Mr. Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University believes that the increase in real estate prices is not just a story of supply and demand but also the result of multiple factors that have a multidimensional impact.

Mr. Nguyen Quang Huy – Nguyen Trai University

|

Firstly, the supply is not meeting the actual demand. In the past years, the market has focused on developing high-end housing, villa, and resort projects. Meanwhile, the supply of social housing and affordable homes – suitable for the middle-income majority – is extremely limited. The demand far exceeds the supply, leading to price pressure.

Secondly, land speculation and auctions have been pushed to excessive levels. The situation of land hoarding for price increases, along with land auction sessions with unreasonably high prices, has increased the value of land plots in the market. This causes an imbalance in supply and demand and creates an unrealistic price level.

Thirdly, the legal process has improved significantly but needs to be further streamlined. The time to complete legal procedures for real estate projects in Vietnam can take a few years, causing cost overruns for investors. As a result, housing prices are pushed up, beyond the affordability of the people.

Fourthly, the population pressure in large cities such as Hanoi and Ho Chi Minh City – the country’s largest economic, political, and cultural centers – attracts a large number of migrants from other provinces. The high population density has increased the demand for housing, especially in central areas, driving up property prices.

Increasing asset value and the risk of a bubble

When real estate prices rise, the value of collateral assets in banks will surely increase, bringing some clear benefits. Loans based on re-evaluated real estate assets will facilitate expanded credit limits or additional disbursements for customers.

Increased collateral value also boosts market confidence, helping banks strengthen their lending capacity. However, if real estate prices rise too quickly, far beyond their actual value, banks need to be cautious about facing some significant risks.

When asset prices are pushed to an unrealistic level, loans based on this value will not be sustainable. If the market turns, these credits can easily become bad debts, risking a credit bubble burst.

Real estate usually has low liquidity, especially when the market freezes. If the value of the asset drops sharply, the bank may not be able to recover enough capital when auctioning the property, making it difficult to handle the collateral.

When most of the bank’s capital is “frozen” in real estate, other economic sectors will face difficulties in accessing credit, causing an imbalance in cash flow and increasing liquidity pressure.

In a recent report to the National Assembly on the supervision of the real estate market, Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong stated that real estate lending had reached VND 3,150,000 billion by the end of September, a 9.15% increase compared to the end of last year. This growth rate is higher than the economy’s credit growth rate (9%) and accounts for 20% of the total outstanding loans in the economy. Real estate business loans increased more than real estate consumer loans, up 16% and 4.6%, respectively, from the beginning of the year. In the past nine months, the banking system has pumped more than VND 280,000 billion into the real estate market.

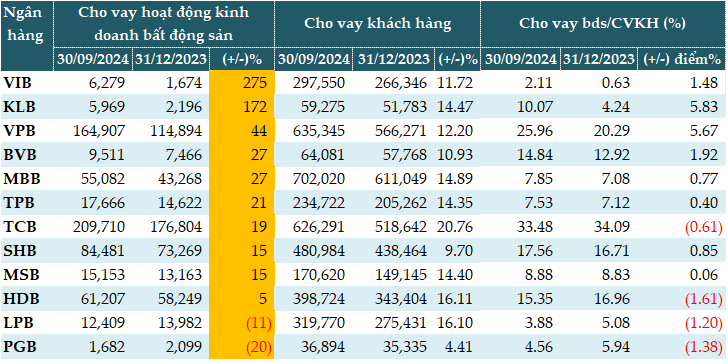

Data from VietstockFinance, as of September 30, 2024, from 12 banks with lending explanations, showed that 10 out of 12 banks increased lending to real estate businesses compared to the beginning of the year. The total outstanding loans for real estate businesses of these 12 banks at the end of the third quarter were VND 644,056 billion, up 23% from the beginning of the year.

|

Real Estate Lending by Banks as of September 30, 2024 (in VND billion)

Source: VietstockFinance

|

Solutions for market stabilization and risk reduction

To ensure the stability of the banking system and the sustainable development of the real estate market, there needs to be a coordinated effort between the government, banks, and real estate businesses.

To tightly manage real estate credit, banks should tighten lending standards for speculative real estate loans and require higher equity for real estate loans to reduce credit risk.

At the same time, there should be an increase in the supply of affordable and social housing. Legal procedures should be simplified, and policies should encourage investment from managing agencies. This includes streamlining the project approval process to speed up implementation, reduce costs, and increase supply; providing tax and credit incentives for developers of affordable and social housing; and constructing social housing projects with government investment to ensure a stable supply.

In parallel, land auction control should be strengthened. Limits should be set for the starting price and the increment in land auction sessions to avoid unreasonable price hikes. Speculation can be curbed by imposing high taxes on unused real estate.

Importantly, market information should be transparent. A real estate data management technology platform should be developed to enhance transparency in transactions, providing accurate information to investors and the public to curb speculation.

In general, the increase in real estate prices presents both opportunities and significant challenges for the real estate market and the banking system. The Vietnamese real estate market still has a lot of potential for development, especially with rapid urbanization and growing housing demand. Instead of focusing on short-term profits, banks and real estate businesses should aim for sustainable development, balancing supply and demand and aligning investment with actual needs. Only then can real estate truly become a growth driver for the economy and bring long-term benefits to society.

Drip Feed Selling, VN-Index Turns Green at the Last Minute, Foreigners Dump Again

Selling pressure mounted slightly in the afternoon session, pushing the VN-Index briefly into negative territory with a sea of red on the screen. However, the extremely low trading volume indicated that buyers were mostly sitting on the sidelines, and the market was quick to rebound as bottom-fishers jumped in.

“Completed Projects Left Unsold Due to Lack of Land Appraisal, While Some Areas Witness a Doubling of Land Prices Within Just Six Months”

This is a statement from Mr. Nguyen Quoc Hiep, Chairman of GP. Invest and the Vietnam Association of Building Contractors, at the forum “Sustainable Development of the Real Estate Market – Awarding the Livable Project Certification 2024” organized by the Enterprise Forum on the morning of November 27th.

The Expert’s Paradox: When Supply Increases, Prices Should Decrease, But Not in This Case.

Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, shared his insights on the country’s real estate market. He noted that it is unlikely for property prices to decrease and that there are indications of rising prices. Interestingly, he pointed out a contradiction where an improvement in supply should, in theory, lead to lower selling prices. However, in the current market, supply is increasing, but prices remain high.