Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association (Vitas), stated that despite the complex and unpredictable global situation, escalating conflicts in many regions, volatile fuel prices and freight rates, slow economic recovery, and a decline in global investment, the Vietnamese textile and apparel industry maintained a significant growth rate.

The estimated export turnover of the textile and apparel industry in 2024 reached 44 billion USD, meeting the expected target and representing an increase of 11.26% compared to 2023. Import turnover was estimated at 25 billion USD, a rise of 14.79%, resulting in a trade surplus of 19 billion USD, up 6.93% from 2023.

The top export market for the industry in 2024 remained the United States, with an estimated turnover of 16.71 billion USD, a 12.33% increase from 2023, accounting for 37.98% of total export turnover. This was followed by Japan, the EU, South Korea, China, and the ASEAN market.

According to Mr. Giang, the positive results in 2024 were attributed to Vitas’s notable achievements in policy advocacy, helping to address challenges faced by businesses. In addition, in-depth domestic and international trade promotion activities were carried out to expand export markets and diversify customers and products.

TAKING ADVANTAGE OF STRENGTHS TO INCREASE EXPORTS

In 2024, the Vietnamese textile and apparel industry had several advantages, including the enforcement of 17/19 new-generation Free Trade Agreements (FTAs). These FTAs provided a global market with significant benefits for the industry. The business community in the sector quickly embraced a strategy of market, customer, and product diversification, focusing on high-value-added items.

The industry also successfully adopted automation and digital management technologies and adapted well to the green and sustainable standards demanded by export markets. This laid the foundation for the sector’s growth in 2024, as emphasized by Mr. Giang.

In reality, many textile and apparel businesses reported growth in the third quarter of 2024 due to favorable export conditions. Some companies had secured orders until the end of the year, with a few even negotiating for the second quarter of 2025.

A notable example is the Vietnam Textile and Apparel Corporation (Vinatex), which recorded a profit after tax of 230 billion VND in the third quarter of 2024, nearly triple that of the same period in 2023. This growth was driven by an increase in orders as a result of political instability in major textile and apparel exporting countries such as Bangladesh and Myanmar.

Similarly, TNG Investment and Trading Joint Stock Company recorded a profit after tax of 111.1 billion VND in the third quarter of 2024, a 63% increase from the previous year. This was achieved by focusing on complex and challenging product lines and expanding export markets. Exports to new markets significantly contributed to revenue growth.

However, according to the Chairman of Vitas, the industry still faces challenges. Specifically, businesses have limited opportunities to access large orders and mostly work with small orders that require quick delivery and stringent standards.

Mr. Giang mentioned a renowned global brand that holds its suppliers accountable for product quality. If consumers find inconsistent quality, they can return the product to the store, which then provides feedback to the manufacturing plant. If the rate of negative feedback exceeds the allowable limit, the brand will discontinue its partnership with the supplier. This creates immense pressure on exporting businesses.

CHALLENGES WITH UNPREDICTABLE ORDERS

Businesses also face pressure regarding order stability due to the rapid decision-making of brands. For instance, an order may be negotiated and finalized, but if consumption slows down even for a week or two, they are willing to put it on hold.

Another challenge the industry faces is the lack of price increases. Vitas data shows that the average export price of yarn and fiber from Vietnam in 2024 remained lower than the low base of 2023. In February, for instance, the average price was around 2,433 USD/ton, a 22% decrease compared to the previous year.

Additionally, there is a challenge concerning the shortage of raw material supply as the new-generation FTAs require rules of origin from yarn onwards. Meanwhile, Vietnam still imports a significant amount of yarn and fabric, particularly from China.

Furthermore, while green growth provides an opportunity for the Vietnamese textile and apparel industry to strengthen its position in export markets, it also presents challenges in terms of financial investment in greening, obtaining green certifications, and consulting services.

To achieve the export target of 47-48 billion USD in 2025 and sustainable development, Vitas leaders believe that the long-term strategy for the industry is to actively diversify its product portfolio, cater to various customer segments, and expand export markets. Since the post-Covid-19 demand slump, brands and distribution systems have shifted towards placing orders directly with factories and delivering them straight to distribution or retail stores, bypassing warehouses.

ENHANCING SUPPLY CHAIN COLLABORATION

With the current ordering trend, businesses need to adjust their production strategies, requiring less labor but producing orders with faster delivery times of 1-2 months instead of 6 months to a year. Therefore, companies must strengthen supply chain collaboration, from raw materials and machinery to product design and trade, to coordinate orders effectively. In terms of production activities, it is crucial to leverage technology and artificial intelligence to enhance productivity, quality, and create unique product values.

The current ordering trend indicates that processing basic products in large quantities is less profitable due to low processing prices. Instead, fashion products with smaller orders are more advantageous. Leaders of the Vietnam Textile and Apparel Corporation (Vinatex) emphasize the importance of proactively developing the upstream supply chain, particularly in product design. Many units are focusing on product development centers, which will undoubtedly be effective in the short term. Units with complete production chains should set specific targets for chain products and vigorously pursue them.

Vinatex also plans to improve its dyeing and weaving capabilities to match its spinning and sewing capacity. Initially, they aim to create a link between a group of units specializing in yarn, dyeing, and sewing, ensuring product and technology compatibility to form a chain for specific products.

To seize the smallest opportunities in the market, Mr. Nguyen Dang Loi, Director of Dong Xuan Knitwear, stated that businesses must proactively implement solutions to adjust their production and business plans and strategies to adapt to market changes. This includes actively seeking partners and customers and expanding markets to ensure job security for workers.

Dong Xuan Knitwear will focus on key tasks such as improving production processes to reduce production costs (electricity, steam, water, chemicals, labor) and enhance competitiveness. They will also invest in new equipment to diversify their product range and expand their customer base. Additionally, they will emphasize training and retraining to improve workers’ skills and productivity and invest in research and product development (R&D)…

Green Growth: Vietnam’s Inevitable Choice for Sustainable Development

“Joining the panel discussion on ‘Green Growth – A Global Trend, Inevitable Choice’, organized by the Government Newspaper on November 28th, representatives from ministries, local governments, and businesses unanimously affirmed that green growth is an irreversible trend and the only choice for Vietnam to achieve its sustainable development goals in the future.”

“The Green Finance Challenge: Transforming Vietnam’s Commercial Credit Landscape”

Green finance in Vietnam accounts for a mere 4-5% of commercial credit. Notably, over 80% of this green finance is directed towards sectors such as electricity, utilities, agriculture, and green buildings.

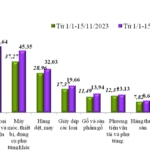

The Art of Trade: Unveiling November’s $681 Billion Dollar Secret

Despite a decline in the first half of November, the total trade value of goods from the beginning of the year to November 15, 2024, reached an impressive $681.48 billion. This remarkable figure marks a 15.7% increase compared to the same period in 2023. Exports witnessed a 14.8% surge, while imports climbed even higher, reaching a 16.6% increase.

Governor: 50 Credit Institutions Offer Green Credit with Outstanding Balance of VND 650 Trillion

Governor Nguyen Thi Hong stated that, in 2017, only five credit institutions (CIs) participated in green credit. Today, we are proud to have 50 CIs with outstanding green credit balances, totaling approximately VND 650 trillion. Of this, renewable and clean energy accounts for 45%, while clean and green agriculture make up 30%.