What’s driving this trend?

Rapid urbanization, soaring land prices, and the fact that young people’s incomes are not yet stable enough to keep up, have made small to medium-sized apartments the top choice.

In 2020, regulations on the minimum area of apartments were reduced from 45sqm to 25sqm to meet real demands and stimulate the market. However, small apartments should prioritize providing a place to live over creating assets for ownership.

The high investment costs of projects force developers to consider reasonable prices. Apartments with moderate areas, smart designs that maximize space, and reasonable starting prices are more likely to attract buyers.

The development of small apartments is recommended in new urban areas rather than in already planned areas to avoid breaking the planning and overloading the infrastructure.

Liquidity

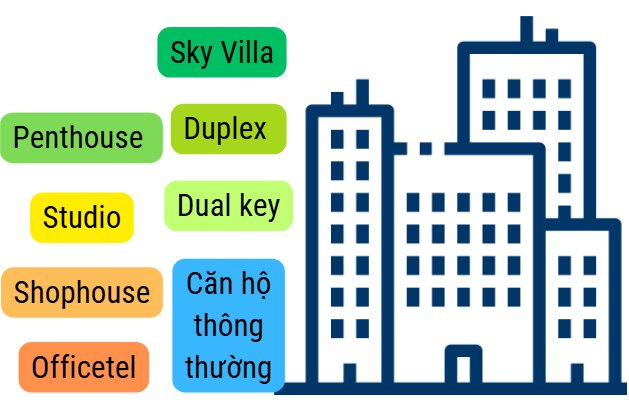

There are currently eight different types of apartments depending on the homeowner’s purpose and budget. The most popular are one-bedroom apartments and expanded (1+) or two-bedroom apartments, accounting for 90-95% of the total number of apartments in the project.

Illustration: TM

|

According to a long-time broker in the Southeast region, in 2024, small apartments with low starting prices in the satellite cities of Ho Chi Minh City will quickly sell out due to the increasing price per square meter, with no signs of decreasing because input costs are too high.

“This situation is due to the fact that the unit price (per square meter) is increasing and there is no chance of a further reduction, as the input costs for investors have become too high, especially for new projects,” said Pham Thi Nguyen Thanh – General Director of DXS.

Although small, these apartments are furnished with multi-functional furniture with flexible transformation capabilities to suit different purposes. Studio apartments with compact areas of 25-40sqm/unit solve the problem of “crowded land, crowded people” and meet the minimalist living trend of today’s Millennials.

Next is the 1BR apartment for singles and young people such as students and office workers who want privacy. Or the 1BR+ with an area of 40-55sqm/unit is very popular nowadays as it has an additional multi-functional space. The selling price and rent are not high, suitable for people with average finances. Thanks to that, this product line sells out very early when rented or sold.

The 2BR apartment with an area of 55-75sqm, optimized design for multiple functions for all members. Families who need long-term stability often opt for a 2BR apartment, whether it’s a couple with 1 or 2 young children, or living with grandparents can live together.

1BR+ (left) and 2BR apartments are designed in a modern Japanese style, suitable for young, dynamic families

|

Preferred style

Vietnam is in the golden population stage with 70% of the population of working age, lasting until 2038. FDI inflows are strong, with China and Korea investing in industrial parks, while Singapore targets the high-end segment and Japan focuses on the affordable segment, prioritizing clean land.

The Japanese style, with its smart design, optimized area, natural lighting, and closeness to nature, has met the modern living needs of young people. Japanese-style projects such as Akari City (Nam Long), Swan Lake Onsen (Ecopark), The Sakura and The Origami (Vinhomes) have brought a new breeze to the real estate market.

A newly launched project, TT AVIO, located right at Vincom Plaza Di An, Binh Duong, a 5-minute drive from Thu Duc City, Ho Chi Minh City, converges styles with a strong Japanese flavor such as minimalism and flexibility to suit the diverse needs of young families.

Mr. Shin Ogawa – Director of Housing Operations, Cosmos Initia – A company with 50 years of experience in joint venture with Japan to invest and develop the TT AVIO project.

|

With prices starting from VND 1.23 billion/unit, considered the lowest starting price in the area, along with flexible sales policies, the project has achieved a high absorption rate in the initial phase. The project is currently preparing to launch Phase 2 to welcome the year-end demand. Unlike many other projects, instead of applying fixed payment schedules, TT AVIO apartment buyers can “negotiate payments”, self-adjusting the schedule to suit their financial capabilities. This not only makes home ownership easier but also optimizes the buyer’s cash flow throughout the contract.

Speaking at the project launch recently, Mr. Shin Ogawa – Director of Housing Operations of Cosmos Initia, shared that with the position of a multi-sector real estate corporation established in 1974 in the land of the rising sun, at that time, Japan had an extremely strong urbanization rate, and the real estate market was continuously expanding. In that context, the Corporation deployed many projects closely following the characteristics of the population. When approaching the Vietnamese real estate market today, Japanese investors see similarities in the shortage of quality housing supply, with affordability being a challenging equation to solve in Vietnam.

“Accordingly, the TT AVIO project, with most of the apartments having an average area but ensuring full functionality, reasonable prices, suitable for the economic conditions of young families or first-time home buyers, is expected to be a premise project, opening up for us a journey of continuously creating new values for customers and Vietnamese people,” said Mr. Ogawa.

“Go Big or Go Home”: A Daring Developer Dishes Out a Yacht and Mercedes to Lucky Home Buyers

As the Lunar New Year approaches, investors are pulling out all the stops with their impressive sales strategies, injecting even more excitement into the market.

The Rising Dragon: Vietnam’s Property Prices Soar Above the Rest

“Over a 5-year period, Vietnam’s property price growth reached an impressive 59%, outperforming many other countries such as the US (54%), Australia (49%), Japan (41%), and Singapore (37%). The high rate of price increase has led to a rental yield of just 4% for Vietnamese properties, while many other countries, including the Philippines, Malaysia, Thailand, Indonesia, the UK, Australia, and the US, enjoy rental yields ranging from 5% to 7%.”