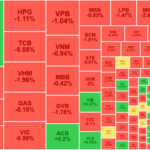

The November session ended on November 29 with the VN-Index closing at 1,250.46 points, a loss of over 14 points, or 1.1% compared to the previous month. Bank stocks recorded a slightly slower decline than the market. VietstockFinance data shows that the banking industry index fell 0.55% from the previous month to 743 points.

Market capitalization decreased by nearly VND 40 trillion

In November, the market capitalization of banks decreased by VND 39,941 billion to VND 2.1 million billion (as of November 29, 2024), a decrease of 1.9% compared to the end of October.

Source: VietstockFinance

|

The main drag on the banking sector’s capitalization was the lackluster performance of the share prices of both state-owned and private banking giants.

Due to a 7% decline in share price, Eximbank (EIB) and MSB experienced the largest market capitalization losses in the group, falling to VND 34,460 billion and VND 29,900 billion, respectively.

A few mid-cap and small-cap stocks that went against the trend, such as NVB (up 2.1 times), VBB (+14%), and SSB (+3%), were not enough to boost the sector’s capitalization. NVB’s strong capitalization growth in the past month was mainly due to an increase in the number of outstanding shares by more than 617.8 million, or 2.1 times, following the bank’s completion of a private placement on November 27, 2024.

Source: VietstockFinance

|

Liquidity “falters”

Nearly 169 million banking shares were traded daily in November, a 31% decrease from October, equivalent to a reduction of more than 75 million shares per day. Accordingly, the trading value decreased by 31% to nearly VND 3,585 billion per day.

Source: VietstockFinance

|

Except for three stocks, VBB (3.2 times), LPB (+89%), and VCB (+19%), which saw strong liquidity growth, the remaining bank stocks experienced a decline in trading volume.

This month, VPB took the lead in terms of liquidity across the system, with nearly 20 million shares traded daily. While the average matched volume decreased by 37% from the previous month to 16.6 million shares per day, negotiated trading volume increased significantly by 77%, reaching over 3 million shares per day.

With a sharp decline in liquidity of up to 99% compared to the previous month, SGB stock had the weakest liquidity, with only 3,556 shares traded daily. The trading value was less than VND 50 million per day.

Source: VietstockFinance

|

Foreign investors net sell nearly VND 2,000 billion

November marked the fourth consecutive month of net selling of large-cap stocks by foreign investors. Specifically, foreign investors net sold more than 86 million bank shares, with a trading value of nearly VND 2,000 billion.

Source: VietstockFinance

|

The strongest buying force was concentrated in CTG stock, with a net buying value of VND 570 billion. Conversely, foreign investors net sold the most HDB stock, with a net selling value of VND 998 billion.

Khang Di

The Battle for Points: VCB and SAB Struggle, Broad Market Adjustments, and Foreigners Withdraw 690 Billion

Finally, a true correction session has arrived for investors who were sitting on the sidelines with cash in hand. The selling pressure intensified during the afternoon session, leading to a broad-based adjustment in stock prices. The VN-Index shed 9.42 points, with the number of declining stocks doubling those that advanced.

The Ultimate Headline: “Selling Pressure Intensifies”

The VN-Index witnessed a significant decline, with trading volume surpassing the 20-day average, indicating a rather negative investor sentiment. The key takeaway here is that if the index manages to hold above the Middle Bollinger Band in upcoming sessions, there’s reason for cautious optimism. It’s worth noting that the MACD indicator continues to flash a buy signal and is poised to cross above the zero threshold. Should this crossover occur, it would bode well for mitigating risks.