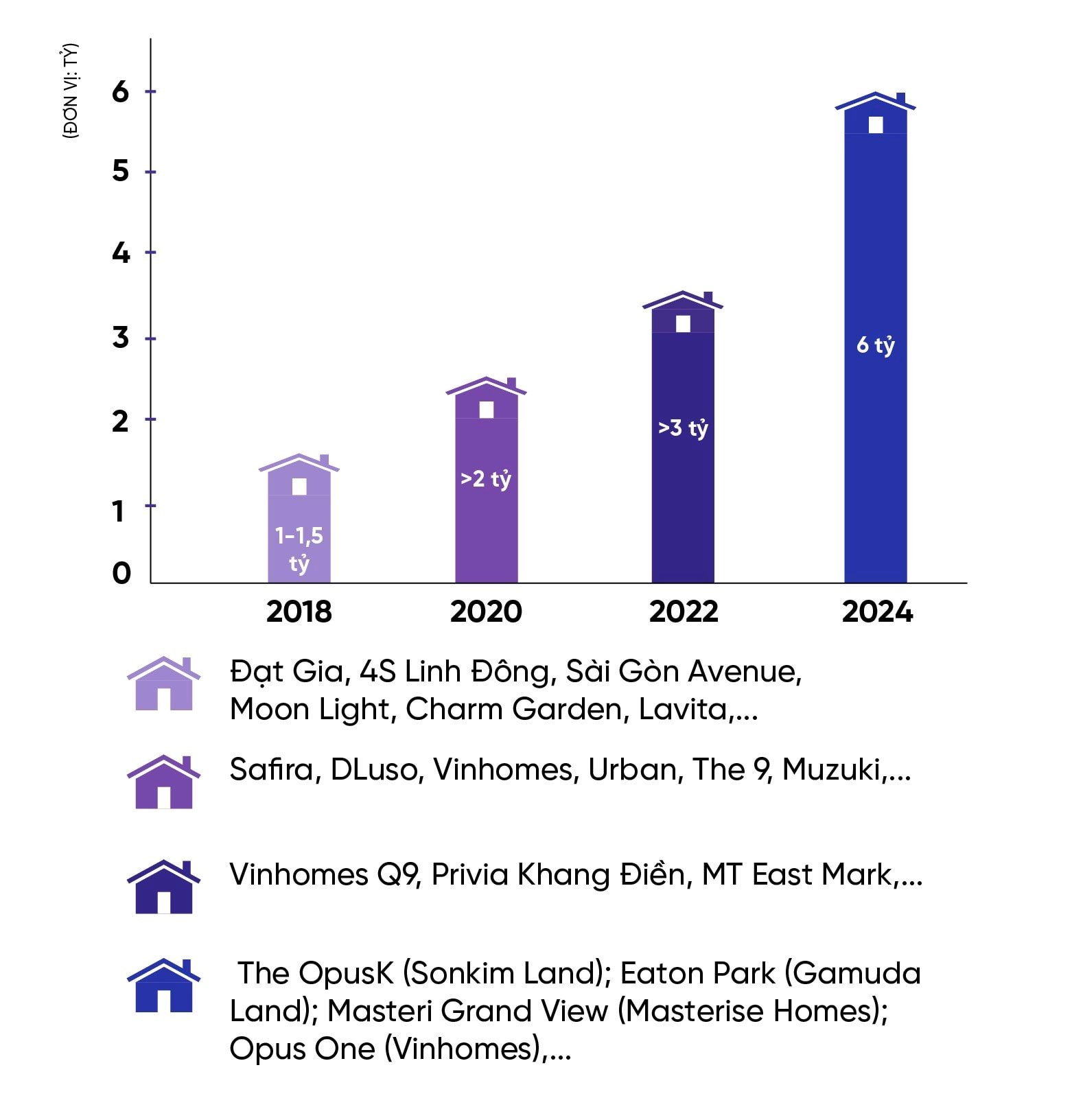

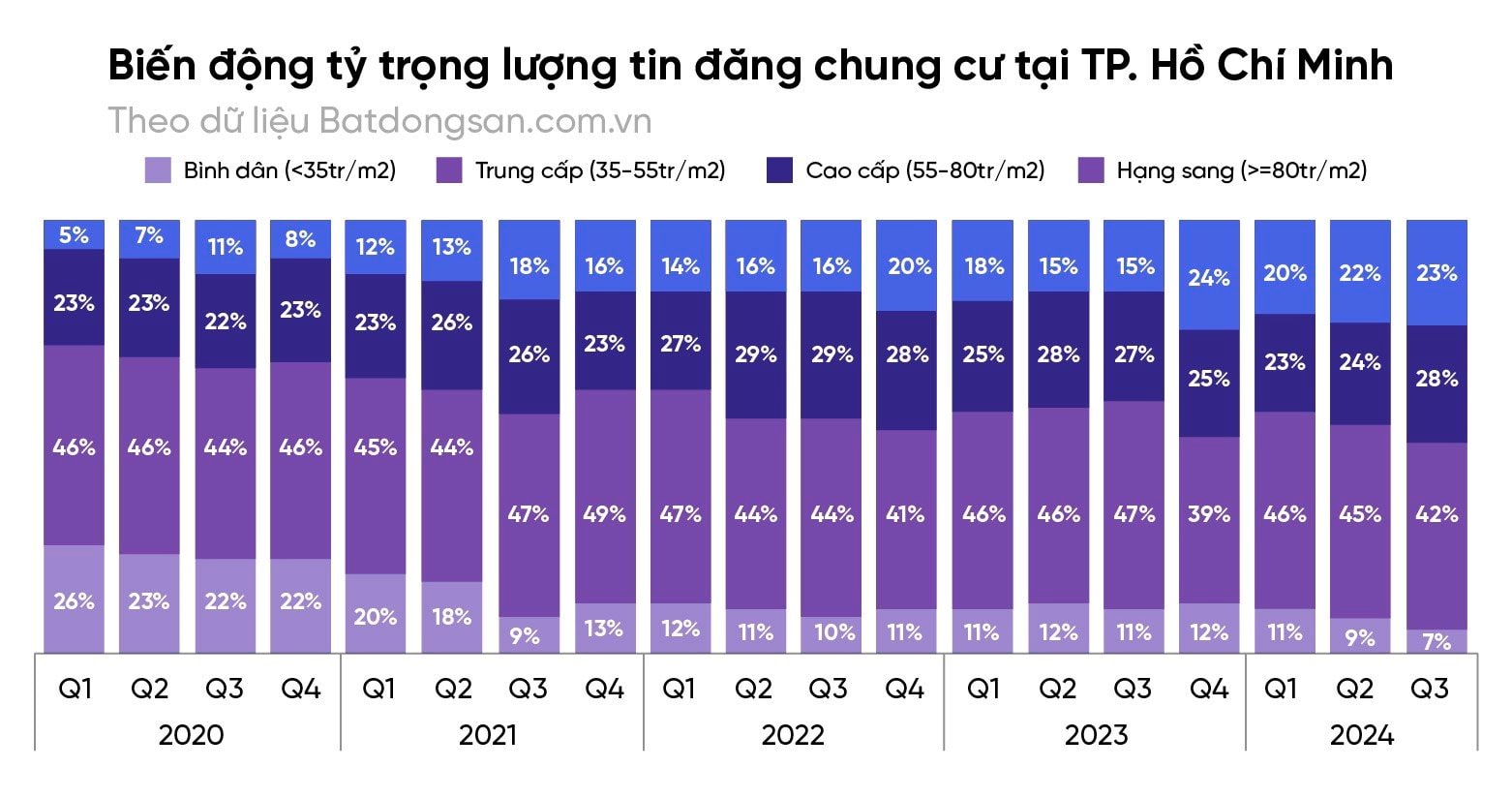

From 2018 to 2024, Ho Chi Minh City’s primary apartment prices increased by approximately 100% (depending on the project and location). The most significant increase occurred during the 2018-2020 period, with an average annual increase of 20-25% per project. The positioning of segments by selling price also gradually changed as price fluctuations continued to occur. Affordable apartments moved into the mid-range segment, while mid-range apartments became premium, and premium apartments reached the luxury threshold.

