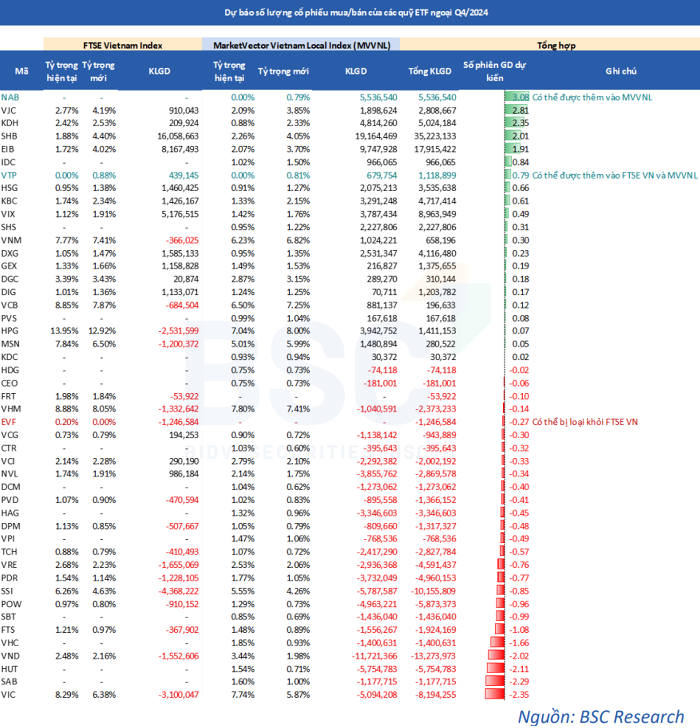

For the FTSE Vietnam Index (a reference for the FTSE ETF), VTP is expected to be added with a weight of 0.81% after meeting the full criteria for liquidity, free-float ratio, and foreign ownership. On the other hand, EVF of EVN Finance may be removed from the portfolio for failing to meet the market cap weight requirement.

Regarding the MarketVector Vietnam Local Index (a reference for the VNM ETF), not only is VTP expected to be included, but NAB of Nam A Bank is also forecasted to join with a weight of 0.79%. Meanwhile, BVH of the Bao Viet Group is at risk of being excluded as its market cap currently falls outside the threshold of 98% of the cumulative market cap of eligible stocks.

In terms of expected trading volume, BSC Research estimates that VTP will be purchased by FTSE ETF for 439,145 shares and VNM ETF will buy an additional 1.1 million shares. Combining the two funds, the stocks with the highest purchases include SHB with 35.2 million shares, EIB with 17.9 million shares, and VIX with 9 million shares.

On the opposite side, selling pressure is concentrated on VND with 13.3 million shares, SSI with 10.2 million shares, and VIC with 8.2 million shares. This is followed by HUT with 5.8 million shares, PDR with 5 million shares, and VRE with 4.6 million shares.

The FTSE ETF has a scale of nearly VND 6,790 billion, while the VNM ETF has a scale of nearly VND 11,260 billion.

|

VNM ETF and FTSE ETF Transaction Forecast

|

According to the schedule, FTSE will announce the constituent stock list on December 6, while MarketVector will announce their portfolio on December 13. The entire restructuring process is expected to be completed by December 20, with the official data closing date for the two indexes being November 29.