October 2024 saw a 28% year-on-year decrease in early bond repurchases by enterprises, totaling 12,772 billion VND. Illustration: VNA

|

Significant Increase in Issuance Volume

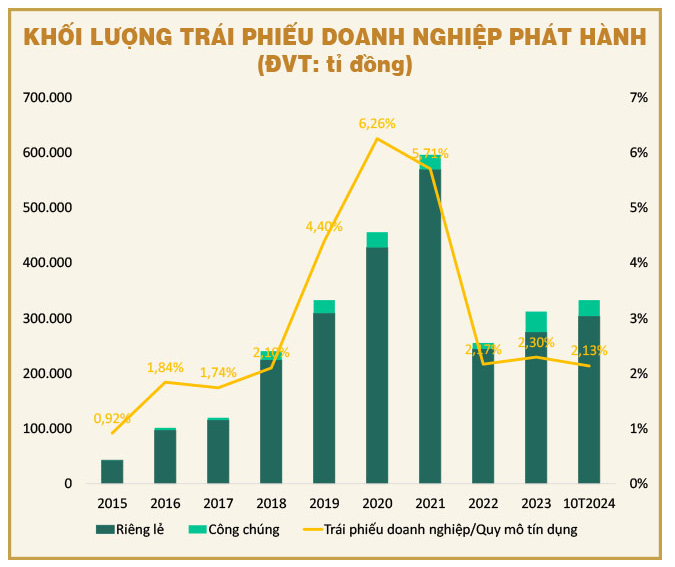

According to the Vietnam Bond Market Association (VBMA), the volume of corporate bond issuances in the first ten months of 2024 reached VND 332,854 billion, marking a 42.9% increase compared to the same period last year. Public issuances accounted for VND 28,854 billion, a 21.4% year-on-year increase, while private placements reached VND 304,000 billion, a significant surge of 454% from the previous year. In comparison to the credit scale, the total volume of corporate bond issuances this year is expected to account for only about 2.5%, a decrease from the 4.5-6% range observed between 2019 and 2021.

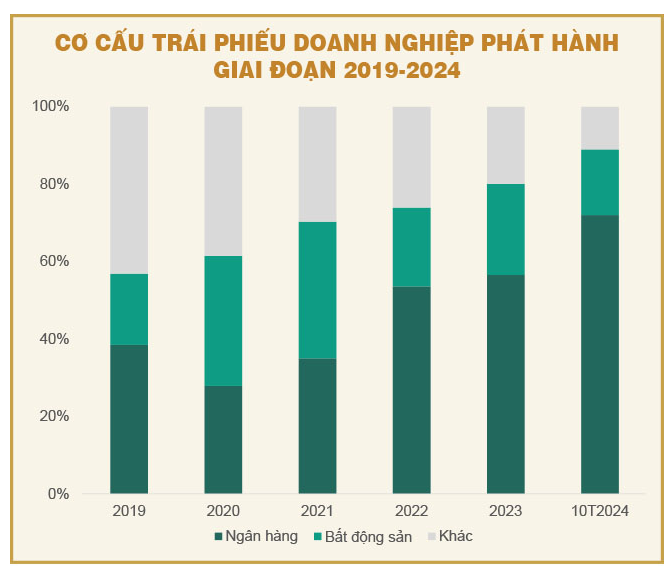

The banking sector dominated with a 72% share of the total issuance volume, a notable increase from 57% in 2023 and an average of 42% during 2019-2023. Conversely, the real estate sector accounted for only 17%, down from 24% in 2023 and an average of 26% in previous years. This shift can be attributed to the increased long-term capital mobilization needs of banks to comply with specialized regulations, while other sectors, particularly real estate, faced challenges in issuing new bonds.

Notably, in October 2024, enterprises repurchased VND 12,772 billion worth of bonds before maturity, a 28% decrease compared to the same period last year. It is forecasted that in the last two months of 2024, approximately VND 65,685 billion worth of bonds will mature, with real estate bonds accounting for 40%, equivalent to VND 26,255 billion.

Maturity Pressure and Capital Challenges

In the last two months of 2024, the corporate bond market faces more than VND 65,000 billion worth of bonds maturing, equivalent to nearly 10% of the remaining credit scale for the year (approximately VND 670,000 billion).

The years 2025 and 2026 will witness even higher maturity pressure, with estimated maturities of VND 250,000 billion and VND 230,000 billion, respectively. Meanwhile, according to Decree 08/2023/ND-CP, corporate bonds can only be extended for a maximum of two years. This implies that from the second quarter of 2025 onwards, the volume of maturities will be very high, creating increasing pressure on issuing organizations.