Today, the market is witnessing a shift towards luxury high-rise developments, which are gradually gaining a larger share of the supply in Ho Chi Minh City. In the city’s eastern region, the emergence of luxury apartment projects in late 2024 attests to the significant changes in price levels.

The proportion of luxury apartment listings is on the rise.

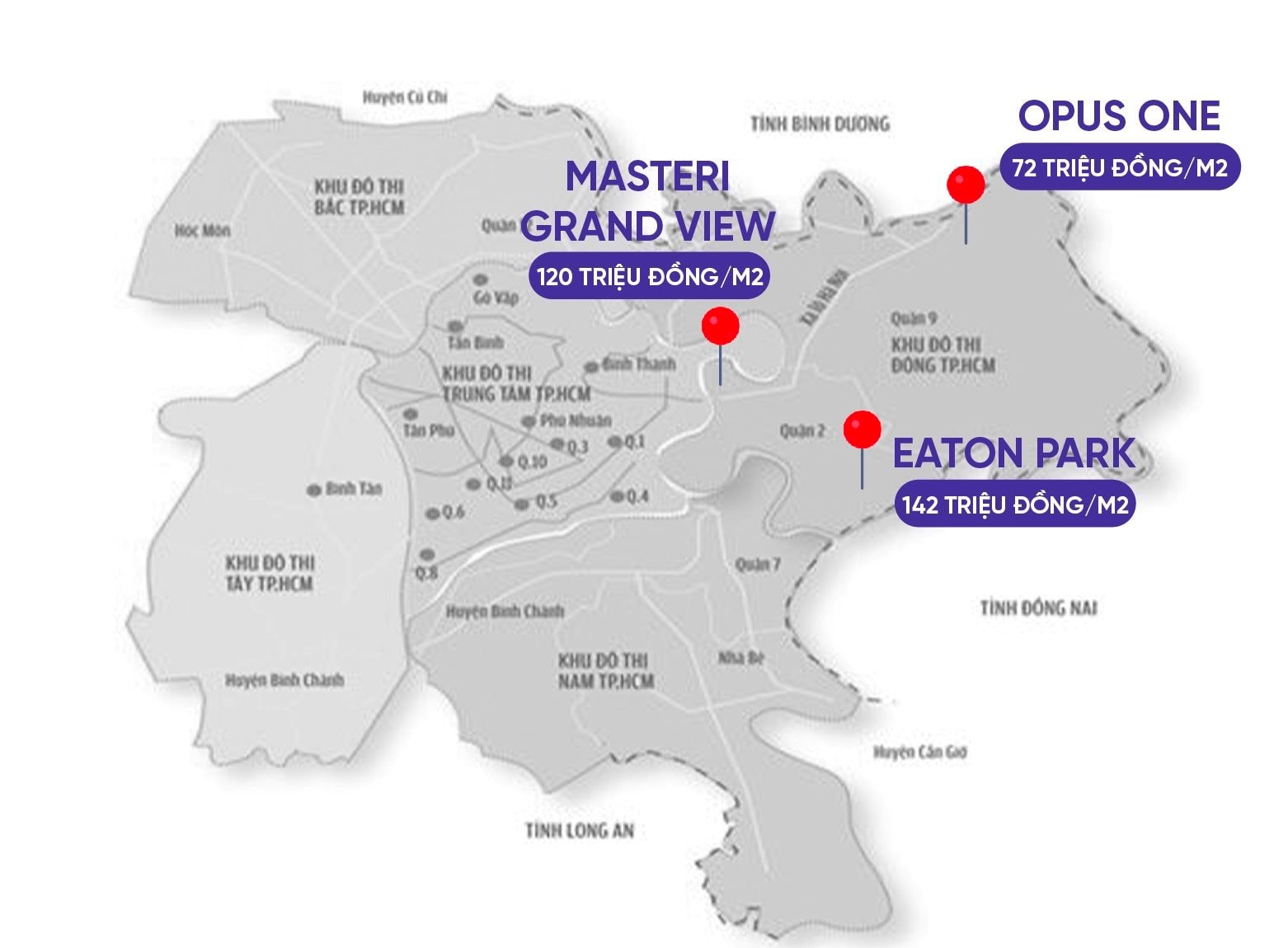

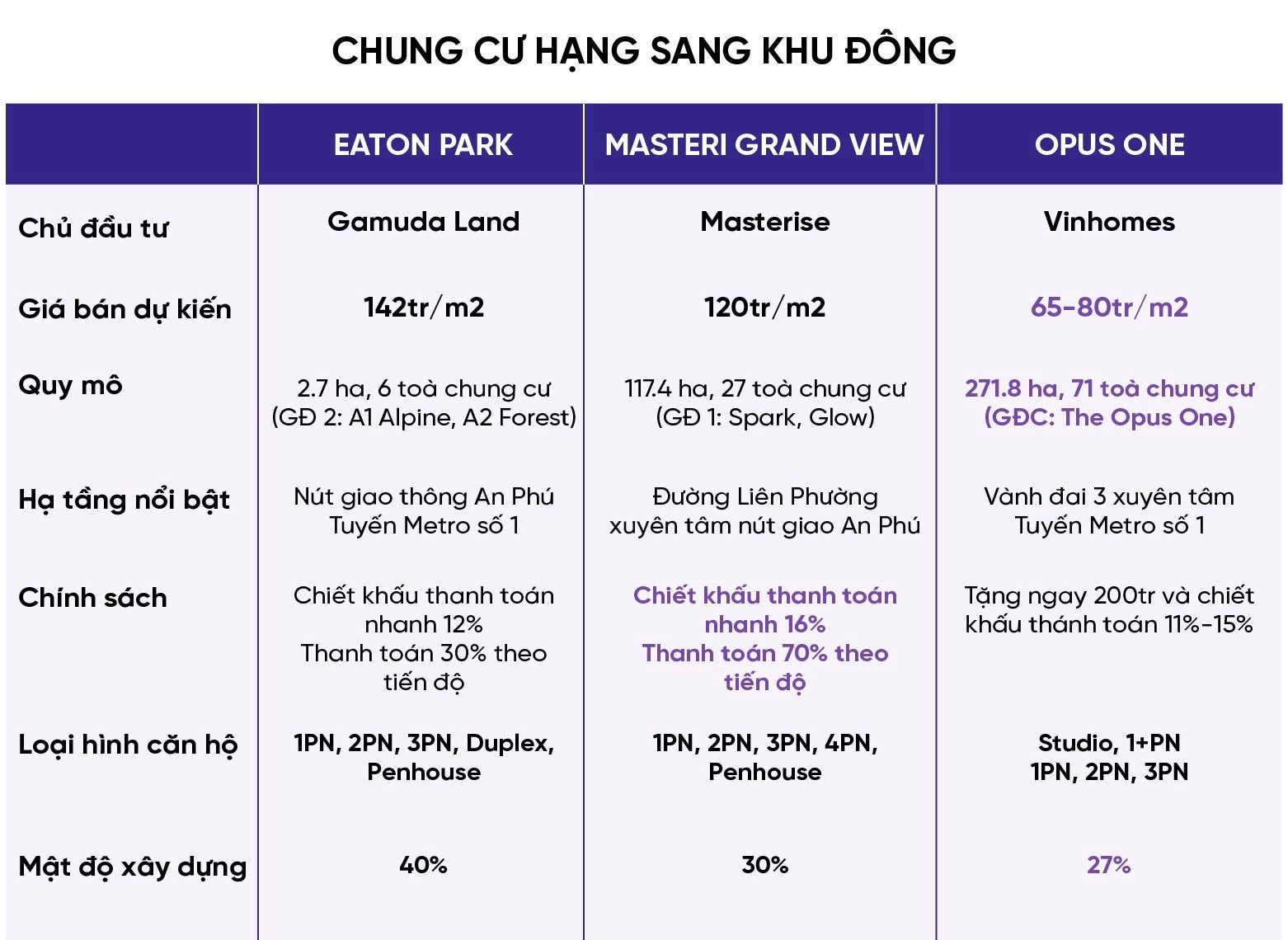

Recently, three industry giants in real estate—Masterise Homes, Gamuda Land, and Vinhomes—engaged in a competitive showdown over price levels, stirring up excitement in the southern real estate market.

