Prior to the transaction, Mr. Duc held nearly 1.07 million shares, equivalent to 2.26% of the company’s charter capital. He was only able to purchase 1.31 million shares out of the registered amount of 1.56 million due to insufficient funds, but this was enough to increase his ownership to 5.04% (nearly 2.4 million shares) and become a major shareholder of the company.

| Price movement of DSD shares since the beginning of 2024 |

During this period, the market did not record any matched orders, but there were several negotiated transactions with volumes equivalent to Mr. Duc’s purchases. This suggests that Mr. Duc likely acquired the shares through negotiated deals. The total value of these transactions exceeded VND 22.2 billion, equivalent to VND 17,000 per share. This price is 15% lower than the current market price of DSD shares (VND 20,000 per share)

DHC Suoi Doi was established in February 2014 in Da Nang, with a charter capital of VND 2 billion. The company primarily operates in the field of entertainment not classified elsewhere (excluding bar and nightclub activities). It owns and operates the Suoi Khoang Nong Nui Than Tai tourist area in Da Nang.

Suoi Khoang Nong Nui Than Tai tourist area in Da Nang

|

In terms of business performance, for the first nine months of 2024, the company achieved VND 157 billion in net revenue, slightly lower than the same period last year. After-tax profit was nearly VND 32.5 billion, a decrease of 11%. Total assets at the end of the third quarter stood at VND 708 billion, an increase of 11% from the beginning of the year, mostly comprised of long-term assets. Short-term assets were nearly VND 44 billion, 2.2 times higher than at the beginning of the year, but cash holdings were only VND 1.4 billion, an increase of 11%.

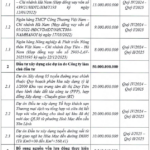

| Business performance of DSD |

Short-term debt at the end of the period decreased by more than half to about VND 30 billion. All solvency ratios were above 1. The company had long-term borrowings of over VND 68 billion (nearly VND 195 billion at the beginning of the year), mostly from Ms. Le Thi Thanh Nga (sister of Mr. Le Minh Duc).

“NHA Scraps Capital Raising Plans from Shareholders”

The Hanoi Southern Housing and Urban Development Corporation (HOSE: NHA) has announced that it will be temporarily halting its plans for a public offering of shares in 2024.

Stock Market Pre-Trading Session, September 26: Truong Thanh Wood Receives Another Warning

The Ho Chi Minh City Stock Exchange (HoSE) has issued a warning to Truong Thanh Wood Industry Corporation (TTF) for delayed disclosure of explanations regarding the discrepancy in post-tax profits on the reviewed semi-annual financial statement for 2024.