Vietnam’s stock market witnessed a positive latter half of November with the VN-Index registering two consecutive weeks of gains. Continuing this positive momentum, the market opened the month of December on a strong note. The overall index surged from the get-go, thanks to a consensus among the blue-chip group, led predominantly by the banking sector, with LPB and VCB taking the lead.

Additionally, stocks of companies related to public investment also shone with an impressive recovery (HHV, LCG). However, weak liquidity prevented the gains from spreading far and wide, while selling pressure gradually increased, causing many stocks to reverse course and retreat to reference levels midway through the session, thus weakening the VN-Index’s upward trajectory.

Foreign investors ended their six-day net buying streak on December 2.

Nonetheless, the selling was not overly aggressive, and there was no widespread sharp decline. Hence, the market’s performance likely reflected investors’ cautious sentiment after the index had rallied nearly 60 points in the past two weeks of recovery.

The afternoon session saw no improvement over the lackluster morning session, with choppy trading pulling the market below the reference level. Selling pressure persisted, and the red dominated, causing the market to lose steam. Towards the end of the session, choppy trading became more frequent. However, a few banking stocks reclaimed their gains, helping the VN-Index close slightly higher.

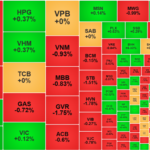

In terms of contributions, VCB, LPB, and BVH were the top three boosters for the overall index, collectively contributing over 2.2 points. On the flip side, FPT, BID, and GAS were the main drags on the index.

Market breadth was negative, with 10 out of 19 sectors declining. The sectors that managed to stay in the green were banking, telecommunications, resources, chemicals, construction materials, retail, insurance, healthcare, and auto parts.

Weak liquidity was a downside during the session, with the trading value reaching approximately VND 13,290 billion across all three exchanges.

Another negative during today’s session was the end of the foreign investors’ six-day net buying streak, as they turned net sellers. They net-sold over VND 424 billion worth of stocks today, focusing their selling on FPT, ACV, and VRE. On the buying side, they mainly purchased CTG, PNJ, and TCB.

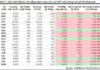

At the close of today’s session, the VN-Index rose 0.75 points to 1,251.2, with 147 gainers and 221 losers. Total trading volume reached 497.4 million shares, and the value was VND 11,965 billion, unchanged in volume and down 11% in value compared to the previous session. Block deals contributed over 108.7 million shares, valued at VND 2,446 billion.

The HNX-Index climbed 0.68 points to 225.3, with 63 advancers and 88 decliners. Total trading volume reached 38.4 million shares, and the value was VND 684 billion, down 26% in volume and 16% in value compared to the previous session. Block deals added 9.8 million shares, valued at VND 591 billion.

The UPCoM-Index shed 0.30 points to 92.44, with 142 gainers and 125 losers. Total trading volume reached 45.5 million shares, and the value was VND 646 billion. Block deals contributed an additional 25.2 million shares, valued at VND 391 billion.

In the derivatives market, all four VN30 futures contracts lost ground.

The VCB Pushes VN-Index Below 1,250 Points, Insurance Stocks Surge: A Market Surprise

The recovery efforts this afternoon failed to bear fruit, as the dominant force of the ‘super-pillar’ VCB overwhelmed the lackluster performance of other blue-chips. The VN-Index closed with a loss of 1.38 points, with VCB’s 1.27% decline accounting for over 1.6 points. However, bottom-fishing funds were active, driving significant gains in numerous stocks, particularly in the insurance sector.

A Pause in the Uptrend

The VN-Index’s upward momentum stalled with a slight dip in the latest trading session as volume remained below the 20-day average. This indicates a continued cautious approach from investors. However, the MACD indicator still holds a buy signal and is poised to cross above the zero threshold. Should this crossover occur, it would provide a more optimistic outlook for the market, suggesting that the dip may be short-lived.