For bonds issued by banks, the maturity pressure is not as severe due to their ability to recycle capital and maintain stable financial health. In contrast, non-banking sectors such as real estate and renewable energy face significantly more complex maturity challenges. During 2019-2023, the non-banking group accounted for more than 55% of the total bond issuance volume, and the maturity pressure in 2025-2026 is expected to reach 12% of the annual credit scale (approximately VND 2,000,000 billion per year during 2021-2024), excluding the need for new capital for development.

This situation predicts that the end of 2024, and especially 2025, will be a challenging period as the volume of maturing corporate bonds reaches a record high. Enterprises without collateral and facing difficulties in mobilizing capital from other channels will bear significant pressure in restructuring their debt.

Additionally, the pressure to increase deposit interest rates is gradually mounting, leading to higher borrowing costs and challenges in accessing new capital sources, putting many issuers in a difficult position. Investor sentiment has not fully recovered from previous fluctuations, and stricter barriers for individual investors when participating in corporate bond purchases make maintaining liquidity to repay maturing bonds while ensuring business operations a complex task for many enterprises.

| In the last two months of 2024, the corporate bond market faces maturities of more than VND 65,000 billion, equivalent to nearly 10% of the remaining credit scale for the year (about VND 670,000 billion). Notably, approximately 40% of this amount pertains to real estate enterprises. The years 2025 and 2026 will witness even higher maturity pressure, with estimated maturities of VND 250,000 billion and VND 230,000 billion, respectively. According to Decree 08/2023/ND-CP, corporate bonds can only be extended for a maximum of two years. |

Opportunities Arising from the New Legal Framework

The latest draft of the amended Securities Law brings optimism for reinvigorating the corporate bond market. Notably, individual professional investors are considered for participation in purchasing privately placed corporate bonds if the issuing enterprise meets one of the following conditions: (1) possesses a credit rating and collateral or (2) has a credit rating and a payment guarantee from a credit institution.

The new regulations, outlined in the draft amended Securities Law and Decree 08/2023/ND-CP, will tighten the conditions for issuance and limit the participants in privately placed corporate bond purchases. This will not only promote the development of public corporate bond issuances but also weed out less capable enterprises, leaving only those with strong financial foundations and transparent governance practices.

Furthermore, with the increasingly refined credit rating system and regulations moving towards enhanced transparency, the corporate bond market is anticipated to evolve and stabilize in the coming years. Specifically, the real estate sector, which is currently facing numerous challenges, may significantly benefit from these new legal projects, helping to resolve legal obstacles and unlock capital flow. Similarly, authorities are also actively addressing lingering issues in the renewable energy sector, creating opportunities for its development in the next one to two years.

However, the new requirements also present significant challenges for regulatory agencies, necessitating stricter supervision of credit rating organizations and payment guarantee providers. This step is crucial to ensure the sustainable and transparent development of the market and reinforce investor confidence.

Trịnh Duy Viết

KienlongBank Announces Its Inaugural Public Offering of Bonds

As part of its sustainable development strategy, KienlongBank is embarking on an exciting journey to offer an attractive investment opportunity to individual and institutional investors. The bank has recently announced its inaugural public bond issuance in Q4 2024, aiming to mobilize financial resources to support its growth objectives and enhance its service quality.

How to Find Gold While Sifting Through Sand: A Guide to Seizing Opportunities

Sharing his insights at the ‘Khớp lệnh’ program on November 25, 2024, Mr. Dao Hong Duong, Director of Industry and Equity Analysis at VPBank Securities Joint Stock Company (VPBankS), asserted that several sectors exhibit positive signals based on their profit growth prospects for 2025. These sectors are expected to be relatively unaffected by external factors and offer suitable valuation ranges.

A Positive Signal from the Corporate Bond Market’s Manufacturing Sector in the First Ten Months

Although corporate bond issuance value plummeted in October, a positive sign emerged with a relatively diverse sectoral issuance structure. Notably, significant value increases were observed in the manufacturing, trading, and services sectors.

The Market Beat: A Surprising Rebound Led by Banking and Real Estate Sectors

The VN-Index staged a strong recovery in the afternoon session, buoyed by gains in the banking and real estate sectors. It closed the day up 5.85 points, or 1.264.48%. The HNX-Index also turned green, rising 0.49 points to 226.36, while the UPCoM-Index edged slightly lower, falling 0.08 points to 92.38.