Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, shared insightful information at the Vietnam Real Estate Conference – VRES 2024, held on December 3rd.

Mr. Quoc Anh analyzed the three primary factors influencing Vietnamese real estate prices: economics, management, and society.

“Vietnam boasts impressive per capita economic growth and inflation rates. Additionally, the interest rate environment and the investment efficiency of domestic channels reinforce consumers’ demand for real estate,” said Mr. Quoc Anh.

Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn.

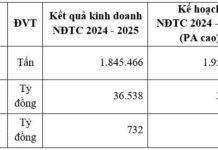

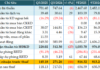

According to Mr. Quoc Anh, Vietnam’s per capita GDP stands at 34.8%, higher than the world average (20.8%) and that of developing countries (22%). Vietnam’s inflation rate is also higher than the global average. Currently, the interest rate environment in Vietnam is becoming more favorable, and the proportion of stored assets in GDP is substantial (32.8%), ranking 27th globally (average of 27.1%).

With their savings, Vietnamese individuals have several main investment channels, including the financial market, real estate, gold, foreign currency, and savings deposits. While gold investments are volatile and risky, with significant discrepancies between domestic and global prices, foreign currency and savings deposits offer relatively low yields, ranging from 5% to 6% annually.

“Real estate has been deemed the most profitable investment channel in Vietnam over the past decade, with apartment types yielding 197% and land plots yielding 137% in Q4 2024 compared to Q1 2015,” Mr. Quoc Anh stated.

Expectations of Real Estate Ownership

According to Mr. Quoc Anh, Vietnam’s population and urbanization rate present significant opportunities for real estate demand growth. The trend toward smaller families also drives the need for real estate purchases for the next generation’s inheritance and the journey of homeownership for young people. Additionally, culturally, Vietnamese people have a strong desire to own real estate during their lifetime.

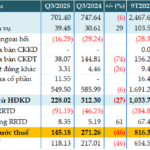

Mr. Quoc Anh calculated that in 2004, an individual from the 7x generation would need approximately 31.3 years of income to purchase a 60m2 apartment worth VND 0.6 billion, assuming a deposit interest rate of 7.4%. A decade later, an individual from the 8x generation would require 22.7 years of income to buy the same apartment, now priced at VND 1.5 billion, while the deposit interest rate had dropped to 6%.

By 2024, a 9x individual would need 25.8 years of income to purchase the aforementioned apartment (priced at VND 3 billion) with a deposit interest rate of 4.5%. Although the number of years of income and interest rates have gradually decreased over time, young people from these generations still need to work hard for an extended period to achieve homeownership.

“Nevertheless, Vietnamese people, in particular, and Asians, in general, have high expectations of owning real estate during their lifetime,” said Mr. Quoc Anh. He added that the common reasons include high and stable yields, an underdeveloped financial market, social recognition, and providing a home for the family. Notably, Vietnam ranks among the top countries globally in terms of real estate ownership, with a rate of 90%, surpassing some Southeast Asian countries such as Singapore (88%), Indonesia (84%), and developed nations like the US (66%) and Australia (66%).”

2025: A Year of Rising Real Estate Market

Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, emphasized that the government has been consistently conveying strong messages, urging relevant agencies to find ways to remove obstacles for projects and promote economic development through accelerated public investment and urbanization.

In the coming time, if factors such as legal policies, finance, and public investment continue to improve, the real estate market is likely to heat up further in 2025 when the new legal corridor officially comes into effect, and investors ramp up project implementation.

“With improvements in these factors, housing supply will be further promoted, creating a driving force for the real estate market’s development through M&A activities in the direction of combining strengths,” Mr. Dinh emphasized.

The Vice President of the Vietnam Real Estate Association, Nguyen Van Dinh, also predicted that the government would enhance its supervision and regulation of the market, ensuring stability and proper development.

“Therefore, various real estate segments are expected to continue their recovery, with high-end apartments leading the market and villas and adjacent plots becoming more vibrant. Additionally, land plots with clear legal procedures will attract investors, and social housing will have further opportunities to regain momentum. Moreover, the growth of industrial real estate and the improvement of tourism and resort real estate are also anticipated, thanks to the legalization of condotel ownership,” Mr. Dinh added.

Dr. Can Van Luc, BIDV’s Chief Economist, shared a similar sentiment, stating that the real estate market has witnessed several positive changes compared to the past. Specifically, the macro economy has entered a stable period, inflation is under control, interest rates in Vietnam remain low, and government debt and obligations are within the limits allowed by the National Assembly.

Additionally, legal obstacles have been gradually addressed, and the institutional framework has received attention for improvement (with the passage and enforcement of numerous related laws and the issuance of decrees and policies). Furthermore, planning at different levels has been refined.

According to Dr. Luc, these are the primary driving forces for the real estate market to enter a new phase and recover sustainably.

The Art of Real Estate: Avoiding the Pitfalls of Selling Cheap and Buying Dear

One of the biggest deal-breakers in real estate transactions is the discrepancy in price expectations. Buyers are concerned about overpaying, while sellers fear selling below market value and feeling shortchanged. So, what’s the solution to these inherent bottlenecks?