Specifically, Eaton Park’s phase 2 rumor price was VND 142 million/m2; Masteri Grand View ranged from VND 120-140 million/m2; and Opus One’s prices fluctuated between VND 72-85 million/m2.

Located in close proximity, Masteri Grand View by Masterise Homes and Eaton Park by Gamuda Land have been continuously compared in terms of price, amenities, location, and legal aspects. On the other hand, Opus One, part of Vinhome Grand Park, is situated farther from the center of Ho Chi Minh City. Despite expectations of a more affordable price, its announced rate of nearly VND 100 million/m2 took many by surprise.

The intense competition among the three real estate powerhouses.

Evidently, the eastern region of Ho Chi Minh City has become the hottest battleground for luxury condominiums, where only investors with strong financial capabilities and long-term vision can afford to play.

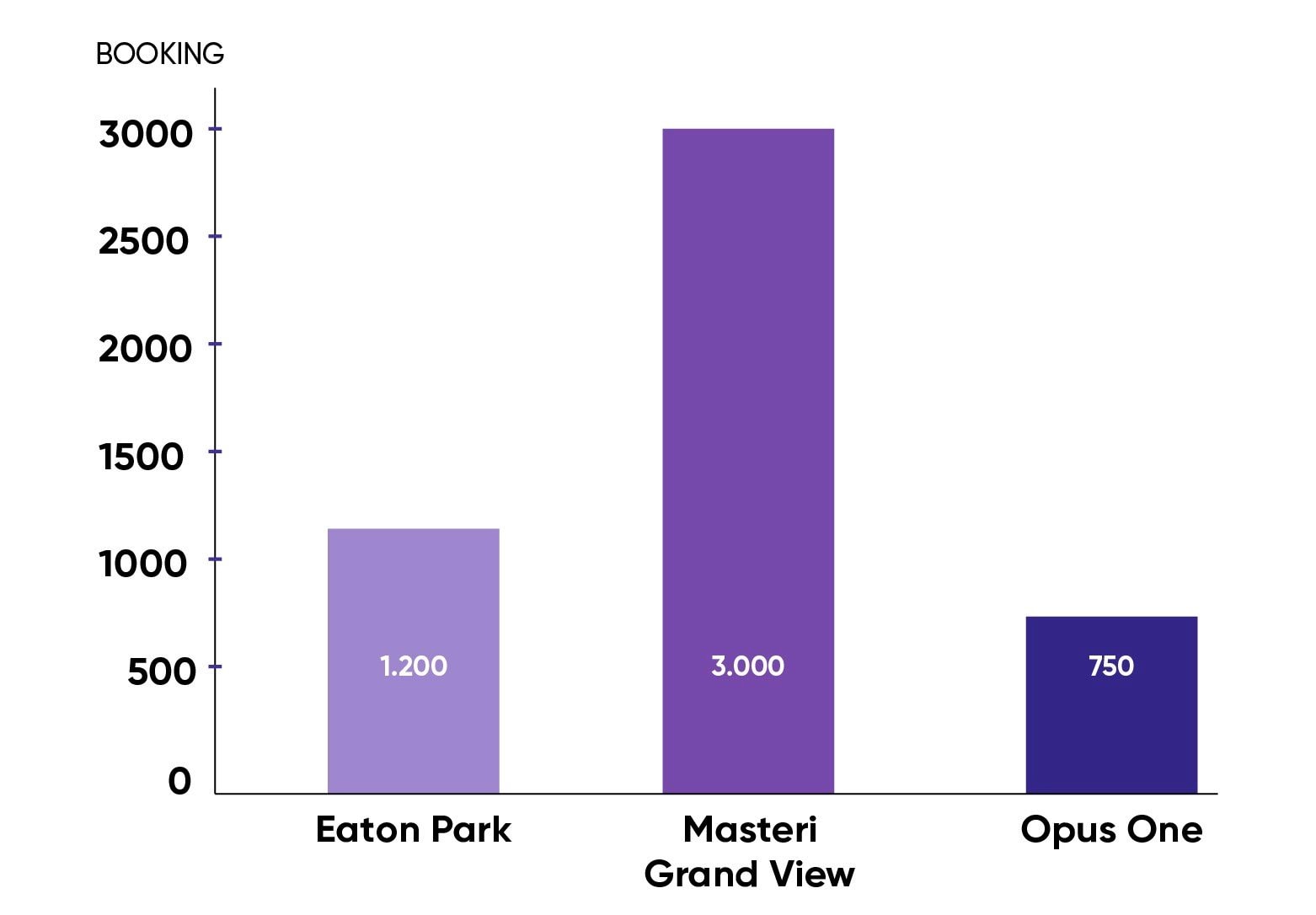

Notably, amidst the recovery phase of the Ho Chi Minh City market, luxury projects in this area continue to impress with their absorption rates. As of November 2024, Eaton Park had 1,200 bookings, Masteri Grand View had 2,800-3,000 bookings, and Opus One had 750 bookings. Recently, the number of “rap can” (apartment combinations) reached 80-90% of the booking volume, leaving later customers without any available options.

Despite the already high price levels, which far exceed the reach of many social segments, luxury apartments in Ho Chi Minh City’s eastern region are predicted to increase by approximately 10% over the next three years. In the next 5-10 years, the price of luxury apartments in the city is not expected to fall below VND 100 million/m2.

