The Massive Scale of Assets Under Management

In the landscape of Vietnam’s asset management industry, the dominant players are the Fund Management Companies (FMCs), backed by significant financial resources from giant insurance conglomerates.

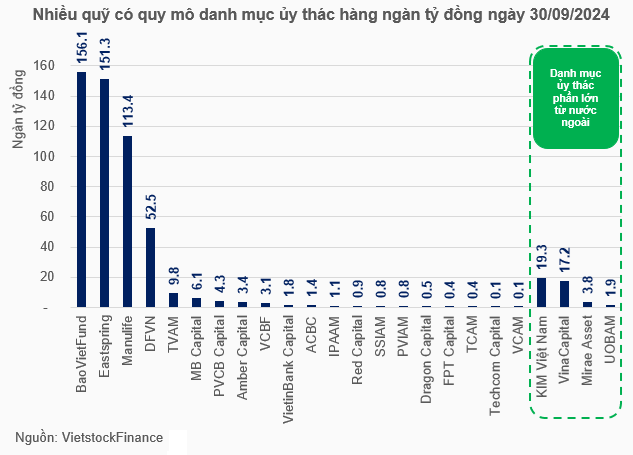

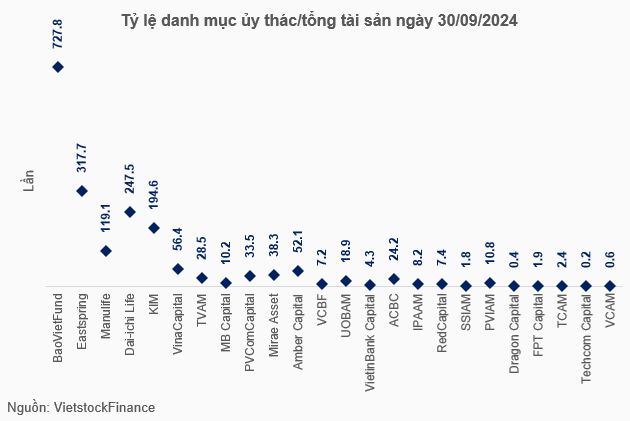

A notable example is Baoviet Fund, a subsidiary of the Baoviet Holdings, boasting assets under management (AUM) of over VND 156 trillion, almost 728 times their total assets. Other prominent FMCs include Eastspring Investments Vietnam, backed by Prudential Vietnam Insurance, Dai-ichi Life Vietnam, and Manulife Investment Vietnam, a subsidiary of Manulife Vietnam.

In addition to these leading companies, there are also FMCs managing tens of trillions of dong in assets from foreign investors, such as KIM Vietnam with over VND 19 trillion and VinaCapital with more than VND 17 trillion.

Unraveling the Flow of Assets Under Management

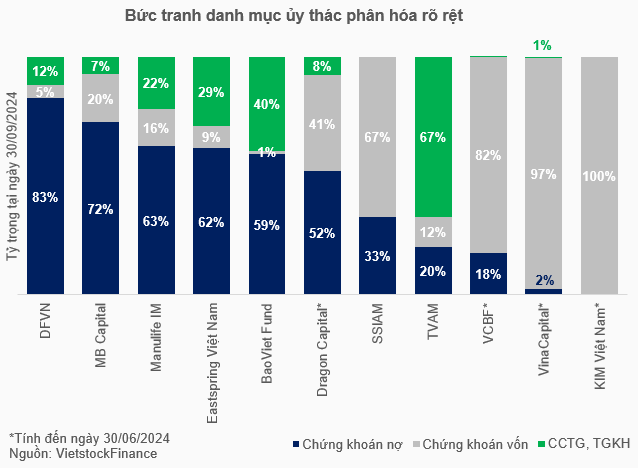

The diverse ownership structure of FMCs results in varied investment portfolios. Companies owned by insurance giants tend to favor lower-risk assets such as bonds (with a significant portion being government bonds), certificates of deposit, and term deposits.

Dai-ichi Life Vietnam’s (DFVN) portfolio, for instance, comprises 83% fixed-income securities and 12% term deposits. Specifically, DFVN manages assets from linked insurance funds, voluntary retirement funds, and traditional insurance products, investing primarily in fixed-income securities. However, assets from linked unit insurance funds are predominantly invested in equities.

Similarly, Manulife IM, Eastspring Vietnam, and Baoviet Fund allocate 63%, 62%, and 59% of their portfolios to fixed-income securities, respectively. Even without an insurance background, Tian Viet Fund Management Company (TVAM) maintains a conservative approach, focusing on low-risk assets like certificates of deposit and term deposits.

In contrast, investment funds tend to favor higher-risk avenues, such as corporate bonds and equity securities.

