Illustrative image

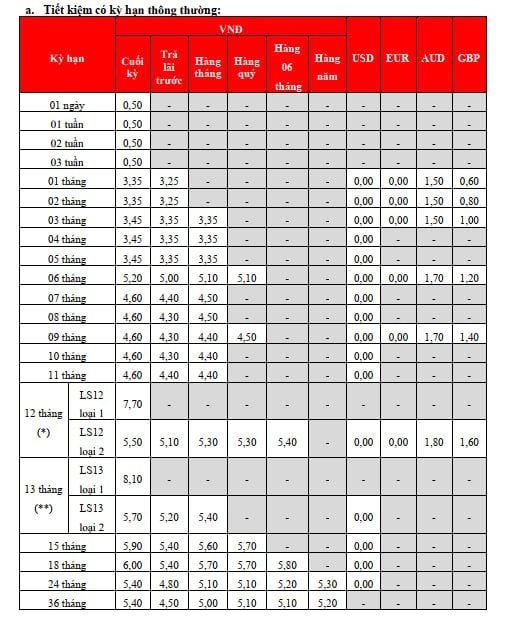

According to the latest survey, Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) currently offers deposit interest rates ranging from 0.5% to 8.1% per annum. Notably, HDBank increased its interest rate for 6-month term deposits by 0.2 percentage points and for 12 and 13-month terms by 0.1 percentage points compared to the beginning of November.

Deposit Interest Rates for Counter Customers in December

For counter deposits, HDBank offers an interest rate of 0.5% per annum for tenors below 1 month. The interest rate for 1-2 month tenors is listed at 3.35% per annum, while 3-5 month deposits earn an interest rate of 3.45% per annum. The bank offers an interest rate of 5.2% per annum for 6-month tenors, and 7-11 month deposits earn an interest rate of 4.6% per annum.

For 12-month tenors, the interest rate for deposits of 500 billion VND and above is 7.7% per annum, while deposits below 500 billion VND earn an interest rate of 5.5% per annum. At the 13-month tenor, the interest rate for deposits of 500 billion VND and above remains at 8.1% per annum, and deposits below 500 billion VND earn an interest rate of 5.7% per annum.

The interest rates for 15 and 18-month tenors are listed at 5.9% and 6.0% per annum, respectively. Deposits with tenors of 24 – 36 months earn an interest rate of 5.4% per annum.

In addition to the end-of-term interest payment option, HDBank also offers various interest payment frequencies with the following interest rates: Advance interest payment: 3.25% – 5.4% per annum; Monthly interest payment: 3.35% – 5.7% per annum; Quarterly interest payment: 4.5% – 5.7% per annum; Semi-annual interest payment: 5.1% – 5.8% per annum; Annual interest payment: 5.2% – 5.3% per annum.

Deposit Interest Rates for HDBank Counter Customers in December 2024

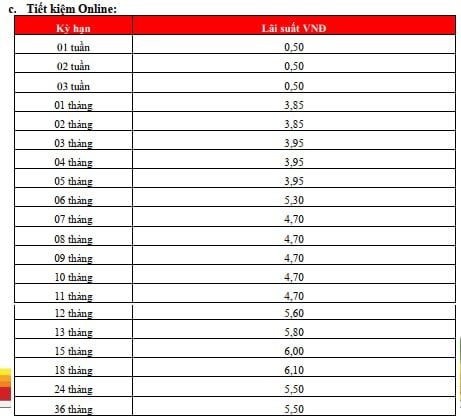

HDBank Online Savings Interest Rates in December 2024

At the beginning of December, HDBank’s interest rates for online savings ranged from 0.5% to 6.1% per annum. Specifically, tenors below 1 month are offered an interest rate of 0.5% per annum, while 1-2 month tenors earn an interest rate of 3.85% per annum. Deposits with tenors of 3-5 months are offered an interest rate of 3.95% per annum, and 6-month tenors earn an interest rate of 5.3% per annum. The interest rate for 7 – 11 month tenors is listed at 4.7% per annum, while 12-month deposits earn an interest rate of 5.6% per annum. The interest rate for 13-month tenors is 5.8% per annum, and 15-month tenors earn an interest rate of 6.0% per annum. The bank offers an interest rate of 6.1% per annum for 18-month tenors, and 24 and 36-month tenors have the same interest rate of 5.5% per annum.

With a maximum interest rate of 6.1% per annum for 18-month tenors, HDBank is one of the banks offering the highest deposit interest rates in the system at present.

HDBank Online Deposit Interest Rates in December 2024

The Central Bank’s New Directive to Commercial Banks: Stabilize Deposit Rates, Lower Lending Rates

The State Bank (SBV) has requested that credit institutions maintain a stable and reasonable deposit interest rate, one that aligns with their capital balancing capabilities, healthy credit expansion, and risk management competencies. This move aims to contribute to the stability of the monetary market and interest rate environment.

‘Bank Health Check’: Capital Raising Race

“Amidst a surge in non-performing loans, banks are engaged in a capital-raising race to bolster their risk buffers. The magnitude of risk provisions depends on each bank’s financial health, resulting in varying levels of non-performing loan coverage across the industry.”