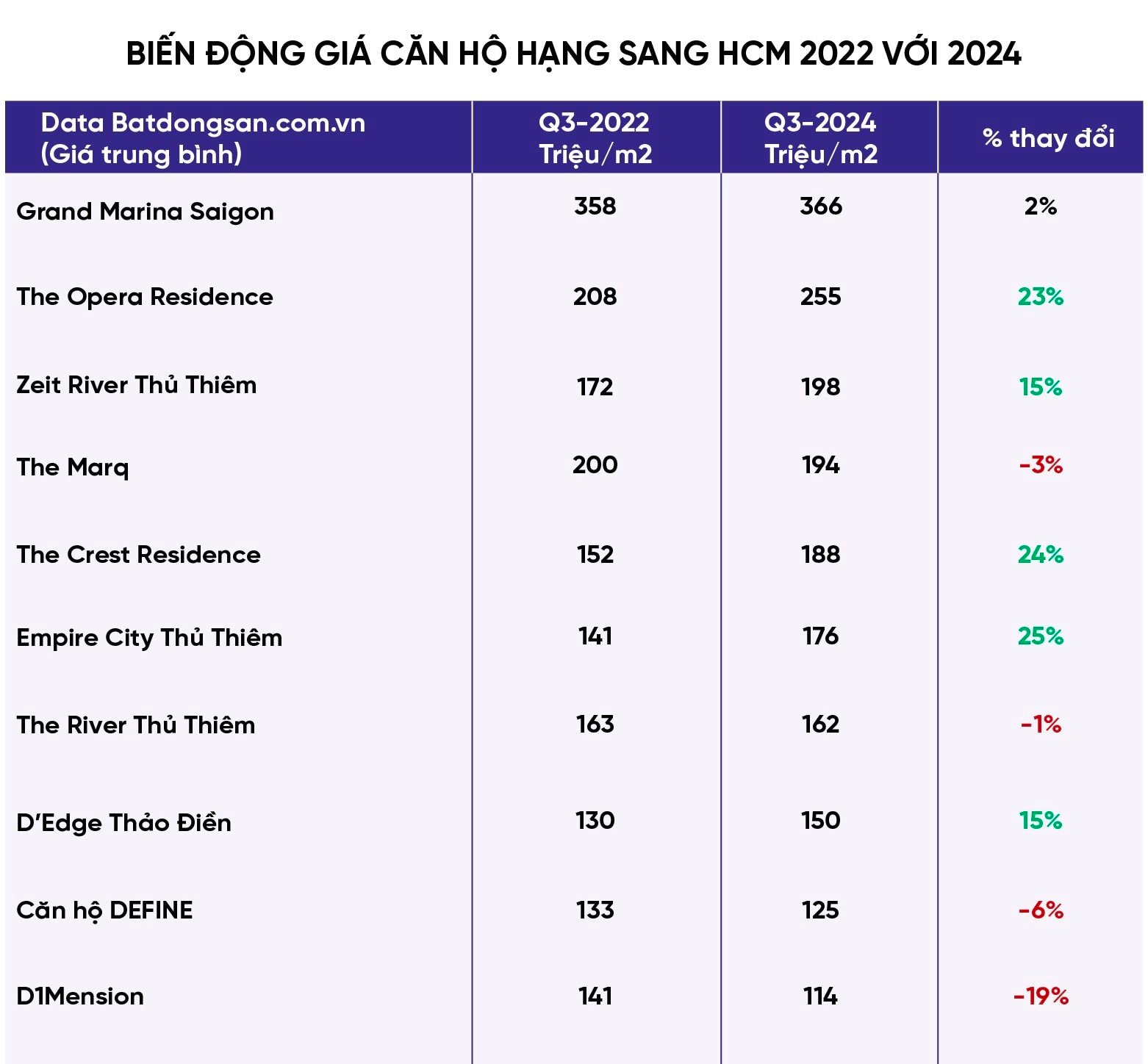

The shrinking central land bank is leading to a scarcity of luxury product supply. Premium and luxury projects launched during 2019-2021 still command impressive price increases compared to the previous year.

Regarding absorption rates, Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region, shared that with the current scarcity of new supply, products entering the market, despite high prices, will sell out. However, some projects with minimum prices set now will likely increase in value over the next 2-3 years, whereas those with maximum prices set now have limited room for further increases.

For instance, Opus One, priced at VND 65-70 million/m2, will likely see further price increases, but if the price reaches VND 88-90 million/m2, significant hikes are unlikely. Masteri Grand View, priced at around VND 120-130 million/m2, will find buyers, but it will be challenging to sell at VND 140 million/m2. Eaton Park’s first phase, priced at approximately VND 125 million/m2, sold very well, but the second phase, at VND 142 million/m2, experienced slower demand. Nonetheless, the overall trend is upward rather than downward.

According to Mr. Tuan, the absorption rate of luxury real estate is relatively better than last year but may slow down after the initial phase, which often includes attractive discounts and promotions from developers. For example, Eaton Park and Masteri Grand View typically experience strong absorption in the first phase but may face challenges in subsequent phases.