KIM Vietnam, for instance, invests solely in listed equities with the over VND 20 trillion it manages from foreign investors. VinaCapital also utilizes its substantial foreign-invested capital to purchase listed shares and UPCoM-traded stocks, with a minor allocation to corporate bonds, certificates of deposit, and term deposits. Other fund management companies with a significant focus on equity securities include VCBF with 82% and SSIAM with 67% of their portfolios.

Management Fees: The Key Profit Driver

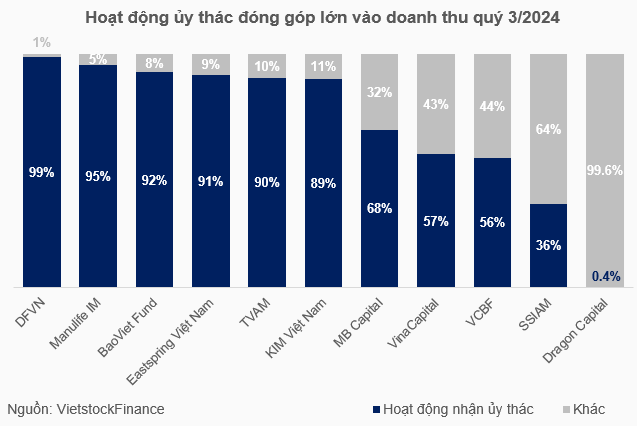

The scale of assets under management, often dwarfing the companies’ total assets, translates into substantial revenue streams from management fees. These fees are typically calculated as a percentage of the total value of the managed portfolio, providing a strong incentive for FMCs to grow their AUM.

In addition to management fees, FMCs also earn revenue from investment performance fees, fund management fees, investment advisory fees, brokerage fees, issuance fees, and repurchase fees for fund certificates. However, these additional sources typically contribute a smaller portion to the overall revenue.

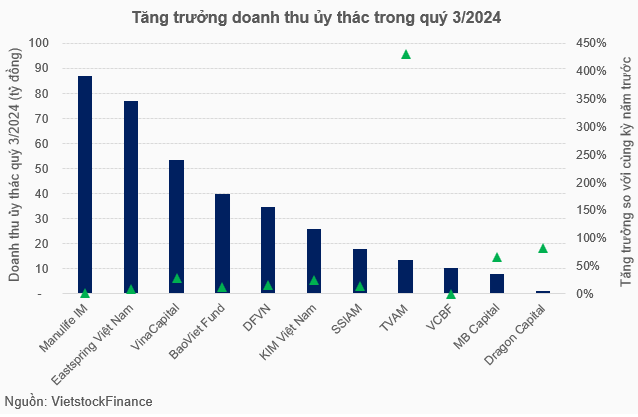

Strong Performance in Q3 2024: Driven by Asset Management

In the third quarter of 2024, several FMCs witnessed notable profit growth compared to the same period last year, primarily attributed to their asset management operations. TVAM, for instance, achieved an impressive 431% surge in asset management revenue, amounting to over VND 13 billion and contributing 90% to their total revenue. VinaCapital also experienced a 28% growth in revenue, surpassing VND 53 billion, mainly driven by the performance of their VinaCapital Vietnam Opportunity Fund (VOF) in asset management.

Other FMCs, such as Manulife IM and DFVN, also reported significant profit increases in Q3 2024, largely due to their asset management activities.

How is VinaCapital Fund Management Performing?

Core Revenue Declines While Expenses Rise: How Profitable was Dragon Capital Fund Management in Q3?

Two Years After the Market Crash from the 1,500-Point Peak: Have Investment Funds Recovered?

The Ultimate Trading Experience: Master the Markets with the UOB Investment Challenge

The knowledge and experience gained from UOBAM experts and the practical investment experience in the UOB Challenge Investment competition will serve as a valuable foundation for young aspiring investors to build their professional investment careers. This real-world exposure and mentorship will empower them to take confident steps towards a successful future in the investment domain.

Sure, I can assist with that.

## ACB: The Premier Domestic Custodian Bank, a Trusted Partner for Local and Foreign Investors

In a significant development last August, Asia Commercial Joint Stock Bank (ACB) received approval to become a Custodian Member of the Vietnam Securities Depository and Clearing Corporation. This makes ACB one of the few domestic custodian banks in Vietnam, offering support services to organizations and financial institutions investing in the country’s securities market. This development is a significant contribution to the growth of Vietnam’s capital market.

Tomorrow’s Stock Market Outlook: Will the Force of Bottom-Fishing Persist?

“The stock market witnessed a late surge of buying activity on September 4th, as bargain hunters stepped in to take advantage of the dip. This bottom-fishing pushed the market to trim its losses, instilling hope among investors that this trend could persist and potentially pave the way for a market rebound.”