In a sharp decline, Arabica coffee prices lost 6.92% to reach $6,526 per ton, the lowest in a week, while Robusta coffee prices fell for the second consecutive session, plunging 10.63% to $4,834 per ton.

The Dollar Index surged by almost 1% in the previous session after Trump’s social media announcement of imposing a 100% tariff on BRICS countries if they deliberately create a new currency to replace the US dollar. Meanwhile, the weakening of the Brazilian real caused the USD/BRL exchange rate to soar by 1.42%, reaching a historical high. This widening gap fueled concerns that Brazilian farmers would rush to sell their coffee holdings to take advantage of the favorable exchange rate, leading to a significant outflow of funds from the coffee market and causing prices to plummet.

Moreover, profit-taking after the previous week’s correction added further pressure, pushing coffee prices to unprecedented lows. Technical adjustments following the sharp rise also contributed to the downward pressure on prices.

On the fundamental side, the market continues to exhibit concerns about coffee supply in key producing countries. Notably, persistent below-average rainfall in Brazil’s main coffee-growing regions has led to a negative outlook for the new crop. Somar Meteorologia reported that rainfall in Minas Gerais, Brazil’s largest Arabica-producing state, stood at 17.8 mm last week, equivalent to just 31% of the historical average.

Sharing similar weather concerns, consulting firm Hedgepoint predicted Brazil’s coffee production for the 2025-2026 crop year to be around 65.2 million bags. Arabica coffee production is expected to reach 42.6 million 60-kg bags, a 1.4% decrease from the previous crop. The firm also noted that their forecast could change depending on future weather conditions.

In the domestic market, as of 11:30 am today (Dec 3), local coffee prices experienced a shocking decline, falling by nearly VND 11,000/kg on average, with prices fluctuating between VND 117,000 and VND 117,500/kg. The average coffee purchasing price in the Tay Nguyen provinces stood at VND 117,400/kg.

Lam Dong province continued to have the lowest coffee purchasing price in the Central Highlands region. Compared to the previous session’s close on Dec 2, coffee prices in this area dropped sharply by VND 10,800/kg, currently standing at VND 117,000/kg.

Gia Lai province followed suit, with a significant decrease of VND 10,800/kg, offering a price of VND 117,200/kg.

Notably, Dak Nong and Dak Lak maintained their leading positions as the provinces with the highest coffee purchasing prices in the country, reaching VND 117,500/kg.

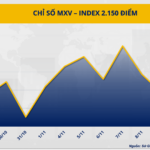

The domestic coffee trading floor witnessed a steep decline today, breaking the upward trend of the past week. Thus far, local coffee prices have dropped by nearly VND 13,000/kg.

The Mystifying Phenomenon of Vietnam’s Coffee Exports

The unusual phenomenon of soaring coffee prices despite a significant dip in export volume compared to the same period last year begs the question: what is the reason behind this anomaly?

“Dollar Soars to a One-Year High as Markets Anticipate Trump’s Policies”

The metals market remains under selling pressure as platinum prices fell for the fourth straight session; COMEX copper prices weakened to a two-month low.