Illustration

Oil Prices Edge Higher

Oil prices edged higher as expectations of stronger demand from increased industrial activity in China outweighed concerns about the Federal Reserve’s interest rate trajectory.

Brent crude oil futures settled at $71.83 per barrel, down 1 US cent, while WTI crude oil futures rose 10 US cents, or 0.15%, to $68.10 per barrel, on December 2, 2024.

The previous week saw both oil benchmarks drop by over 3%, pressured by easing Middle East tensions and forecasts of a surplus in 2025 despite expected output cuts.

A private survey showed that Chinese manufacturing activity expanded at the fastest pace in five months in November, boosting optimism among Chinese businesses despite escalating trade threats from US President-elect Donald Trump.

Oil prices also faced downward pressure from a stronger US dollar after Trump threatened to impose a 100% tariff on BRICS countries unless they commit to not establishing a new currency or supporting another currency that could rival the US dollar.

The surge in the US dollar made dollar-denominated oil more expensive for investors holding other currencies, reducing demand.

US Natural Gas Prices Tumble Nearly 5%

Natural gas prices in the US tumbled nearly 5% to their lowest in over a week, pressured by rising production and milder-than-expected weather forecasts, which are expected to curb heating demand in the coming week.

Natural gas futures for January 2025 on the New York Mercantile Exchange fell 15 US cents, or 4.7%, to $3.213 per mmBTU, the lowest since November 22, 2024.

Gold Prices Slip

Gold prices slipped, snapping a four-day winning streak, as a stronger US dollar and investors’ focus on key economic data and the Federal Reserve’s interest rate path weighed on the precious metal.

Spot gold on the LBMA declined 0.6% to $2,636.54 an ounce, after plunging 1% earlier in the session. Gold futures for February 2025 on the New York Mercantile Exchange fell 0.8% to $2,658.50 an ounce.

The US dollar’s surge, partly fueled by comments from US President-elect Donald Trump that BRICS countries should refrain from challenging the US dollar, exerted pressure on gold prices, according to Peter Grant, vice president and senior metals strategist at Zaner Metals.

Trump called on the nine-nation bloc to neither endorse nor create alternatives to the US dollar and threatened to impose a 100% tariff if violated.

The US dollar index climbed 0.7% to its highest in nearly four weeks, making gold more expensive for buyers holding other currencies.

Copper Hits Over Two-Week Low

Copper prices slid to their lowest in over two weeks as a robust US dollar triggered a sell-off, overshadowing signs of recovery in China’s manufacturing sector—a major consumer of industrial metals.

Copper futures on the London Metal Exchange fell 0.3% to $8,985 a ton, after touching $8,904 a ton earlier in the session—the lowest since November 14, 2024.

The surging US dollar made metals priced in the greenback more expensive for buyers holding other currencies, potentially dampening demand.

Iron Ore and Steel Rebar Prices Climb

Iron ore prices on the Dalian Commodity Exchange rose, supported by upbeat factory data from top consumer China, although weak demand limited gains.

Iron ore futures for January 2025 on the Dalian Commodity Exchange increased by 1.26% to 806 CNY ($110.90) per ton, after hitting their highest since October 14, 2024 (810.50 CNY per ton) earlier in the session.

Meanwhile, iron ore futures for January 2025 on the Singapore Exchange inched up 0.1% to $104.50 a ton.

The private survey revealed that Chinese manufacturing activity expanded at the quickest pace in five months in November, as new orders, including those from abroad, led to a sharp rise in production.

On the Shanghai Futures Exchange, steel rebar prices rose 0.18%, hot-rolled coil climbed 0.8%, wire rod gained 0.97%, while stainless steel dropped 0.77%.

Rubber Prices in Japan Fall for a Third Straight Session

Rubber prices in Japan fell for a third consecutive session as uncertainty about demand prospects overshadowed a slew of upbeat economic data from top consumer China.

Rubber futures for May 2025 on the Osaka Stock Exchange slipped 0.8 JPY, or 0.22%, to 362.2 JPY ($2.41) per kg.

At the same time, rubber futures for May 2025 on the Shanghai Futures Exchange dropped 45 CNY, or 0.25%, to 18,210 CNY ($2,505.43) per ton.

Rubber futures for January 2025 on the Singapore Exchange fell 0.6% to 196.7 US cents per kg.

Coffee Prices Retreat from 47-Year Highs

Coffee prices on the London market pulled back after hitting multi-decade highs in the previous week, as a weaker Brazilian currency triggered a wave of selling.

Arabica coffee futures for March 2025 on ICE dropped 22 US cents, or 6.9%, to $2.9605 per lb, after reaching their highest since 1977 ($3.3545 per lb) in the previous session.

At the same time, robusta coffee futures for January 2025 on the London market fell 10.6% to $4,806 per ton, after touching their highest since 1977 ($5,694 per ton) in the previous session, according to the International Coffee Organization’s price index.

Sugar Prices Hold Steady

Raw sugar futures for March 2025 on ICE held steady at 21.07 US cents per lb, after touching a two-month low of 20.7 US cents per lb earlier in the session.

Meanwhile, white sugar futures for March 2025 on the London market steadied at $547.70 per ton.

Soybean, Corn, and Wheat Prices Decline

Soybean prices on the Chicago Board of Trade eased as favorable weather in South America, forecasts of a record-high harvest in Brazil, and concerns about the Trump administration’s stance on top importer China weighed on the market.

