Reporter: There is only one month left in 2024. What, in your opinion, are the notable achievements of the banking industry in the past 11 months?

First and foremost, the banking system’s resilience and stable development amidst the SCB shock is a remarkable success for the industry this year. The restructuring process has been smooth, without causing any concerns among depositors.

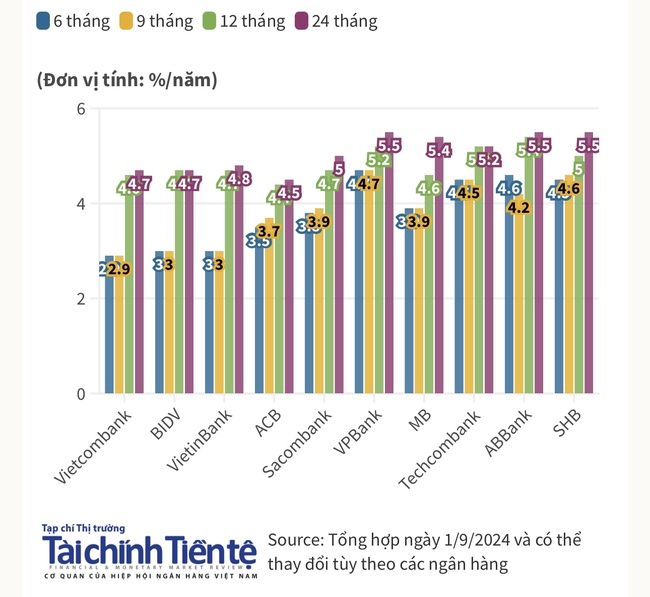

Secondly, deposit and lending rates have been stable, with no instances of high-interest rate competition to attract funds as seen in the previous year. Currently, the VND interest rate at 5% per annum is reasonable and will contribute to capital market stability.

It’s important to understand that savings deposits are not an investment channel for high returns with low risk. Deposit rates in developed countries are typically low, slightly above the inflation rate.

In Vietnam, the 12-month savings deposit rate at the four state-owned commercial banks is below 5% per annum, which is a very reasonable level, about 1% higher than the inflation rate.

Why is a low deposit rate beneficial for the economy? When people deposit money in banks, they expect both safety and high-interest returns. However, this creates a high cost of capital for the banking industry, leading to higher lending rates for businesses and consumers.

In 2024, we are witnessing a period of stable interest rates, which is not a place to seek profits. This helps bring down the cost of capital through the supply of bank credit, supporting the economy’s sustainable recovery and development.

Another positive development is that despite the significant involvement of banks in real estate lending and investment in real estate companies’ bonds in recent years, with many bond loans needing to be extended, the system remains stable. During the Covid-19 pandemic, businesses faced challenges, and the State Bank of Vietnam allowed debt rescheduling until the end of December 2024. Although capital sources are still tight, the overall banking system is stable, and capital is being channeled into the economy without the bottlenecks seen in 2022. This is a significant achievement for the industry.

What are the pressing issues in the banking industry as of now?

We’ve observed that in the latter part of the third quarter and the beginning of the fourth quarter, there is a tendency for deposit rates to increase again. While the inflation rate during this period was below 4%, which is quite positive, the rise in deposit rates could be due to banks’ capital needs. If this trend continues in the short term, it may not be a cause for concern. However, if banks continue to compete for loans by raising interest rates to meet their capital requirements, it is an issue that warrants attention.

Secondly, the ratio of deposits to loans has been increasing, although it is still within a safe threshold for banks. It is crucial to maintain the Basel II standards for the ratios of deposits to loans.

Additionally, regarding medium and long-term loan capital, banks are gradually reducing their reliance on short-term deposits from individuals. They are now focusing on issuing medium and long-term bonds to secure long-term capital. This is a notable shift in the current banking system.

What internal challenges will the banking industry face in 2025?

In previous years, the industry went through a phase of aggressively pushing medium and long-term loans while also investing in real estate companies’ bonds. These two factors have become a hindrance for banks as they have heavily relied on real estate collateral. When the real estate market experiences a downturn, small banks, in particular, face capital shortages.

