Da Nang’s Apartment Market is Not Outside the “Game”

As the market is in the early stages of recovery, investors’ psychology has shifted from ‘surfing’ for opportunities to seeking real value and dual profits from price appreciation and cash flow potential. As a result, batdongsan.com.vn has identified apartments as the first product to recover and lead the rest of the market segments.

According to batdongsan.com.vn’s statistics, apartments are currently the most sought-after asset class in the real estate market. Specifically, from Q2 2022 to Q3 2024, the interest in apartment units increased by 4%, while all other segments, including land, houses, townhouses, and villas, witnessed steep declines ranging from 12-42%. Notably, 44% of those surveyed believe that the apartment segment has been and will continue to grow strongly.

In reality, apartments have already created localized frenzies in Hanoi’s market during the first nine months of the year. Several apartment projects in the west and east of the capital attracted thousands of people on their opening days. This excitement in Hanoi quickly awakened the apartment market in Ho Chi Minh City. Many projects experienced a sudden surge in interested customers, leading developers to adopt a lottery system for home purchases.

Da Nang’s bustling apartment market with a series of successfully launched projects (Photo: Mien Tran)

Not only in major markets like Hanoi and Ho Chi Minh City, but apartments are also proving to be the leading segment in Da Nang, driving the recovery of the local real estate market. According to current surveys, interest in Da Nang apartments has increased by 45% compared to the beginning of the year, and price fluctuations have risen by 32% to the highest level in Central Vietnam. The apartment market in Da Nang is thriving, with numerous successfully launched projects in the past, such as The Ori Garden, Sun Symphony Residence, and Peninsula Da Nang.

In addition to the impact of the hot apartment markets in Hanoi and Ho Chi Minh City, the momentum from the pilot mechanism of the special free trade area, economic development, and the strong recovery of tourism are advantages that boost the robust growth of Da Nang’s apartment market.

The Apartment Market is Vibrant but Still Reveals a “Weak Point”

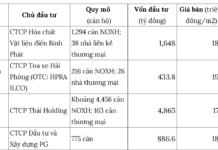

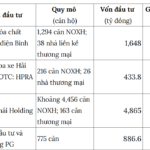

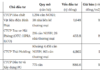

Leading the market’s vibrancy and heading the pace of asking price increases, Da Nang’s apartment price level in the last three quarters has set a new record, surpassing VND 100 million/sqm, a 95% increase compared to Q1/2023. This surge can be attributed to the emergence of numerous luxury apartment projects in the past, pulling up the average price. Statistics show that most apartment projects in the city are concentrated in the districts of Thanh Khe, Hai Chau, and Son Tra, clustered along both sides of the Han River, offering luxury products priced from VND 70 million/sqm.

Notably, the proportion of searches for Da Nang apartments by Hanoi investors is growing, increasing by 90% in Q2 2024 compared to the previous quarter. This somewhat demonstrates the appeal of Da Nang’s market to investors from other provinces. Especially, the vibrancy of this market has somewhat captivated local customers, with surveys showing that nearly 85% of respondents are more open to apartment products. However, 59% of the surveyed population are still interested but have some “barriers” to this type of product.

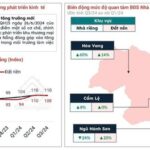

Map of apartment distribution in Da Nang city

One of the identified reasons is the market’s imbalance in apartment segments. Given the reality of concentrated supply in the city center, where population density is high, such as Hai Chau and Thanh Khe districts, with a density of 20,080 people/km2, many are concerned about the continued absence of affordable housing options. Currently, most projects are developed in the luxury and ultra-luxury segments, with prices no lower than VND 70 million/sqm. Only a few projects are launched in the affordable segment, with prices ranging from VND 25-45 million/sqm, such as The Ori Garden and FPT Plaza 3, which recorded high absorption rates of over 95%.

Notably, the forecast of apartment supply by 2025 indicates that most projects are still concentrated in traditional areas and developed in the luxury and high-end segments, with very few projects priced below VND 50 million/sqm to serve the housing needs of the existing population. In contrast, hot development areas like Lien Chieu, which is the city’s planning highlight with the Lien Chieu Superport and the Free Trade Area, have extremely limited supply, with only one luxury and one mid-range project.

Given the existing demand from natural population growth and the challenge of building a modern city suitable for the dynamic younger generation on increasingly scarce land, the trend toward apartment development is inevitable anywhere. This presents a challenge for the Da Nang market to balance supply and demand and is also an opportunity for developers with a focus on deploying apartments in this promising market in the future.

Prime Minister Calls for Intensified Land-Use Fee Collection Efforts in the Year-End Period

The Prime Minister has instructed the Ministry of Finance to take the lead and collaborate with relevant agencies to review and expedite the collection of taxes and land lease payments that have been extended… in the final month of 2024. This proactive approach ensures timely revenue for the state budget and fosters a culture of fiscal responsibility.

“A More Realistic Land Price Index Could Boost Land and Property Sales and Rental Prices”

“This is the opinion of Dr. Can Van Luc, BIDV’s Chief Economist, on land valuation based on market principles at the Sustainable Real Estate Market Development Forum held on the morning of November 27th.”