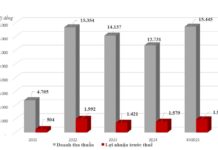

The market witnessed a downward slide during this morning’s session, but selling pressure has not yet overwhelmed the market. Matching volume on the HoSE decreased by 10% compared to the previous session, reaching only 4,843 billion VND, with the main impact coming from the blue-chip group.

The VN-Index started the day on a positive note, reaching a high of 1258.05 points, a gain of 7.6 points from the reference level. However, by the end of the session, the gain narrowed to 1.74 points (+0.14%). The VN30-Index, on the other hand, decreased by 1.81 points (-0.14%).

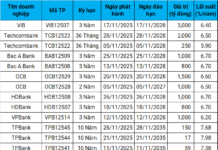

Initially, all 30 blue-chip stocks were in the green, but as the session progressed, 15 of them turned red, leaving only 10 in positive territory. News of approved capital increase plans pushed VCB up by 1.93% just minutes after the market opened. This led to a rally in banking stocks, with most of them trading in the green. However, this momentum was short-lived as a divergence emerged soon after. VCB itself witnessed a continuous decline and ended the session with a more modest gain of 1.07%. Aside from VCB, only three other banking stocks in the VN30 basket managed to stay in positive territory: CTG, up 0.28%; HDB, up 0.39%; and TPB, up 0.31%. These stocks also retreated significantly from their intraday highs. Out of the 27 banking stocks across all exchanges, only five managed to post gains, including LPB, which rose by 3.1%.

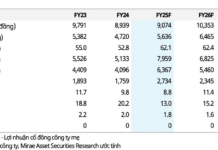

This price decline was a common theme, as none of the stocks in the VN30 basket were able to maintain their intraday highs, with eight of them falling by more than 1%. FPT, which had just hit a historical high last weekend, climbed by 1.88% in the morning session but quickly gave up those gains, ending the day with a meager increase of 0.07% on the ex-dividend date. POW also saw some excitement at the start of the day after the amended Power Law was passed last weekend, rising by as much as 1.61% before giving back all its gains to close unchanged. The morning trading volume of the VN30 basket was relatively low, reaching only 2,186.9 billion VND, an 11% decrease from the previous morning’s session, indicating a lack of buying momentum. Notably, just two stocks, FPT and HPG, accounted for 38.8% of the total trading volume of the basket.

Expanding our view to the entire HoSE, we observed a similar price decline in 80% of the stocks that were traded on the exchange. Only about 30 stocks managed to post gains and maintain their intraday highs, equivalent to approximately 9.2% of the exchange. At 9:30 am, the VN-Index recorded 215 gainers and 65 losers, and by the end of the session, these numbers stood at 151 gainers and 183 losers. This indicates a significant number of stocks reversing their intraday performance and changing color. These two statistics are quite consistent and explain the VN-Index’s downward slide, accompanied by appropriate price adjustments in individual stocks.

On a positive note, similar to previous corrective sessions that narrowed the upward range, not many stocks experienced significant price declines or faced strong selling pressure. Specifically, out of the 183 losing stocks in the VN-Index, only 46 declined by more than 1%, and only six of them had trading volumes exceeding 10 billion VND. In fact, these 46 stocks accounted for only 4% of the total matching volume on the HoSE. The stocks that stood out in terms of selling pressure were KDH, with a volume of 38.5 billion VND and a price decline of 1.36%; HAG, with a volume of 32.9 billion VND and a price drop of 1.67%; GMD, with a volume of 26.8 billion VND and a decline of 1.08%; TLG, with a volume of 26.3 billion VND and a drop of 2.98%; NLG, with a volume of 16.9 billion VND and a decline of 1.3%; and CSM, with a volume of 12.1 billion VND and a drop of 2.19%.

Stocks with sufficiently large trading volumes to ensure reliable price movements mostly saw only minor declines, and the number of gainers even outnumbered the losers. For example, out of the 25 stocks on the HoSE with trading volumes exceeding 50 billion VND, 10 were in the red, and none of them experienced a decline of more than 1%. PDR, the weakest performer, fell by only 0.94%, while DXG dropped by 0.86%.

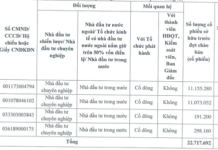

On the other hand, the group of gainers, although smaller in number compared to the losers (as indicated by the negative breadth), attracted better buying interest and exhibited more dynamic trading activity. Specifically, out of the 151 gainers, 53 stocks rose by more than 1%, accounting for 20.7% of the exchange’s trading volume. Stocks in the industrial real estate and infrastructure sectors posted impressive gains: VCG increased by 3.45% with a volume of 111.3 billion VND; HHV rose by 4.11% with a volume of 66.2 billion VND; DIG climbed by 1.48% with a volume of 63.8 billion VND; CTD advanced by 1.98% with a volume of 53.2 billion VND; KBC increased by 1.44% with a volume of 49.5 billion VND; SZC rose by 2.58% with a volume of 49.4 billion VND; and CII gained 2.84% with a volume of 42.7 billion VND…

In a somewhat surprising turn of events, foreign investors turned net sellers of FPT, offloading approximately 74.8 billion VND worth of the stock. They also reversed their stance on the HoSE, becoming net sellers to the tune of 294.7 billion VND. The total selling volume surged to 1,084.9 billion VND, the highest in seven sessions. In addition to FPT, they sold VRE (-43.4 billion VND), STB (-33.9 billion VND), HPG (-33.9 billion VND), and KDH (-32.2 billion VND). On the buying side, they net purchased PNJ (+46.4 billion VND), LPB (+32.9 billion VND), and CTG (+22.3 billion VND).

The VN-Index ended the morning session slightly higher by 1.74 points, maintaining its level above 1252.2 points. Although the index managed to hold above the 1250-point level, which can be considered a strong signal, there is evident selling pressure restraining it from breaking through the 1260-point mark. Nonetheless, sellers refrained from aggressive offloading, as evident from the low trading volumes and narrow price ranges.