“From an investor’s perspective, the most critical factors for luxury real estate are attractive discounts and financing policies,” emphasized Mr. Tuan. “During this period, if there are favorable policies in place, demand will remain stable; otherwise, liquidity will be challenging. In the long run, projects in prime locations with excellent transportation connections will have the most potential. The price appreciation potential of these projects will depend on the development of key infrastructure and the introduction of notable project amenities.”

Gem Park – A Haven for Homeowners, a Goldmine for Investors

Gem Park – A prestigious apartment project boasting the first Korean standards in Hai Phong is attracting buyers for both residential and investment purposes. With its superior quality and design, Gem Park offers an enticing opportunity for those seeking a luxurious lifestyle and a stable, profitable rental investment.

Foreign Fund Joint Venture Announces Haus Da Lat’s Exclusive Distributor in Vietnam

At Haus Da Lat, four experts and associates will become the exclusive representatives and distributors for the Vietnamese market.

“A Brewing Headache: The Conundrum of the Latest Coffee Craze”

“As coffee prices surge, farmers rejoice while businesses brace for a challenging season ahead. The upcoming harvest looms large, with rising costs putting pressure on an industry already facing a slew of economic hurdles. With input expenses climbing, the future looks uncertain for those tasked with bringing our favorite brew to the masses.”

The Homebuying Dilemma: Amidst the Hustle and Bustle of City Life, Where Can One Find an Affordable Home to Celebrate the Lunar New Year?

As of now, finding an apartment in bustling cities like Ho Chi Minh City for 3-4 billion VND (approximately $129,000 – $172,000) is becoming increasingly challenging. With a limited supply and ever-rising prices, securing a home in this desirable location is proving to be a difficult task for many.