Illustrative image

In its latest macroeconomic update report, HSC Securities (HSC) has adjusted its USD/VND exchange rate forecast to 25,450, 26,000, and 26,000 at the end of 2024, 2025, and 2026, respectively, up from previous estimates of 24,950, 24,850, and 24,750.

Explaining this forecast, HSC attributes it to the potential continued strengthening of the US dollar, particularly if Trump enacts expansionary fiscal policies and implements tariff policies. While these measures could boost US economic growth, they may also lead to higher inflation. As a result, HSC predicts that the VND will depreciate for the fourth consecutive year, a trend previously observed during the periods of 2008-2011 and 2013-2016.

Additionally, HSC expects policy rates to increase slightly to 4.75% and 5% by the end of 2025 and 2026, respectively.

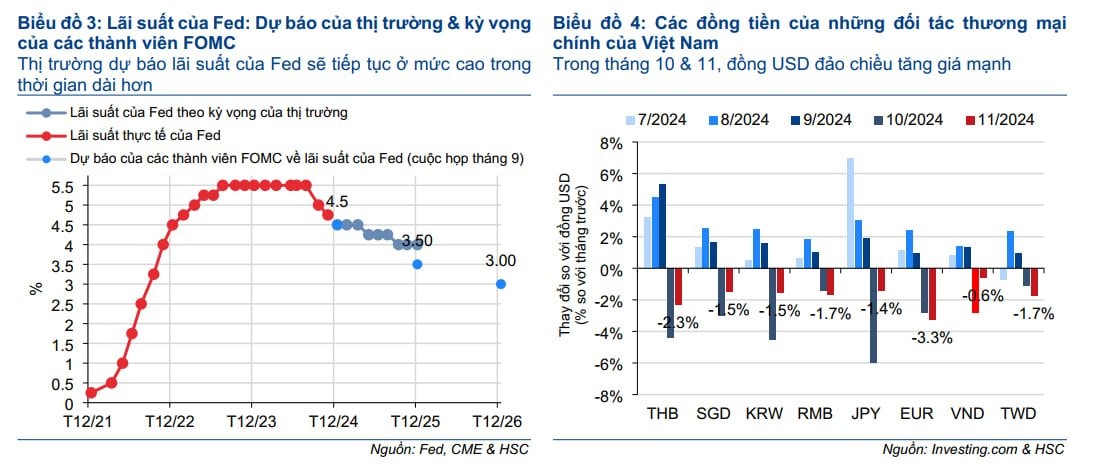

According to HSC, in the months following Donald Trump’s victory in the US presidential election, along with the Republican Party’s control of both the Senate and the House of Representatives, the market anticipated that the Fed would maintain a higher level of policy rates for a more extended period. Consequently, the market now expects the Fed to cut policy rates only twice in 2025, which is 50 basis points higher than the September FOMC meeting projections.

HSC attributes the VND’s depreciation against the USD and the currencies of Vietnam’s major trading partners in October and November 2024 to Trump’s campaign pledges, which included imposing a minimum tariff of 60% on Chinese goods and a global tariff of 10-20% on imports from other countries.

Additionally, Trump has proposed further fiscal policy expansion, including additional cuts to corporate and personal income taxes. While these measures are likely to boost economic growth, they may also fuel inflation, limiting the Fed’s monetary policy easing room and bolstering the USD’s strength.

HSC’s data reveals that the VND has depreciated by nearly 11% over the last three years. However, the State Bank of Vietnam (SBV) seems to view this depreciation as manageable when compared to other currencies, including the EUR, KRW, TWD, RMB, and JPY, especially considering that Vietnam’s primary focus remains on boosting economic growth.

Meanwhile, the National Assembly passed a resolution on the socio-economic development plan for 2025, targeting GDP growth of around 6.5-7%, with an effort to reach 7-7.5% (significantly higher than the 6-6.5% target set for 2024). Additionally, inflation is targeted to be kept below 4.5% (compared to the 4-4.5% range for 2024).

“This suggests that the USD/VND exchange rate is likely to remain under significant pressure in 2025, influenced by both external and internal factors, as monetary policy will need to remain accommodative (high credit growth target and low policy rates) to achieve the growth objectives,” HSC stated.

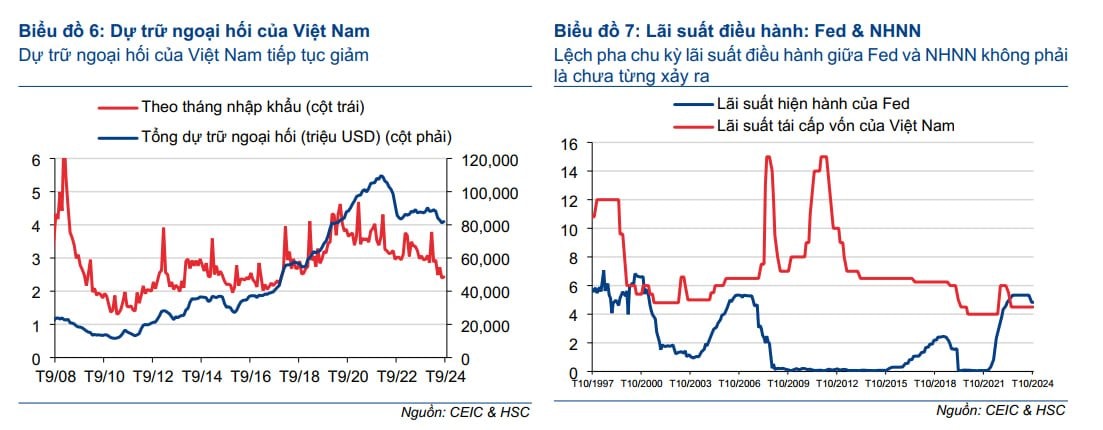

However, with foreign exchange reserves continuing to decline, HSC predicts that the SBV will eventually have to consider raising policy rates to support the VND and replenish reserves. Additionally, a weaker VND could exacerbate the trade deficit between the US and Vietnam, potentially leading to similar issues as those faced in 2020.

Moreover, while a divergence in policy rate cycles between the Fed and the SBV is not unprecedented, HSC’s analysts believe that the SBV will not immediately raise policy rates. Instead, they forecast a 25-basis point increase in the refinancing rate in Q4 2025, followed by an additional 25-basis point hike in 2026.

The Greenback’s Freefall: A Sudden Drop

The U.S. dollar’s relentless rally on international markets came to an end last week (November 25-29, 2024) as President-elect Donald Trump’s comments on tariffs stirred up anxiety in the financial world.

The Prime Minister Calls for Lower Bank Interest Rates

Prime Minister Pham Minh Chinh has urged the Governor of the State Bank of Vietnam to continue instructing commercial banks to cut costs, boost digital technology adoption, and reduce interest rates for businesses and individuals. This move aims to stimulate production and business activities in the remaining months of this year and the beginning of 2025.