech industrial parks. This perfect storm of economic drivers is transforming the area into a thriving hub of activity, attracting investors and businesses alike.

The Eastern Promise: Real Estate Development with a Cultural Twist

Eastern Era has proven its sustainable development strategy with the success of the Vaquarius project in Van Giang, Hung Yen. The project showcases the company’s ability to create urban cultures that are deeply rooted in local traditions and communities. This achievement stands as a testament to Eastern Era’s commitment to fostering a harmonious relationship between development and the preservation of cultural heritage.