The decision to adjust the offering plan is in line with the Company’s current production and business operations, as well as its capital mobilization and utilization plans for the upcoming period. The Board of Directors of the Company will reconsider, decide, and implement the offering at a different time to ensure the Company’s and shareholders’ interests. The Board will report to the General Meeting of Shareholders at the nearest meeting.

Previously, on September 30, the Board of Directors of NHA approved the registration dossier for the public offering of additional shares in 2024. The Company planned to offer more than 8.8 million shares at a price of 10,000 VND per share, raising over 88 billion VND. All shares were unrestricted in terms of transferability. The execution ratio was 5:1, meaning that for every 5 shares held, investors could buy 1 new share.

The offering was expected to take place in the fourth quarter of 2024 and the first quarter of 2025, subject to SSC approval. If successful, the Company’s charter capital would have increased to 530 billion VND.

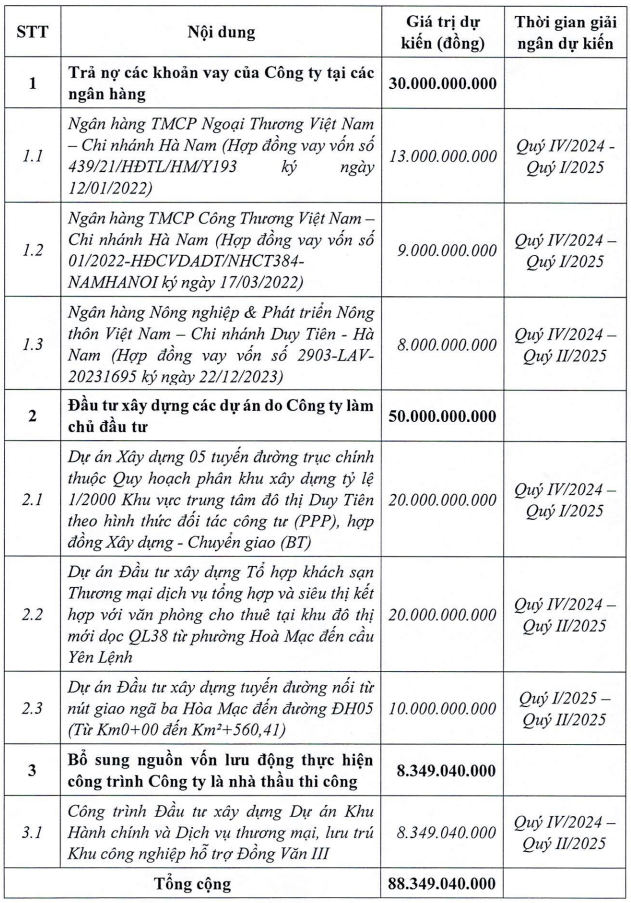

Regarding the raised funds, NHA planned to use 30 billion VND for debt repayment, 50 billion VND for investment in construction projects, and the remaining over 8 billion VND for capital supplementation.

Detailed plan for the use of proceeds from the offering. Source: NHA

|

In terms of business performance, in the third quarter of 2024, NHA recorded 25 billion VND in net revenue, more than three times the figure of the same period last year. Notably, the main business segment of construction recorded zero revenue (compared to nearly 8 billion VND in the previous period), while the real estate business segment contributed 99% of the total revenue for this quarter.

The significant increase in revenue led to a surge in gross profit margin to 69%, the highest level ever. As a result, net profit reached 12 billion VND, an increase of more than 197 times compared to the same period last year. For the first nine months of the year, the Company’s net profit exceeded 53 billion VND, surpassing the yearly plan by 6%.

| NHA’s quarterly business results for the period 2023-2024 |

In the stock market, as of 11:15 am on December 2, NHA’s share price decreased by 0.71% to 27,900 VND per share. However, the price has increased by nearly 13% in the last month and by 63% in the past year.

| Share price movement of NHA in the past year |

Handico6 Switches Dividend Payout from Stock to Cash

The Hanoi No. 6 Housing Investment and Development JSC (Handico6, UPCoM: HD6) has just announced a cash dividend for the year 2023. The record date for this dividend is set as December 9, 2024, meaning that shareholders who own the stock on this date will be eligible to receive the dividend payment.

“Eximbank Receives Approval from State Bank of Vietnam to Amend Chartered Capital to Over VND 18,688 Billion”

On November 25, 2024, the State Bank of Vietnam approved a change in the charter capital of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB). As a result, Eximbank’s charter capital has been adjusted to VND 18,688,106,070,000 (eighteen thousand six hundred and eighty-eight billion one hundred and six million seventy thousand dong).

“Foreign Fund Group Offloads Over 1.2 Million PVS Shares”

On November 21, 2024, Dragon Capital demonstrated its strategic acumen in the stock market by purchasing 170,000 PVS shares while offloading 1.4 million, thereby reducing its ownership stake to below 7%.