Looking ahead to 2025, Mr. Phan Dinh Phuc, CEO of Seenee, predicts that real estate prices will start to rise in accordance with the law.

According to Mr. Phuc, 2025 will be a transitional year to implement and enforce new legal frameworks. Once the system stabilizes and the laws take effect, the market will respond, and real estate prices will start to climb.

“We can now be certain that the bottom has passed and the most challenging phase of the real estate market is behind us,” he says. “Looking back at past milestones, I foresee that we are at the beginning of a new cycle. This is evident from the enactment of the Land Law, Business Law, and Housing Law, the introduction of new land prices, the simultaneous development of infrastructure, and the emphasis on housing policies such as the VND 120 trillion package.”

Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, shares a similar outlook. He expects the real estate market to enter a prosperous phase starting in Q2 2025, with prices continuing their upward trajectory.

Mr. Quoc Anh notes a significant increase in interest in real estate, a restoration of market confidence, and an improvement in investor sentiment, all of which influence investment decisions.

“The real estate market is in a new cycle, and the current context is shaped by three factors: credit, interest rates, and policies,” he emphasizes. “The early enforcement of new laws will boost the market’s recovery.”

Providing a more detailed analysis, Mr. Quoc Anh predicts that each development phase of the real estate market will exhibit distinct characteristics, influenced by cyclical fluctuations.

From now until the end of Q1 2025, the market will remain in a consolidation phase, with buyers focusing on real housing needs. Detached houses and townhouses will be the preferred choices.

Starting in Q2 2025 and continuing through Q4 2025, the real estate market will enter a prosperous phase, led by high-profit segments such as land plots and project villas.

From Q1 to Q4 2026, the market will stabilize, with prices and liquidity improving across various property types.

Real estate prices in 2025 are expected to continue their upward trend. (Photo: Minh Duc)

According to a report by Vietcap Securities Joint Stock Company, Vietnam’s real estate market is expected to maintain stable growth in 2025, with property prices in areas with good infrastructure connections increasing by an average of 10-15% annually.

Additionally, primary real estate transactions are forecast to rise due to genuine housing demands and the gradual recovery of long-term investment capital.

Moreover, stable interest rates continue to benefit homebuyers. Vietcap predicts that mortgage rates will remain low, reducing financial burdens, especially as development costs for real estate projects are on the rise.

Mr. Giang Anh Tuan, Director of Tuan Anh Real Estate Floor, shares a similar outlook, stating that real estate prices in 2025 are unlikely to decrease due to various factors. These include the growing housing needs of the population, particularly in major cities like Hanoi and Ho Chi Minh City.

Additionally, after a period of stagnation, investment demand is starting to recover, especially for carefully selected landed properties such as townhouses/villas and land plots with good infrastructure and utilities.

Homebuyers will continue to favor projects developed by reputable investors with a proven track record in pink book delivery and after-sales service. Clear legal status, strategic locations, and good connectivity to amenities and infrastructure development will also be crucial factors.

In terms of supply, Mr. Tuan expects an improvement in 2025 but believes it will not be significant compared to the demand, resulting in a continued imbalance between supply and demand.

Finally, improved market sentiment, stable mortgage interest rates, and accelerated development of key infrastructure projects will contribute to rising property prices.

Regarding Hanoi’s apartment market, one of the hottest segments in 2024, Ms. Nguyen Hoai An, Director of CBRE Hanoi, offers her insights. She states that the Hanoi apartment market is gradually alleviating the shortage of housing supply. While prices are not expected to drop, the rapid increase witnessed in the previous period is unlikely to recur.

Currently, there is a diverse range of apartment products for both owner-occupiers and investors, and price levels are higher than in previous years. Therefore, expecting a decrease in property prices is unrealistic. According to Ms. An, real estate prices can only decrease under two conditions: first, when there is an oversupply and slow demand that affects market liquidity and selling prices; and second, when there are significant macro fluctuations in finance, economics, etc.

In Vietnam, despite stable economic growth and controlled interest rates, inflation, and exchange rates, the housing supply remains inadequate and imbalanced across segments. Therefore, in the short term, it is improbable for real estate prices to decline.

“In 2025, the supply of new apartments may reach over 30,000 units. Prices will not decrease but will also not increase rapidly as in the previous period, possibly rising by only 5-8% compared to 2024,” emphasizes Ms. Hoai An.

“Completed Projects Left Unsold Due to Lack of Land Appraisal, While Some Areas Witness a Doubling of Land Prices Within Just Six Months”

This is a statement from Mr. Nguyen Quoc Hiep, Chairman of GP. Invest and the Vietnam Association of Building Contractors, at the forum “Sustainable Development of the Real Estate Market – Awarding the Livable Project Certification 2024” organized by the Enterprise Forum on the morning of November 27th.

The Expert’s Paradox: When Supply Increases, Prices Should Decrease, But Not in This Case.

Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, shared his insights on the country’s real estate market. He noted that it is unlikely for property prices to decrease and that there are indications of rising prices. Interestingly, he pointed out a contradiction where an improvement in supply should, in theory, lead to lower selling prices. However, in the current market, supply is increasing, but prices remain high.

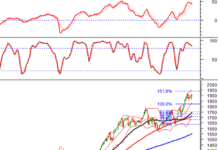

The Stock Market Observer: Bottom Fishers Out in Force

Today’s market showed a significant boost in positivity, not just in terms of the upward index movement but also in the balance and strength of the bottom-fishing money flow. The shift from indiscriminate selling to price-conscious selling and a tug-of-war is a notable change in psychology and risk assessment.

Weaving a Brighter Future: Vietnam’s Textile Industry on Track to Achieve $44 Billion Export Target

The Vietnam Textile and Apparel Association (Vitas) asserts that the textile industry’s export target of 44 billion USD by 2024 is well within reach. The association bases this optimism on the fact that the end of the year typically sees a surge in production orders for the festive season, encompassing both Christmas and New Year celebrations.