In 2025, banks will need to continue addressing this issue to prevent an increase in non-performing loans and improve capital recovery from real estate companies.

This challenge also highlights the importance of having a professional Board of Directors and Executive Board. While banks are joint-stock companies, they are also crucial financial institutions. The Board of Directors should be selected based on their expertise and reputation, independent of their level of ownership in the bank.

Why is this important? Many of the issues banks face, such as bad debts and capital mobilization challenges, are partly due to insider lending and cronyism, which occur when the Board of Directors lacks independence and professionalism.

If the Vietnamese banking system takes a step further in this regard, it will become stronger, and capital allocation will be more efficient.

In 2024, the State Bank of Vietnam changed the mechanism for allocating credit growth limits, providing them at the beginning of the year and offering opportunities for banks to grow. What is your assessment of this change?

For commercial banks, credit development must be part of a long-term strategy rather than constant adjustments. Each year, they set their credit growth plans, so providing the limits at the beginning of the year is entirely appropriate for their annual operations. If conditions are favorable and commercial banks are granted additional credit growth limits, it will not affect their business direction. This approach also aligns with market developments.

Of course, it is advisable for the State Bank of Vietnam to review and adjust credit limits every six months, as economic conditions can change rapidly.

What is your forecast for achieving the credit growth target in 2024?

I believe reaching the expected 16% credit growth target set by the State Bank of Vietnam will not be difficult. Commercial banks have various strategies to achieve this goal.

For the banking industry, credit growth is a crucial indicator for generating profits. It is not just a performance metric but also a factor considered by shareholders during annual general meetings. Shareholders naturally want banks to grow rapidly and perform well to increase profits and, consequently, share prices.

While some banks have achieved impressive credit growth targets, they have also encountered issues with non-performing loans. Therefore, banks should focus on a portfolio of indicators that includes not only credit growth but also non-performing loan ratios, credit quality, service revenue targets, and customer retention in lending and deposit-taking processes. These indicators contribute to the bank’s value creation through its services.

Commercial banks need to formulate sustainable development strategies that align with the economy’s goals. This means considering not only GDP growth targets but also the quality of that growth to ensure both expansion and longevity.

As we move into 2025, what opportunities do you foresee for the banking industry?

The landscape in 2025 will be significantly different, presenting a new context. We are already seeing many positive signals in the Vietnamese economy, with improvements in FDI, exports, agriculture, and consumer spending. The trade and service sector is expected to grow by 10% in 2025, outpacing 2024.

The real estate industry is focusing on value creation rather than price speculation. Regions with potential for population accumulation, industrial production, and commercial office rentals will witness recovery and growth from late 2025 to early 2026. On the other hand, real estate in remote areas, relying on infrastructure development and potential for functional conversion, are unlikely to recover in 2025.

With this backdrop, the banking industry has a favorable foundation and can plan to channel capital into the market more efficiently.

How do you predict credit flows will move across sectors in 2025?

Bank credit in 2025 will focus on value-creating sectors, primarily production and business. The trade and service sector, including previously disadvantaged areas like seafood, is expected to recover and attract credit flows.

In 2025, individual investors will likely increase their borrowing to invest in real estate with income-generating potential. Banks will also channel capital into projects within urbanized areas with rental potential. Credit for real estate is forecast to increase. However, credit for speculative real estate investments will struggle to access capital.

– Thank you for your insights!

This Week’s Market: Will Liquidity Continue to Decline, but Can VN-Index Sustain Its Uptrend?

Despite the uncertain recovery pace, with liquidity continuing to decline, the Vn-Index is expected to extend its upward trajectory, buoyed by supportive domestic news.

The Central Bank’s New Directive to Commercial Banks: Stabilize Deposit Rates, Lower Lending Rates

The State Bank (SBV) has requested that credit institutions maintain a stable and reasonable deposit interest rate, one that aligns with their capital balancing capabilities, healthy credit expansion, and risk management competencies. This move aims to contribute to the stability of the monetary market and interest rate environment.

Will Interest Rates Drop Further by Year-End?

The continuous rise in deposit interest rates in recent times has sparked a question: Can lending rates drop further by the year-end?