On the Chicago Board of Trade, soybean futures for January 2025 fell 4-1/4 US cents to $9.85-1/4 per bushel, corn futures for March 2025 slipped 1/2 US cent to $4.32-1/2 per bushel, and wheat futures for March 2025 dropped 3/4 US cent to $5.47-1/4 a bushel, dipping to a three-month low during the session.

Palm Oil Prices Slip After Five Straight Sessions of Gains

Palm oil prices in Malaysia eased, retreating from five straight sessions of gains, as weaker soybean oil prices on the Dalian and Chicago exchanges and lower November exports weighed on the market.

Palm oil futures for February 2025 on the Bursa Malaysia Exchange fell 62 ringgit, or 1.24%, to 4,958 ringgit ($1,112.41) per ton. Overall, palm oil prices rose 6.9% in November, marking the fourth consecutive month of gains.

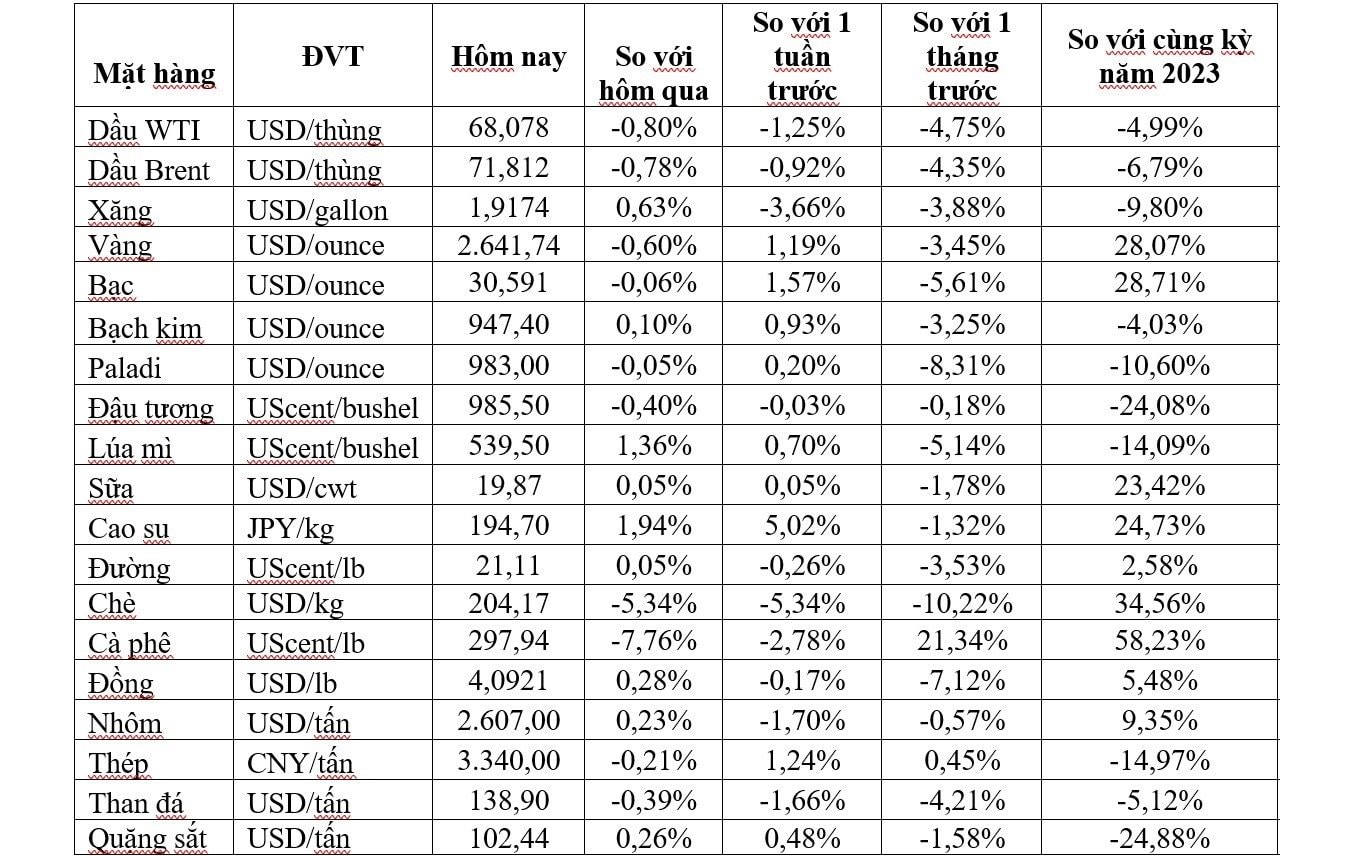

Prices of Key Commodities on December 3, 2024

The Golden Opportunity: Unveiling the Power of Words in the Digital Age

On the morning of November 28, domestic gold prices reversed course and fell after a strong recovery in the previous session.

The Market on Nov 30th: Oil Slides, Gold Gains, Iron Ore Hits 1-Month High

“Oil prices fell on Nov 29, 2022, as concerns over supply risks eased. Gold rallied on a weaker dollar and geopolitical tensions. Copper prices edged higher but were still on course for a second straight monthly loss. The price of iron ore on the Dalian exchange rose on a resilient Chinese economic outlook, posting a weekly gain. Robusta coffee prices fell back after reaching their highest level in over two months. Export prices for rice rose in India and Thailand. Japanese rubber prices declined amid demand concerns.”