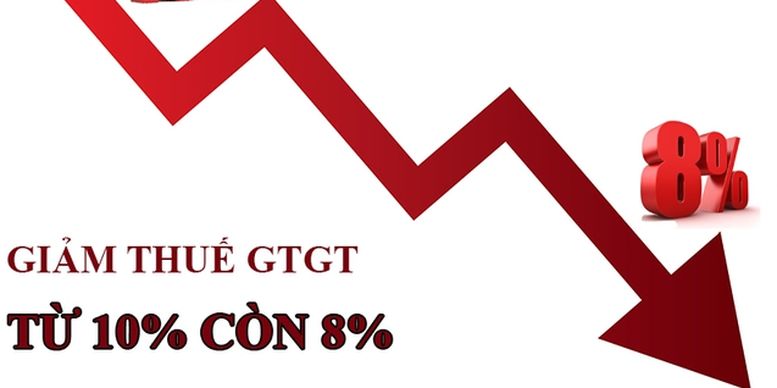

**Reducing VAT to Stimulate Consumption and Support Economic Recovery**

Reducing VAT for goods and services currently subject to a 10% rate, except for certain specified categories.

According to the Ministry of Finance, the decree aims to stimulate consumer demand, fitting the current economic context. This will boost production and business activities, leading to a quicker recovery and contribution to the state budget and the economy as a whole, in line with the Five-Year Socio-Economic Development Plan for 2021–2025, annual socio-economic development plans, and the economic restructuring plan for 2021–2025.

VAT Reduction for Goods and Services Subject to a 10% Rate

The draft decree states: VAT will be reduced for goods and services currently subject to a 10% rate, except for the following categories:

a) Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and metal products, mining products (excluding coal mining), coke, refined petroleum products, and chemical products. Details are provided in Appendix 1 issued with this decree.

b) Goods and services subject to excise tax. Details are provided in Appendix II issued with this decree.

c) Information technology as defined by relevant laws. Details are provided in Appendix III issued with this decree.

d) The VAT reduction applies uniformly to import, production, processing, and commercial trading activities. For domestically mined coal sold (including cases where coal is mined and then screened and sorted in a closed process before being sold), the VAT reduction applies. Coal falling under Appendix I issued with this decree is not eligible for VAT reduction in any other stages beyond the mining and selling stage.

State-owned corporations and economic groups that implement closed processes before selling are also eligible for VAT reduction for mined coal sold.

If the goods and services listed in Appendices I, II, and III issued with this decree are exempt from VAT or subject to a 5% VAT rate as per the Law on VAT, the provisions of the Law on VAT shall prevail, and no VAT reduction shall be applied.

2% VAT Reduction

As per the draft, businesses calculating VAT by the deduction method shall apply an 8% VAT rate for the aforementioned goods and services.

Businesses (including business households and individual business operators) calculating VAT by the percentage of turnover method shall reduce the percentage for VAT calculation by 20% when issuing invoices for the aforementioned goods and services eligible for VAT reduction.

This decree takes effect from January 1, 2025, until June 30, 2025.

Ministries, based on their functions and tasks, and the People’s Committees of provinces and centrally-run cities shall direct relevant agencies to propagate, guide, inspect, and supervise the implementation of this decree to ensure that consumers understand and benefit from the VAT reduction stipulated herein. They shall focus on solutions to stabilize the supply and demand of goods and services subject to VAT reduction to maintain market price stability (excluding VAT) from January 1, 2025, to June 30, 2025.

State Budget Revenue Expected to Decrease by VND 26.1 Trillion

The Ministry of Finance stated that implementing the 2% VAT reduction policy as per the National Assembly’s resolution is expected to reduce state budget revenue by approximately VND 26.1 trillion in the first six months of 2025 (approximately VND 4.35 trillion per month, including a reduction of about VND 2.85 trillion per month in the domestic sector and about VND 1.5 trillion per month in the import sector).

While the VAT reduction will lead to a decrease in state budget revenue, it will also stimulate production and promote business activities, thereby contributing to increasing state budget revenue in the long run.

Readers can access the full draft and provide feedback here .

Prime Minister Calls for Intensified Land-Use Fee Collection Efforts in the Year-End Period

The Prime Minister has instructed the Ministry of Finance to take the lead and collaborate with relevant agencies to review and expedite the collection of taxes and land lease payments that have been extended… in the final month of 2024. This proactive approach ensures timely revenue for the state budget and fosters a culture of fiscal responsibility.

Will Interest Rates Drop Further by Year-End?

The continuous rise in deposit interest rates in recent times has sparked a question: Can lending rates drop further by the year-end?

The VAT Amendment Law’s Impact on State Budget Collection and Business Operations

The newly amended Value-Added Tax Law, approved by the National Assembly, will come into force on July 1, 2025, with significant changes. This revised law is a step towards practicality and is expected to have a notable impact on both state budget revenue and business operations.