Illustrative Image

Rental Apartments Segment Attracts Investors in Major Cities

According to Avison Young, the serviced apartment market in large cities has consistently maintained positive rental rates and absorption capabilities. Avison Young’s Q3 report indicates that the average monthly rent is over VND 800,000 per square meter for Grade A and over VND 400,000 per square meter for Grade B.

The investment opportunity is incredibly attractive with the rental apartment model, offering returns comparable to savings accounts. This investment channel can provide investors with a regular monthly income like a savings account, while also benefiting from real estate appreciation over the years.

When investing in rental serviced apartments, projects located in the centers of major cities such as Hanoi and Ho Chi Minh City should be preferred due to their stable demand. The “plus point” of these areas is the concentration of medical, educational, cultural, and social infrastructure, as well as entertainment services to meet the needs of residents’ daily lives, rest, and relaxation.

In recent years, Vietnam has attracted significant FDI inflows due to the signing of numerous trade agreements with major countries, especially in large cities. In 2024, Hanoi aims to attract approximately USD 3.15 billion in FDI, with projects using land accounting for over USD 2.15 billion and commercial and service projects reaching USD 1 billion. In 2025, the city will continue to attract approximately USD 2.7 billion in FDI.

These figures indicate that the wave of investment and industrial park development by global corporations and enterprises will continue to expand in Vietnam. The influx of foreign experts to live and work in Vietnam is expected to increase the demand for housing and rentals.

With interest rates remaining low and other investment channels being volatile, the rental apartment investment segment has become a stable and profitable channel, offering a “double benefit” to investors. It allows for both rental income and long-term capital appreciation as real estate prices continue to rise over time.

Stable Cash Flow from Rental Rates

Regarding apartment rental rates, prices continue to surge in Hanoi, ranging from VND 8-15 million per month. Rental prices in Ho Chi Minh City have also been on an upward trend, especially in the inner city, with significantly higher rental rates than in Hanoi. A mid-range apartment in the center of Ho Chi Minh City now averages between VND 20-23 million per month.

The recent increase in apartment rental rates can be attributed to the continuous escalation of apartment prices, causing many to postpone or abandon their plans to purchase property. As a result, renting has become a more popular option. Another factor is the rising demand for rentals due to the influx of foreign experts through FDI projects.

With the economic recovery and the return of foreign experts, the demand for accommodation is expected to grow steadily. Hanoi has attracted the highest FDI registration in the past three years, reaching USD 2.9 billion, a 70% year-on-year increase. The city aims to develop numerous industrial parks while improving its infrastructure to attract more foreign investors, which will contribute to the demand for accommodation from foreign experts. Meanwhile, as the demand for housing increases, the high property prices and limited supply push customers towards renting instead of buying.

According to experts from the Vietnam Real Estate Brokers Association (VARS), apartment rental rates have increased significantly in recent years, offering higher returns than street house rentals. Investing in apartments and then renting them out has become a popular trend in major cities. Rental prices are expected to continue rising but at a slower pace.

As a result, investing in apartment buildings may become the dominant trend in the real estate market in the last quarter of 2024 and is forecasted to return to the “double profit” era in the coming years.

The Ultimate Investment: Unlock High Returns with a Smart 400 Million VND Property Purchase

With an attractive rental yield and ownership prices at half the rate of Ho Chi Minh City, this wise investment proposition has sparked a rush of interest in the Thuan An apartments, conveniently located on the front of National Highway 13.

“Phát Đạt’s New Business Strategy: Leading Through Innovation”

The Chairman of the Board of Directors at PDR emphasized that the company has at least six solid projects in the pipeline, which are set to be continuously developed and implemented from now until 2027. These projects are expected to generate an impressive forecasted revenue of up to 50 trillion VND for Phat Dat.

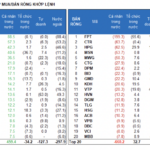

Foreign Investors Net Buy for the 6th Straight Session, Heavily Buying FPT Shares

The market continues to rally despite uncertain cash flows, with today’s liquidity not exceptionally high as the three exchanges traded nearly VND 15,000 billion, including net foreign purchases of VND 359.7 billion, and matched transactions of VND 226.9 billion.